Intro

In today’s world it’s easy to get wrapped up in the 24-hour news cycle. Networks and news outlets are designed around viewership and the human brain is psychologically wired for a greater sensitivity to negative news. In 2014, Russian news site City Reporter decided to conduct a social experiment and only reported good news to its readers for an entire day. The website lost two-thirds of its normal readership. The following day, the City Reporter decided to return to more reliable staples: car crashes and burst water pipes.

Negativity sells and an increasingly commercialized and consolidated media landscape is structured around that behavior. When a viewer is shown the fact that fatal shark attacks spiked by 400% last year, this likely elicits a highly negative reaction. That same viewer has a much different reaction when informed that the number of fatal shark attacks in 2020 jumped 400% to a total of 10. The average person has a higher chance of being killed by a champagne cork than by a shark, and yet half of Americans are absolutely terrified of sharks and 38% are scared to swim in the ocean because of them.

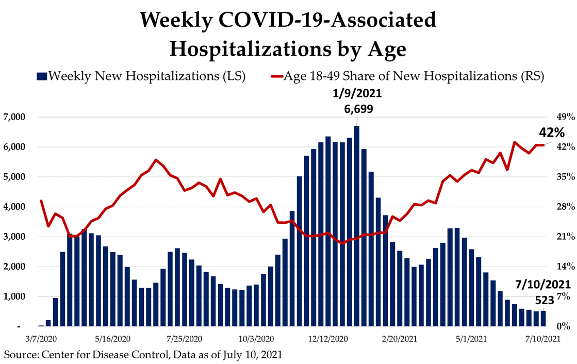

This is happening to an extent with the “Delta” variant of COVID-19. Cases and hospitalizations are rising off of a very low base so percentage increases are eyewatering. News reports are focusing on the fact that younger people are at their highest share of new COVID-19 related hospitalizations since the start of the pandemic. Without context, this makes it look like we have entered a new phase of the pandemic – where the previously unaffected are now being hospitalized in much greater numbers.

What is mentioned substantially less, however, is that new hospitalizations in July are down 92% from their peaks in January, and that the younger demographics are much less likely to be vaccinated. This is because the effects of COVID-19 are so highly stratified by age. If a vaccine reduces an 80-year-old’s risk of death from COVID-19 by 95%, for instance, that 80-year-old’s risk of death might still be greater than the risk faced by an unvaccinated 20-year-old.

What is mentioned substantially less, however, is that new hospitalizations in July are down 92% from their peaks in January, and that the younger demographics are much less likely to be vaccinated. This is because the effects of COVID-19 are so highly stratified by age. If a vaccine reduces an 80-year-old’s risk of death from COVID-19 by 95%, for instance, that 80-year-old’s risk of death might still be greater than the risk faced by an unvaccinated 20-year-old.

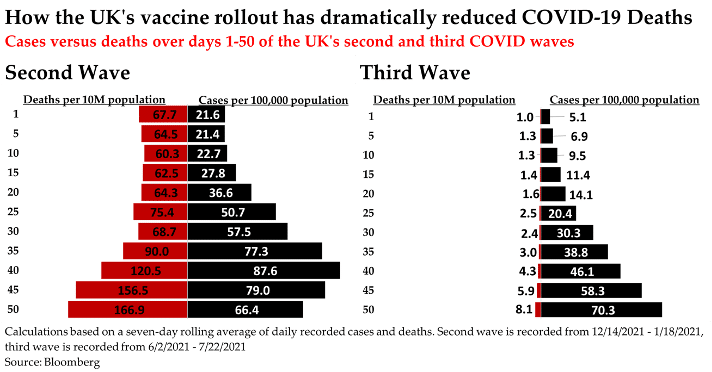

The end points of the vaccine trials last year were never around whether cases were prevented but rather whether there was efficacy in prevention of severe disease, hospitalization, or fatality. While cases are on the rise globally again and we view another wave as likely, at this juncture the vaccine rollout seems to have resulted in a decoupling between cases and hospitalizations or deaths. A look at the United Kingdom, the most vaccinated large western country and the first experience with a wave of Delta, is a great example of this. Despite hitting daily case numbers equivalent to those in the winter, deaths so far have not correlated in similar fashion to previous waves.

