Bottom Line Up Front:

In June, we suggested that the market would go down 5% before it would go up 10%. That was the case in the aftermath of Brexit. The decline was fast, violent, and short-lived. From the Brexit-low, the S&P 500 Index has rallied 9.7% and the market has reached an all-time high. The lessons of the last two years have shown us that being tactical is very important even for the long-term investors. For the past two years, we have had a 10% or more downturn between July and November. We have seen many of the traditional correlations used to mitigate risk or to validate resistance levels of the stock market break down. The earnings of the S&P 500 index (EPS) have been falling for six consecutive quarters1 while its price-to-earnings (PE) ratio2, called the multiple, is at its highest level since 2004, excluding the Great Recession [Chart 1]. In order to justify current prices, either earnings have to go up or the traditional PE ratios have to be adjusted due to historically low interest rates. We believe the dislocation between earnings and stock prices is an unintended consequence of the central banks' asset purchase programs to stimulate aggregate demand. While aiming to provide more liquidity, the central banks have also caused bond prices to rise and yields to fall, causing many investors to feel they have no choice but to stay in equities, especially in dividend paying stocks. In other words, this is a historically unusual period. And, we are expecting some volatility between now and the end of the year. It is important to keep a look-out for changes in market sentiment, statements from the Federal Reserve (Fed), and the outcome of the US Presidential Election.

The Way We See It:

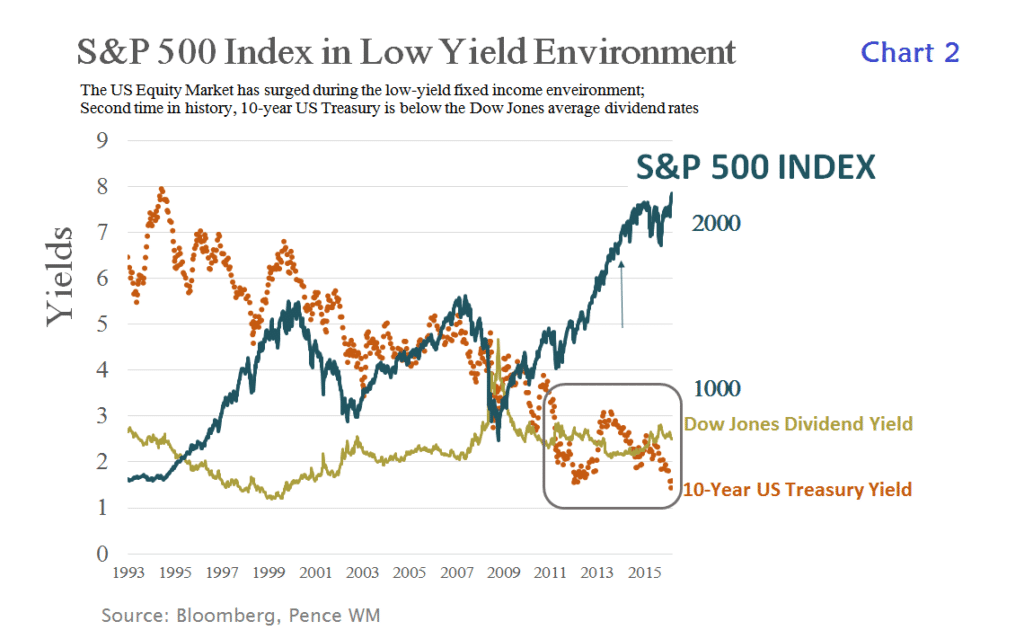

Today, the US is still the prettiest house in a rough neighborhood. This is because the US financial markets offer better risk adjusted returns relative to the rest of the developed markets and elsewhere. The globally low yields in fixed income are forcing investors to purchase more US assets, the US Stability Premium.3 On one hand, the US Stability Premium is pushing the yields in US government bonds lower (despite the Fed's willingness to increase rates), while on the other hand, it is pushing the equity prices higher (despite declining earnings growth). This is not just an anomaly but a paradigm shift. The real question is how long is this sustainable? We think the answer will depend on the sustainability of US corporate earnings, which are tied to both domestic and global economic recovery as well as US fiscal policies, the strength of US dollar, and the path of Fed interest rate hike. [Chart 2] below depicts the low yield environment in the US since 2011 and the run-up in US equities, mostly due to the search for yield.

If corporate earnings are gradually to increase in coming quarters, we believe the market can justify the current valuations despite trading at historically high multiples. While we expect the Fed to raise rates slowly and gradually, the dislocations in the shorter end of the yield curve between US bonds versus those in Europe and Japan force us to be more tactical. We believe as long as the yield on 10-year US Treasury stays below the average US blue-chip equity yield4 of 2.5% – 3%, equity prices will remain elevated though open to headline shocks similar to Brexit. Investors seem to perceive shocks as buying opportunities though. That is why shocks are mostly violent yet short-lived as investors get right back in the market. In the low-yield environment, they have nowhere else to go. If the dislocation between earnings and stock prices gets wider, we believe, there will be a greater hyper volatility towards headline news.

