Intro

2020 was a historic year. A once in a century pandemic, the fastest bear market in history, and the largest year-over-year drop in economic output since just after World War II. This was coupled with the quickest recovery from a bear market in history and a year that saw two successive records for household wealth despite the damage. While there is still a way to go, the recovery displayed so far has surpassed even the most optimistic expectations, and the Congressional Budget Office now expects the U.S. economy to hit pre-pandemic levels by the middle of this year.

Just a year after the emergence of COVID-19, we are likely to have Emergency Use Approvals (EUAs) for 5 vaccines of various efficacy levels, reasonably effective therapeutics, and a recognition that COVID-19’s worst effects are largely localized in one specific age demographic. COVID-19 is the worst pandemic in 100 years but it is not the Spanish Flu. The Spanish Flu killed 1 in 10 individuals across a year and 3 waves, taking the lives of what would, today, be over 2 million people in the United States adjusted for population – disproportionately causing mortality in the younger, healthier groups it infected and ultimately leading to runaway wage inflation in the years after the pandemic. This is very much in contrast with COVID-19 – healthy individuals under the age of 30 are more likely to die choking on their next meal than they are from contracting the disease.

Today, COVID and the economy are coexisting in way that seemed unthinkable in March and will seem like a distant memory with enough time. A casual glance around any local economy likely shows a host of businesses who have cleverly adapted to an unprecedented market environment in order to survive – and in some cases even thrive.

To put it plainly: Life finds a way.

Markets

Broadly speaking, this has been, and continues to be, a glass half full market. Time after time last year the market looked through economic and political disruptions, with good news being considered a boost to growth and future valuations while bad news was viewed as an increase to the likelihood and magnitude of further stimulus. There is a tremendous level of sentiment currently, driven by four primary pillars.

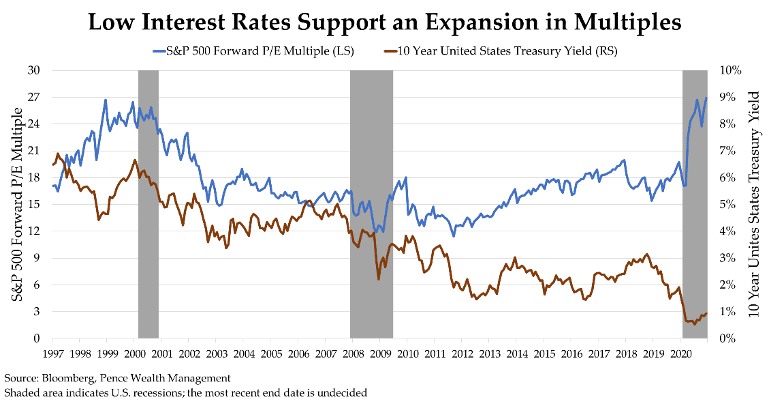

- Interest Rates – Interest rates are at historical lows, and are expected to remain at these levels for the foreseeable future, until either inflation creeps above 2% on a sustained basis or until the Fed begins tapering.

- Stimulus – Support provided to the economy, both Fiscal and Monetary, largely exceeded the damage done over the course of the shutdown.

- “Looking Through” Covid – The damage from the virus has largely come in lower than expected and for many companies it has actually been a benefit to their business.

- Vaccine – More vaccines are available, with higher efficacy levels than expected – assuming the new variants can be reasonably addressed with minor modifications to existing vaccines.

With the strong prospect of another round of stimulus, corporate results continuing to come in better than expected, and the Federal Reserve communicating its commitment to its “symmetric” inflation target – equities continue to have a tailwind. The “There Is No Alternative” theme is still well intact. The 10-year Treasury is widely considered a risky investment and the average money market fund yield doesn’t even cover its expense ratio. As long as this remains true, risk adjusted returns will lean towards equities. Simply put, investors have an option between taking nine-plus years of duration risk on a treasury that yields marginally more than a percent or putting it in equities – which has an indicated yield of 1.5%, provides the potential for capital growth, and has the backdrop of a Federal Government whose primary goal thus far has very evidently been to keep asset prices stable.