The risks from Delta, in our view, are more tilted towards policy makers re-enacting restrictions than they are towards a meaningful organic pullback in activity. We would suggest that readers focus on hospitalizations and deaths, not cases. While the vaccines are doing a good job in regards to severe disease and death, emerging evidence suggests limited impact when it comes to preventing spread – Israel and Iceland are examples of highly vaccinated countries that are seeing rising cases but both without meaningful increases in mortality at time of writing. Delta is a more contagious variant of SARS-CoV-2, and it appears to diminish the effectiveness of vaccines, but there is no conclusive evidence at this stage that it is more deadly – Public Health England estimates the fatality rate for Delta closer to 0.3%, compared to 1.9% for Alpha.

“COVID Zero” is an extremely unlikely event, and in our view it’s time to recognize the virus as endemic with seasonal waves that diminish with time as immunity builds. In 1961, 6 years after the licensing of the Salk Polio vaccine, only 54% of the U.S. population had received the vaccine. Today 90% of the over-65 demographic has received at least one dose of the COVID vaccine. This should be viewed as a major medical victory – 79.2% of COVID deaths through July 28 are in that demographic, and for younger individuals COVID-19 is typically mild and in stark contrast to Polio which carries a fatality rate of up to 30%. Absent further restrictions – which we do not expect on a national level – we see few headwinds preventing the US economy proceeding from recovering to recovered.

Markets

In the second quarter, the reflation trade – which has been the predominant theme for the first half of this year – took a major step backwards. As the Federal Reserve reassured of its dovish policy and investors began to focus on the prospect of peaking growth Big Tech regained favor. In low growth environments, investors are willing to pay higher multiples for higher growth companies.

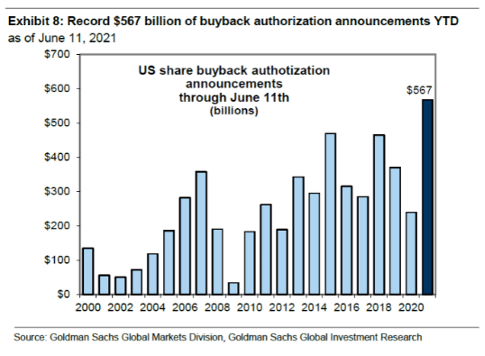

This has been accompanied by what has been a record level of new buyback announcements. Through June 11 of this year, S&P 500 companies announced $567 billion in new buyback plans according to Goldman Sachs, the highest total through June in at least 22 years. S&P 500 companies entered 2020 with record levels of cash and equivalents at $1.9 trillion, up nearly $400 billion from 2019. When companies buy back their stock, that typically is a very positive sign for investors – few individuals no more about a company than that company’s CFO.

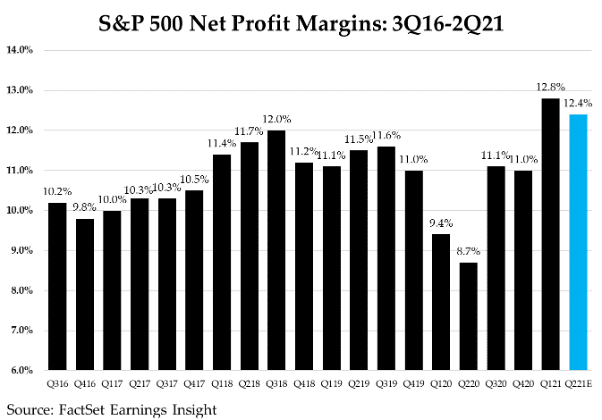

Put frankly, corporate performance is not an issue. 2nd quarter earnings have come in way better than expected – Bloomberg data shows that 87% of companies have beaten earnings estimates and 84% have surpassed expectations for revenue as of August 2. Earnings are now expected to increase 85% in Q2, the highest since Q4 2009, while on a per share basis, the S&P 500 now makes 12% more profit than in the comparable period of 2019 – essentially marking the recovery to corporate profitability complete. As an illustration of why investors have been so profoundly positive on equities over the backdrop of such Main Street dismay, just one year after the largest disruption to economic activity in a non-war period, the S&P 500 is expected to post its 2nd highest net profit margin since 2008, just below the margin in Q1.