Fed Caution on Interest Rates and US Stability Premium

Former Fed chairman Ben Bernanke once said "the state of the economy, not the Fed, is the ultimate determinant of the sustainable level of real returns. This helps explain why real interest rates are low throughout the industrialized world, not just in the United States." The 2008 global financial crisis produced the current state of the global economy and it is taking longer for the world to completely get out of it. In his remarks, Mr. Bernanke also implied that, in a slowly growing or recessionary economy, the rate is likely to be low since investment opportunities are limited and relatively unprofitable. Conversely, interest rates should go up as the economy gets stronger because investors would demand higher rates of return during economic expansions.

Most Fed officials believe domestic indicators such as the strengthening labor market and more importantly consumer confidence and consumer spending as well as inflation are all pointing to a green light for further rate hikes. In fact, since last December, the Fed has already started tightening, not doing asset purchases like Europe, UK, or Japan as shown in [Charts 3].

Asset purchases are another way for central banks to throw money at the economy. The Bank of Japan's (BOJ) total assets have grown nearly 3 times since 2012. The European Central Bank (ECB) has increased its purchases over 60% just within the past two years. Most recently, The Bank of England (BOE) launched a stimulus package to cushion the Brexit downturn, its first rate cut in more than seven years.

As [Charts 3] depicts above, the more the central banks buy bonds, the more bond yields fall. However, something unique has been happening to the US rates. Despite the Fed's desire for a gradual-yet-slow tightening, meaning not purchasing additional bonds (circled line on the chart), the yield on 10-year US Treasury has kept falling to its lowest levels in recorded history instead of staying stable, if not going higher. This is due to a higher demand for US bonds from global investors. This situation puts the Fed at a very tricky spot. The Fed may not have as much control over interest rates as it would like. On one hand, the Fed wants to raise the rates, on the other hand, the rest of the world is pushing the rates down. This makes the timing of further rate hikes very critical. A pre-mature Fed rate hike may have adverse consequences such as another run-up in the US dollar, which may affect capital flows to the emerging markets and disrupt commodity prices. So before raising rates for the second time, the Fed has to take into account global factors. It has to allow time to get a better assessment of the global risk, which has the potential to damage global financial markets and in turn can create headwinds for the US economic outlook as it faces uncertainties ahead of the U.S. presidential election in November. For those reasons, we are assigning a 50% probability for another rate hike this year, if so, possibly after the election in December.

Staying on a drug that doesn't fully cure a patient for longer than anticipated may cause side effects.

Low Yields, Pension Paradox, and High Stock Valuations

As Mohamed El-Erian once said staying on a drug that doesn't fully cure a patient for longer than anticipated may cause side effects. There is more evidence today that the low yield environment has stimulated the US economy and helped the recovery from the Great Recession. But we think we may have stayed on it longer than we previously anticipated. And at this point, it's hard to tell the side effects.

According to Bank of America, today there is nearly $13 trillion of global negative-yielding debt. In practice, this means that instead of receiving interest on the reserves that banks hold with the central bank, they are charged a fee on reserves above a threshold. According to Citigroup, nearly 80% of Japanese and German government bonds have negative yields. In Switzerland, a government bond due in nearly half a century is now yielding below zero. What this means is that people are paying their governments to lose them money. It's like a tax, not a bond.