While interest rates have been rising of late in anticipation of a pickup in growth and inflation, interest rates are still historically low – which is the primary difference between today’s market and that in 1999. Interest rates in 1999 were substantially higher than today, yet forward multiples were about the same. Lower interest rates mean a higher present value for future cashflows[1], allowing investors to bring forward the valuation potential of higher growth companies. This means a company with a compound double digit earnings growth over the next decade can get higher value today for its future earnings because those earnings are being discounted at a lower interest rate.

However, it is very important to note that market performance to this point has largely been the result of the continued strength of all four pillars, and material change of any of them could lead to a significant repricing. Eurodollar futures are now pricing in more than one rate hike by the Federal Reserve by 2023, compared with an expectation of barely one increase at the end of December. A miscommunication by the Fed, an underperformance of high-expectation growth companies, or a large policy mistake by the new administration are the largest risks in our view and investors should keep a close eye on inflation expectations as a pickup there likely puts the Fed back on the table sooner rather than later which weakens the primary pillar of this rally.

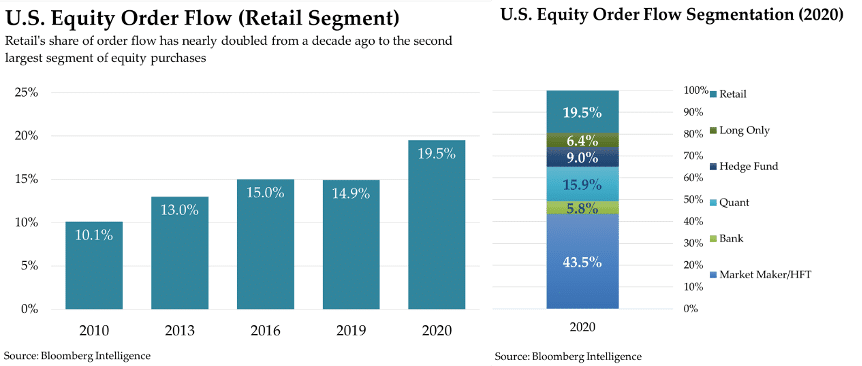

Another aspect of the market rebound that is becoming more pronounced is the rise of the retail investor. JMP securities estimates that over 10 million brokerage accounts were opened in 2020, which has led to a dramatically increased share of equity order flow for the retail segment of the U.S. equity market. Compared to a decade ago, the share of retail has nearly doubled to the second largest group of purchasers in the market at 20% on average last year. January’s volatility saw retail account for a record 48.6% of all trading, using the Trade Reporting Facility as a proxy. This phenomenon has never been seen clearer than in the recent performance of GameStop.

While the price action in GameStop defied belief and some people did inevitably get hurt, GameStop at a $20 Billion valuation made no sense but neither did GameStop at zero. 140% of the total share count were short in what is, ultimately, a reasonable business. The fundamentals behind the stock aren’t tremendous but GameStop has a decent retail presence and has the tailwind of two brand new console launches that have proven tremendously popular.

This episode demonstrates that Wall Street doesn’t have the monopoly on information it used to, nor does it have the strangle hold on the market in the days of old. This event, in and of itself, is not evidence of a bubble, in our view, more that it was irresponsible risk taking by hedge funds that retail took advantage of. Technology has given an economic voice to the masses, and today’s market has a player that hasn’t featured prominently in previous decades and the effect of which has likely not been fully taken into account in equity risk premiums and may require an adjustment in long-short positioning by hedge funds going forward.

Covid, Vaccines & the Economy

Since the approval of the Moderna and Pfizer vaccines in December, the United States recently hit a major milestone in the fight against the pandemic: More Americans have been vaccinated than have reportedly contracted COVID-19.