Economy & Policy

With the recent GDP print, the US economy is now larger – in nominal terms – than it was going into the shutdowns. While growth is expected to slow more toward pre-pandemic trend next year, going from the largest disruption to economic activity in a non-war period to pre-pandemic levels in just a year underscores the speed of the recovery that began last summer. In terms of economic output, the United States has made a full recovery – although a return to potential is still some ways off.

The labor market, while still reflecting substantial damage compared to pre-pandemic, has shown robust growth so far this year. Through June, more than 3 million jobs have been added this year, and with the expiration of the expanded unemployment benefits in September we expect job additions to accelerate.

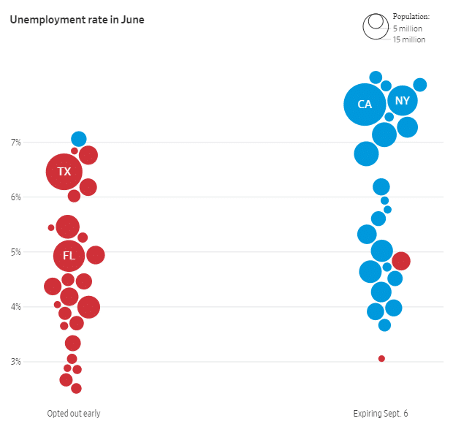

About half of states have acted to the enhanced and extended unemployment benefits early, and the early signs show that unemployment rates have declined further and faster compared to states that opted to keep them until expiration. An analysis by Jefferies economists found that the number of workers paid benefits through regular state programs fell 13.8% by the week ended June 12 from mid-May—when many governors announced changes—in states saying that benefits would end in June. That compares with a 10% decline in states ending benefits in July, and a 5.7% decrease in states ending benefits in September.

Currently, there is shortage of workers and a record number of job openings. The May Job Openings and Labor Turnover Survey (JOLTS) showed 9.2 million available job openings, compared to 7.1 million fewer job holders from the pre-pandemic United States total employment level in February 2020. Jobs are plentiful for those who want one, and June consumer confidence numbers showed the labor differential hit records. The share of respondents who said jobs were plentiful exceeded the share of those who said they were hard to get by the most since 2000, while 20% of job postings on ZipRecruiter in June offered a signing bonus, up from just 2% advertised on the site in March. In our view, this makes a very slim likelihood of the path back from COVID-19 being that of a jobless recovery, which is a substantial positive and a major reversal from the recovery from the Global Financial Crisis.

On the policy front, we continue to expect the majority of President Biden’s economic initiatives to pass. In the first several months of the new Administration, 2 sweeping economic plans were proposed – the “American Jobs Plan” (AJP), earmarked at about $2.2 trillion, and the “American Families Plan” (AFP), which was estimated at about $1.8 trillion. Combined, the initiatives would result in about $4 trillion in new spending without modifications.

There are early signs that the number proposed will be the number enacted. With the bipartisan agreement on an infrastructure bill representing about $550 billion in new spending – amounting to $1.2 trillion including previously expected funding over 8 years – and a $3.5 trillion budget blueprint framework proposed by the Senate Majority Leader, spending looks like it will be around the originally intended $4 trillion number.

With 67 votes in support of the infrastructure initiative, it overrides a filibuster and we are expecting its passage in the next few weeks. While $550 billion in new spending is substantial in nominal terms, it’s just one step in the process and still well short of what the American Society of Civil Engineers (ASCE) estimates is required for a healthy infrastructure grade that can handle a growing economy. Complicating matters towards passage is the demand of at least 10 House Democrats that the bill be accompanied by the full $3.5 trillion budget legislation – which Sen. Kyrsten Sinema (D, AZ.) does not support in current form and has received a lukewarm response from Sen. Joe Manchin (D, WV.).