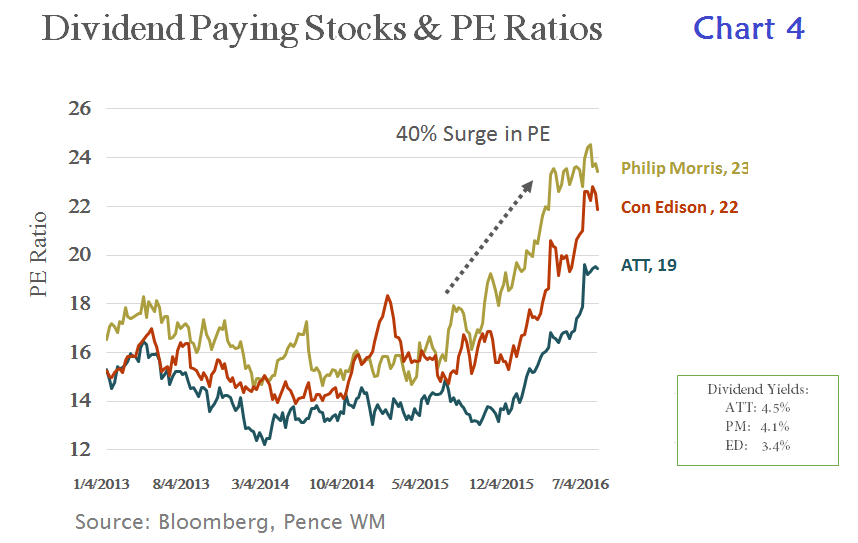

Even when returns being offered on longer-term debt may be positive, they are still inadequate for most investors especially pension funds and insurers. Low bond yields are a serious threat to the solvency of pension funds and life insurers. It's called the Critical Yield.5 Pensions lose money when bonds with bigger payouts purchased years ago mature and are replaced with lower-yielding securities. At low yield environments, insurers and pension funds are being increasingly tempted to find alternatives. For example, pensions have cut investing in bonds in order to match the levels of returns promised to beneficiaries when interest rates were higher. In 2001, the average plan held 64% of its investments in equities, real estate, or alternative investments, and 36% in bonds. By 2013, the average plan held 72% in those risky asset classes with only 28% in bonds.6 Money has to go somewhere. Today, there are over $12 trillion assets in US pension funds.7 Of those assets, 47% is invested in equities and over 70% of that in US equities, equivalent to $4 trillion. This represents over 20% of the $19 trillion of the total market cap of all the companies in the S&P 500 Index. An 8% reduction in their fixed income allocation means nearly $1 trillion have moved out of the bond market. Given the tepid earnings growth, higher demand for equities only pushes the multiples higher. For example, high-dividend-paying sectors such as telecom and utilities are up over 20% year to date, while multiples on some equities (such as AT&T, Phillips Morris, and Consolidated Edison) expanded more than 40% as seen in [Chart 4].

Investing In The Current Environment

In today's investment landscape, we have two new paradigms. One, the Fed wants to raise rates but global risk factors are not allowing it to do so, at least not at a speed the Fed wants. Thus, the Fed has no choice but to be patient while the rest of the world cleans up its house. This means we will have to get used to low interest rates for a longer than expected time frame. Second, low rates are bad news for the institutional investors especially pension funds and insurers. They have little choice but to invest in US equities even at lofty PE ratios. This means that the market may continue to tick up higher while it remains hyper-sensitive to headline news, which requires us to be more tactical.

Low yields in developed markets have also sent some investors looking for higher-yielding assets in emerging markets. In recent years, lower commodity prices and concerns about higher interest rates have exacerbated the flight of cash out of emerging markets. However, the tide seems to be turning for emerging markets as the rate of change in interest rates and dollar has slowed. For example, as of August 29 2016, MSCI Emerging Markets Index (EEM) is up over 15% year to date. India appears to be better placed among emerging markets given its relatively lower dependence on exports. India's new tax reforms which replaced the overlapping tax codes will only increase the country's economic growth rate of 7.6%, which is already bigger than China.

In our portfolios, we will make equity purchases on a security-by-security basis where we see value. We will focus on being well-diversified between our equities and fixed income allocations while being tactical with our cash by participating in the market and keeping a close watch on volatility. In terms of regions and sectors, we continue to overweight US-based companies with solid earnings. We will also begin to look at some exposure to emerging markets that are in stable regions on the map. Less stable regions, conflicts, and terrorism have set the world on edge after the high-profile attacks on major cities in Turkey, Belgium, France and the United States. That is why we continue to favor US defense companies as we see higher terrorist threat globally.

E. Dryden Pence III

Chief Investment Officer

LPL Financial Registered Principal

CA Insurance License # 0F82198

Ali Arik, Ph.D

Senior Analyst,

LPL Financial Registered

Administrative Associate

For our clients with Strategic Asset Management (SAM) accounts where we manage with full discretion, depending on your individual situation, objectives and type of accounts, we expect to hold slightly higher cash positions. We will deploy excess cash positions opportunistically as we evaluate both volatility and value. In short, we will remain tactical in a market we expect to be volatile.

For our clients who hold brokerage accounts, if you are interested in a similar fee-based strategy, please contact your advisor.

If you are not yet a client and are interested in learning more about our services, please contact Milo Reyes at 949.660.8777, extension 129, or Ramilo.Reyes@lpl.com to schedule an appointment.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The Standard & Poor's 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy. The MSCI Emerging Markets Index consists of 23 countries representing 10% of world market capitalization. The Index is available for a number of regions, market segments/sizes and covers approximately 85% of the free float-adjusted market capitalization in each of the 23 countries.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All investing involves risk including potential loss of principal. Tactical allocation may involve more frequent buying and selling of assets and will tend to generate higher transaction cost. Investors should consider the tax consequences of moving positions more frequently.

The payment of dividends is not guaranteed. Companies may reduce or eliminate the payment of dividends at any given time. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

[1] Most of the blame goes to energy sector.

[2] P/E is short for the ratio of the S&P 500 Index level to its trailing twelve month per-share earnings. As the name implies, to calculate the P/E, you simply take the current index level and divide by its earnings per share (EPS).

It is important to keep a look-out for changes in market sentiment, statements from the Federal Reserve (Fed), and the outcome of the US Presidential Election.

[3] We talked about US Stability Premium in our October 2014, January 2015, and October 2015 newsletters

[4] Since 2008, the aggregate dividend yield on the 30 stocks that make up the Dow Jones Industrial Average was 2.61%, according to Bloomberg data.

[5] The critical yield is the investment growth rate required in income drawdown to provide and maintain an income equal to that obtainable under an annuity.

[6] According to THE JOURNAL OF RETIREMENT Summer 2014, The Public Pension Quadrilemma: The Intersection of Investment

[7] Source: Global Pension Assets Study 2016 by Willis Towers Watson