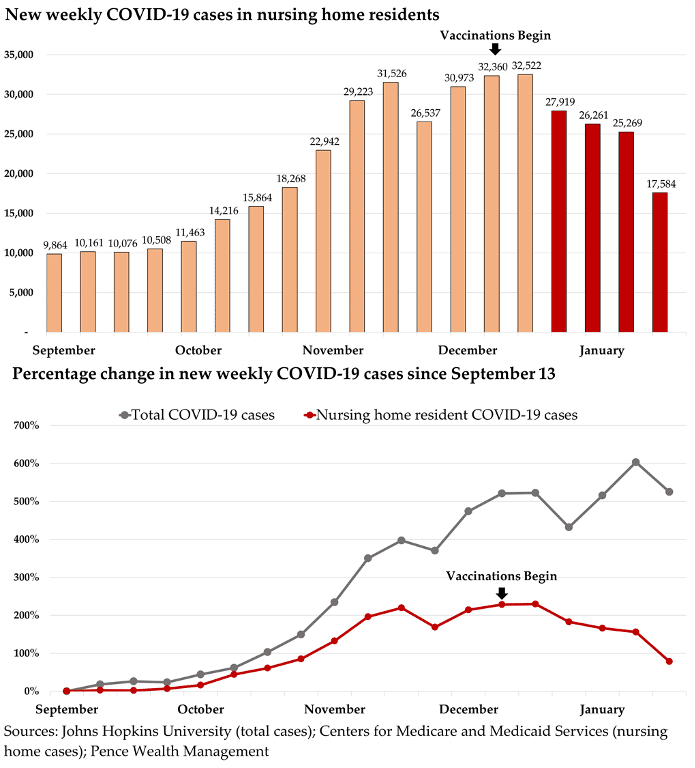

The impact of the vaccinations has been particularly pronounced in elder care facilities, which has seen a steep drop in cases that the rest of the United States has not. Nursing homes, due to the age of their residents, have been a disproportionate share of deaths in the pandemic. New York’s early policy with regards to COVID patients and nursing homes means that the state still has the most deaths in the country, which investigators are saying is certainly an undercount, despite no meaningful second wave occurring. While that demographic is less than 3% of the population, a Wall Street Journal tally shows that long term care facilities have been about 38% of COVID deaths – making impactful vaccination numbers essential.

The impact of the vaccinations has been particularly pronounced in elder care facilities, which has seen a steep drop in cases that the rest of the United States has not. Nursing homes, due to the age of their residents, have been a disproportionate share of deaths in the pandemic. New York’s early policy with regards to COVID patients and nursing homes means that the state still has the most deaths in the country, which investigators are saying is certainly an undercount, despite no meaningful second wave occurring. While that demographic is less than 3% of the population, a Wall Street Journal tally shows that long term care facilities have been about 38% of COVID deaths – making impactful vaccination numbers essential.

Nationally, the immunization effort in long-term care facilities has led to a stark drop in hospitalizations – which have now decreased for 29 consecutive days as of Feb 10 – with every state in the country showing a drop in daily new positive tests. As further approvals for vaccines come in over the next month or so and the national vaccination effort picks up speed, we expect this trend to continue. An optimistic scenario could see the United States vaccinating half of its population by sometime in the summer with a pickup from the current 7 day rolling average of 1.6 million shots a day as of Feb 10.

Potential headwinds to this include a continued lackluster immunization effort outside of the long-term care population and the emergence of variant strains of COVID-19, but at present existing vaccines are expected to have some level of effectiveness against them and the economy has shown a resounding resilience to the rise in cases over the back half of last year. December’s negative headline jobs number, as just one example, masked a lot of underlying strength as almost all of the job losses were concentrated in Leisure and Hospitality – a category where lockdown measures would clearly take a toll.

Over the duration of the pandemic the economy has grown more versatile, assisted by the backdrop of tremendous financial support and a reshaping of the U.S job market. Between February and November of last year, employment at Bars and Restaurants dropped 17.2%, but payrolls for Couriers and Messengers increased by 21.5% as online demand skyrocketed. Today’s economy and employment picture are very different from where they were a year ago, and the result has been readily apparent over the last few months of rising cases.