Ultimately, our expectations from our last newsletter have not materially changed. We believe both sets of legislation will pass, though we think the corporate tax rate will likely settle around 25% and the capital gains hike ends up below the 39.6% proposed, which likely lowers the ultimate price tag as all reconciliation bills must be fully paid for.

The Federal Reserve & Inflation

While inflation has picked up – with June’s 5.4% year-over-year increase being the fastest in 13 years – a large part of the increase has been due to a historic market for used vehicles. Used cars and trucks drove a full third of the overall Consumer Price Index (CPI) jump in June. This is a direct result of the shutdowns, as a major disruption in production resulted in a supply-demand mismatch when consumer demand for cars snapped back within months. Used car prices are so red-hot that Ally Financial, one of the nation’s largest auto lenders actually made a $5 million profit on defaulted car loans in the second quarter for the first time in the bank’s history. In the first quarter it charged off $97 million in the same segment.

For the next two quarters, we are likely to get a much better view on just how durable inflation really is as the pandemic-contaminated comparisons fade. From August forward in 2020 the U.S. economy was functioning much closer to how it was in 2019 and, so far, comparisons to 2019 inflation levels make those of 2021 seem much less severe. There are areas that give us concern, namely rents – a much stickier category of inflation which carries heavier weights and is officially above their trend from pre-pandemic – and wage inflation. Average hourly wages for retail workers were up 8.6% in June from February 2020, before the pandemic took hold in the U.S – this is historically high. Rising wages are certainly a positive for economic activity and a strong middle-class, but a recent survey from the Federal Reserve Bank of New York found that wage demands for workers with under $60,000 in annual wages are up 26% from Pre-Pandemic levels.

While inflation might not be hyper, it will almost certainly be higher and we think investors and consumers should be prepared for that possibility. While financial markets continue to view inflation as broadly transitory, inflation has been a common theme on earnings calls in July – with it being mentioned on 87% of company calls during the month. Higher inflation numbers have also meaningfully pulled back consumer sentiment surveys in recent weeks.

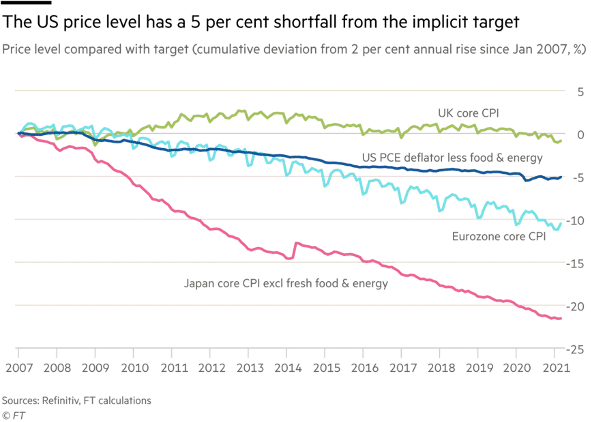

While this adds an element of uncertainty to the “transitory” view of inflation, we do not expect it to put rate hikes on the table sooner than expected because of the Fed’s new framework. Essentially, depending on how far back the Federal Reserve is willing to look in order to target “average” inflation, policy makers have a lot of wiggle room. Going back to January 2007, Core Personal Consumption Expenditures (Core PCE) have had a 5% cumulative deviation from the Fed’s 2% target. This suggests the Federal Reserve could ultimately be willing to accept a 3% PCE number for 5 years before feeling like they need to raise rates.

We do not expect interest rates to be at zero for the next 5 years, but we think it likely means the Federal Reserve isn’t going to feel pressured to raise rates sooner than they want to. Their new framework of average inflation gives them a lot of maneuverability in what is still an uncertain period of the recovery and we expect them to take full advantage.

The most likely path forward, in our view, is for interest rates to start increasing in early 2023 with the Federal Reserve to start tapering purchases either in the last quarter of this year or the first quarter of 2022. Current market forecasts are expecting the tapering to result in a full halt to Treasury and Bond purchases by the Federal Reserve in 4Q22, while the CME’s FedWatch tool puts a December 2022 rate hike at about 50/50.

The Federal Reserve’s dual mandate is for stable prices and full employment. With the labor market still quite a way away from recovered, “stable prices” now being a long run average, and the lofty valuations commanded by equity markets we think the Fed is likely to be more than happy to be patient. The shift to “show me” rather than reacting pre-emptively based on forecasts leaves a lot of room for lower for longer in our opinion. Current growth projections put the S&P 500 reasonably valued based on 3-year forward multiples, and in our view the Federal Reserve would much rather an economy that progressively grows into its valuation rather than removing the backstop in a market trading largely on expectations – which, in our view, could cause more problems to the recovery than would a pickup in inflation.

So What

- We do not at this juncture expect the Delta variant to lead to a substantial deterioration of economy activity for several reasons

- The United States has just had a historically successful vaccination campaign, with the most at-risk demographics nearly completely covered.

- These vaccines have resulted in a large decoupling between cases and hospitalizations, even in countries hit by Delta.

- While Delta appears more infectious, at this juncture it does not appear to be more deadly. Claims by the CDC do not align with the experience in Iceland, the United Kingdom, and Israel at time of writing.

- Stimulus has had substantial impact of corporate performance. Even the most optimistic market participants at this time last year likely did not expect for nominal activity and corporate activity to return to pre-pandemic levels this quickly.

- Inflation will likely influence the Fed, but we do not expect them to move quickly. Their new framework is purposefully flexible, and they have been very communicative about their view of a still uncertain recovery.

- In our view, equity markets will be a bit of a grind for the rest of the year as markets digest data points with more normalized year-over-year comparisons. An inflation pickup or growth slowdown will be more noticeable as we close out the year.

For our clients with Strategic Asset Management (SAM) accounts where we manage with full discretion. Depending on your individual situation, objectives and type of accounts, we may lean towards building slightly higher cash or near cash equivalent positions as we evaluate both volatility and values in line with our current outlook. This will give us an opportunity to mitigate volatility and take advantage of opportunities around our generally positive outlook for the second half of the year.

For our clients who hold brokerage accounts, if you are interested in a similar fee-based strategy, please contact your advisor.

If you are not yet a client and are interested in learning more about our services, please contact our team at (949) 660-8777 or team@pencewealthmanagement.com to schedule an appointment.

E. Dryden Pence III

Chief Investment Officer

LPL Financial Registered Principal

CA Insurance License # 0F82198

Ali Arik, Ph.D

Senior Analyst,

LPL Financial Registered

Administrative Associate

Ian Venzon

Analyst,

LPL Registered

Administrative Associate

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All investing involves risk including potential loss of principal. Tactical allocation may involve more frequent buying and selling of assets and will tend to generate higher transaction cost. Investors should consider the tax consequences of moving positions more frequently.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Pence Wealth Management (“PWM”) is a sophisticated financial services practice within LPL Financial, LLC (“LPL Financial”) comprised of multiple financial professionals that provide a series of services including personal investment advisory, third party managed advisory and brokerage services. Pence Wealth Management, Inc. is an investment adviser registered with the State of California to provide financial planning services. The financial professionals affiliated with PWM are registered with and offer securities and investment advisory services through LPL Financial, member FINRA/SIPC and a registered investment adviser. As of 4/1/2021, the total assets serviced by PWM through LPL Financial consist of $1.7 billion in advisory assets and $300 million in brokerage assets.

Dryden Pence is a registered representative with and offers securities and advisory services though LPL Financial, LLC (“LPL Financial”) member FINRA/SIPC and a registered investment adviser. Mr. Pence may offer financial planning services through Pence Wealth Management (“PWM”), a registered investment advisor. Pence Wealth Management and LPL Financial are separate entities.