Jobless claims over the last 2 months have been nowhere near the levels of March last year or even over the summer and are already back to a declining trend which is a significant positive. This overperformance has resulted in the Congressional Budget Office (CBO) hiking its forecasts, now expecting a return to pre-pandemic level economic output by the middle of this year – compared to a prior expectation in July of mid-2022 – “in large part because the downturn was not as severe as expected and because the first stage of the recovery took place sooner and was stronger than expected,” the agency said.

Policy & Stimulus

A large part of that upgrade was the $900 billion relief bill enacted in December, which the CBO expects to add 1.5% to the level of GDP this year and next. Meanwhile, with the flip of both seats in Georgia there is the very real prospect of more stimulus on the horizon. Two major proposals currently floated are President Biden’s “American Recovery Plan” (ARP) – a $1.9 trillion stimulus plan and an as-of-yet unnamed infrastructure plan earmarked at around $2.0 trillion. Similar to last year, we expect stimulus to be a significant theme around the performance of markets.

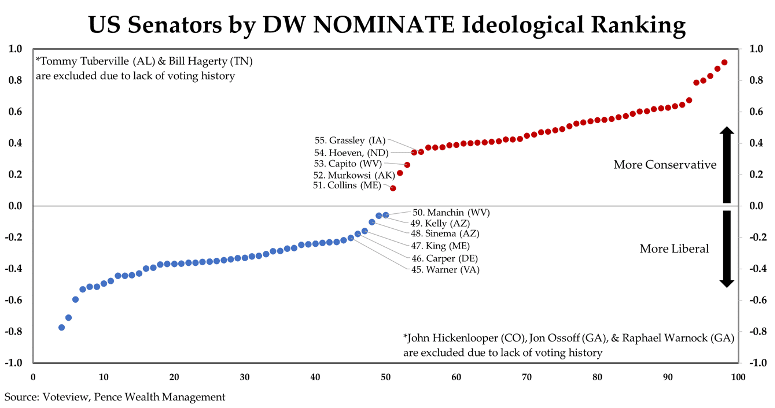

There has been much conversation about using the “reconciliation” process, which only requires the vote of 51 Senators and therefore needs no Republican support, but there are limits to this framework in both subject matter and timing. Reconciliation cannot be used to pass legislation – only matters related to Spending, Revenue, and the Debt Limit can be covered – and each subject can only be addressed once per year. Functionally, this often limits the Senate to one bill per year but depending on how legislation is structured there could be as much as two.

We are expecting a number between $700 billion and $1.1 trillion for a bipartisan stimulus – slightly below the midpoint of Biden’s plan and that proposed by a group of 10 Republican senators, but there is significant uncertainty around timing and the vehicle through which the legislation is passed and a bill without Republican support likely ends up closer to a $1.5 – $1.7 trillion number. Changes to Social Security are ineligible for reconciliation, meaning a hike in the social security tax for high income individuals would need to come through normal legislation – making it highly unlikely to pass. A $15 minimum wage is likely to see the same fate as it isn’t a strictly budgetary measure.

The Georgia results means that the Senate is tied at 50-50, with Vice President Kamala Harris casting the tie breaking vote. However, the results in the general election – where Republicans picked up at least 11 seats in the House – mean that the margins of the Democrats in both Houses are historically slim. As a result, there is significant political calculus that could drastically alter legislation from proposal to enactment.

With margins this slim, essentially all power rests within more moderate Democratic senators such as Joe Manchin (D., WV), Kyrsten Sinema (D., AZ), and Mark Kelly (D., AZ) – which has already been seen with the shift to more targeted individual checks in the ARP relative to broad-based checks as initially intended, and the possibility of the ARP passing via reconciliation as opposed to being planned as a bipartisan measure at its introduction.

At this juncture, it’s very difficult to chart a path for legislation and policy considering how many pieces are moving at this moment. A reconciliation bill for stimulus likely puts infrastructure on the 2022 agenda considering how unlikely it is to get widespread Republican support, while there is a real likelihood that an increase in taxes comes via a reconciliation bill later in the year, likely December, which we do not expect to be retroactive. We anticipate a corporate tax rate of 28% and an increase in the capital gains rate for individuals with over $1 million in Adjusted Gross Income. To what level that rate goes up is an open question, many consultancies speak of a 24% capital gains rate as a “psychological Reagan level” but it is better to expect higher taxes in the future and hope for a lower rate than proposed, in our view.

Conclusion

The virus did not cause this recession, government policy did. Federal, State, and Local governments picked winners and losers, selected activities that could be undertaken by individuals, and effectively rendered entire livelihoods illegal citing public health. The primary function of the vaccine, in our view, is that it gives no excuse for policy to remain in its current form past the spring. Regardless of vaccine take-up, at risk individuals have a medical solution to a disease that has very limited effects on other age groups and there should be no justification for an extension of existing policy. While the virus has been devasting for many, the recovery both physically and economically is now gaining traction.

The greatest stimulus possible is a reopening of the economy and a recission of the economic limitations would do substantial good for the near-term recovery. We see this year being a “Tale of Two Halves”, the first half revolving around stimulus from the government and the second half being a realization of what is likely to be a high level of pent-up demand. Stimulus is necessary and good, for the first half of the year it will come from the government, for the second half of the year it will need to come from the populace. We anticipate this year to have some headline volatility but in general the economy and markets should be improving throughout the year. Our fundamental 2021 outlook is positive.

As you know, part of our investment analysis focuses on significant short- and long-term trends in human behavior and while the economy has begun the process of healing, the societal effects of the lockdowns and government curbs to activity may not be realized for years. 2020 is likely to go down as one of the largest transfers of wealth in modern history and the impact on Americans in other ways should not be discounted. We are not entering a post COVID world but rather a world post COVID – there are things that will change and effects that will be felt for a long time.

Just as the Great Depression or the Vietnam War shaped the psyche of the American Public for years, COVID-19 will have created long-term changes in human behavior and leave behind some significant scars that we should not discount. Economic stimulus and thoughtful navigation of the markets can allow us to help keep your finances in order and recovering. It is, however, important for us to point out key elements of the world around us that we should all be attentive to. We are a multi-generational firm serving multi-generational families. It is time for everyone to pay attention and embrace each other, physically and emotionally. There are scars that need help healing.

In what is likely one of the first examples of the non-financial toll of COVID -19, the Clark County School District – which serves Las Vegas and other cities in Nevada – is now formulating a plan to allow some elementary grade and struggling youth to return to classrooms following 18 suicides amongst its student body between March and the end of December last year, The New York Times reported. That number reportedly was twice the amount the district recorded in the entirety of 2019.

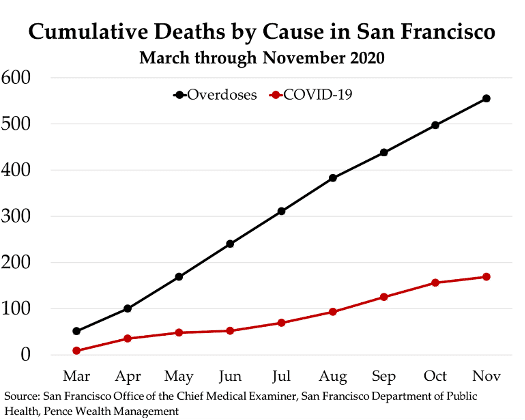

This is unlikely to be an isolated incident and in June, just after the first lockdowns, 11% of American adults seriously considered suicide – including a full 25% of men aged 18-25. A shocking 40% of adults reported struggling with mental health or substance abuse in June, which surely has some correlation with the fact that through November of last year 621 people died of drug overdoses in San Francisco. That represents an increase of 41% relative to last year and well outpaces the city’s COVID-19 death toll of 173 through the same period.

Between the protests over the summer, the events at the Capitol, and the performance of GameStop this year there is a real level of angst in the general population that is starting to make it to the mainstream. The GameStop trade was a rare moment of retail victory that caught many hedge funds flat footed, however much of what is being missed in the analysis of the GameStop phenomenon is that the cause of it has been over a decade in the making.

The events of 2008 and 2009 still resonate with a majority of Americans and they shaped the fortunes of an entire generation. With the Great Lockdown, the Millennial generation has now experienced two once-in-a-generation recessions within 12 years and came of economic age in one of the worst job markets and slowest periods of economic growth in recent memory. As a result, Millennials are the most educated generation in history, the most indebted generation in history, and today a majority of young adults live with their parents – a higher share than even during the Great Depression.

It is important to pay attention to the health of Main Street – which just saw its largest increase in poverty in 60 years – even if there is little to no correlation with the fortunes of Wall Street at present. The lockdowns have touched everybody in the country but America’s youth indisputably bore the brunt. Children have lost a full year of their K-12 schooling, skill building, and social development. For young adults, a quarter of their college experience has disappeared with no reduction in cost. Those in their mid-twenties or thirties have lost a year of developing relationships or taking advantage of their youth in any real capacity. These things matter when you are talking about an inclusive and sustainable economy over the long run – without even considering the fact that prior to COVID-19 Millennials were already forming households at only two-thirds the rate the Boomer generation did at the same age. From a societal standpoint, COVID-19, the lockdowns, the stimulus, and the ongoing affects thereof will be statistically, economically, and socially relevant for decades. We will remain vigilant and considerate of these long-term issues.

For our clients, economically we see things moving forward, your accounts should be of relatively little concern and we have a long history of navigating market cycles and volatility. We will focus on your accounts, so you can please focus on your health and the ones you love.

For all of our readers, we would encourage reaching out to those around you because what is visible may not be reflective of the actual damage. Human beings are social creatures and the lockdowns have led to substantial stress, isolation, loneliness and depression in wide swaths of the population. As we approach the one-year anniversary of “15 Days to Slow the Spread” we are also facing what is likely to be a major challenge – flattening the mental health curve.

While we expect a robust year of economic growth and a positive year for equities, these societal factors – as difficult as they are to hear – need to receive adequate attention. While the stock market is not the economy, the economy is a function of those that reside within it. A failure to address the personal, social, and emotional costs of the lockdowns could have long term ramifications that hinder the economy’s return to potential. Either virtually or in person, hug those you love.

For our clients with Strategic Asset Management (SAM) accounts where we manage with full discretion. Depending on your individual situation, objectives and type of accounts, we may lean towards building slightly higher cash or near cash equivalent positions as we evaluate both volatility and values in line with our current outlook. This will give us an opportunity to mitigate volatility and take advantage of opportunities around our generally positive outlook for the second half of the year.

For our clients who hold brokerage accounts, if you are interested in a similar fee-based strategy, please contact your advisor.

If you are not yet a client and are interested in learning more about our services, please contact Milo Reyes at (949) 660-8777 extension 129 or Ramilo.Reyes@lpl.com to schedule an appointment.

E. Dryden Pence III

Chief Investment Officer

LPL Financial Registered Principal

CA Insurance License # 0F82198

Ali Arik, Ph.D

Senior Analyst,

LPL Financial Registered

Administrative Associate

Ian Venzon

Analyst,

LPL Registered

Administrative Associate

[1] Discounted cash flow (DCF) is a valuation method used to estimate the value of an investment based on its expected future cash flows. DCF analysis attempts to figure out the value of an investment today, based on projections of how much money it will generate in the future.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All investing involves risk including potential loss of principal. Tactical allocation may involve more frequent buying and selling of assets and will tend to generate higher transaction cost. Investors should consider the tax consequences of moving positions more frequently.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC. Financial Planning offered through Pence Wealth Management, a registered investment advisor and separate entity.