Intro

The old adage "Don't fight the Fed" has been incredibly accurate over the last year and we do not expect that to change soon. In our view, equities are still the best place to put money to work but we think investors should focus on owning quality companies, elevating their yield profile, and maintaining higher levels of cash to take advantage of dislocations as the economy proceeds to a broader recovery.

There is a flood of money in the economy, which has led to historically elevated savings, spending, and sentiment. Combining all fiscal measures from March 2020 through March 2021, the United States committed $5.4 trillion to the United States economy – approximately $42,000 per household. This is, inflation adjusted, a larger amount than was spent on World War II according to the Congressional Research Service. As a result, the United States economy in 2020 saw the deepest drop in year over year economic output since World War II but also the second-best year for nominal growth in US Household Net Worth since the Federal Reserve began keeping records in 1989.

Markets

Much of this money and sentiment has made its way into equities. Bank of America estimated in early April that global equities have seen inflows of more than $576 billion since November – a number larger than the previous 12 years combined. Bloomberg data shows that, as of April 15, 89 S&P 500 companies were up 50% or more from February 19, 2020 – the S&P 500's peak before the COVID-19 driven sell off of last spring.

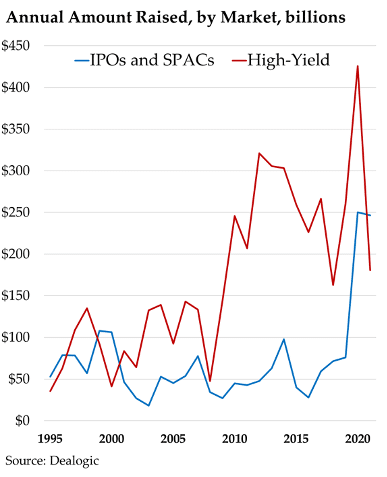

The "Everything Rally" of the last year means there are certainly aspects of the market that, in our view, show signs of froth. The flood of new money and new investors has pushed broader market valuations to levels that are very elevated historically. Companies have taken full advantage; funds raised via Special Purpose Acquisition Companies (SPAC) and Initial Public Offering (IPO) transactions through April 20 of this year have already reached the same amount raised in all of 2020, according to data from Dealogic. Meanwhile, Tesla's $1.5 billion Bitcoin purchase in January of this year was worth $2.48 billion at the end of March. That $1 billion paper gain was $200 million higher than Tesla's full year profit in 2020.

Naturally, there have a been a number of comparisons of today's market to that in the dot com era. At this time, we do not share this assessment. There are certainly areas of the market where years of growth have been extrapolated, but while current valuations suggest a degree of high expectations today's market leaders are large technology companies that make tons of money rather than telecommunications firms offering hype and promise. As just one example, Amazon's $89 billion in expected revenue growth just this year would be the 90th highest valued company in the S&P 500. At a 6.4x revenue multiple – the median price-to-sales of a technology firm in the broader index at time of writing – Amazon's revenue growth alone would be worth more than J.P. Morgan.

This environment, in our view, is not so much that markets are in a bubble rather that investors should brace for the prospect of lower returns going forward. High valuations don't necessarily suggest a sustained, broad-based crash, rather that investors have pulled forward a lot of growth. The S&P 500, at present, is trading for 18 times 2023 earnings which, on a trailing basis, would be well within historical averages for equity valuations. In markets like this we prefer to focus on "Quality of Price" – companies that had provable business models, fundamental strength, and strong growth prospects prior to the pandemic and stand to benefit from changes to consumer behavior going forward.

The key pillars of this rally are still intact, in our view, and we think equities remain the vehicle for investors in the search of strongest risk adjusted returns given the outlook in bonds with a rising interest rate environment on the horizon. But we also anticipate that there will be growing pains as we proceed towards a broad-based economic recovery that justifies today's valuations. There are only so many years of growth that markets can pull forward and we think investors are best suited to own quality companies, limit excessive exposure to hype, and have elevated cash positions to take advantage of dislocations when they occur in what looks like the early stages of a very robust growth cycle.

Going forward, stock picking matters.

Growth and Fiscal Policy

A large degree of market performance has been around expectations for growth, which have risen prodigiously in recent months after the passage of President Biden's $1.9 trillion "American Rescue Plan" (ARP) and as the U.S. inoculation campaign has picked up pace. The United States is now vaccinating over 2 million people per day on average which, at the current rate, puts the 70-75% threshold for "herd immunity" about 4 months away.

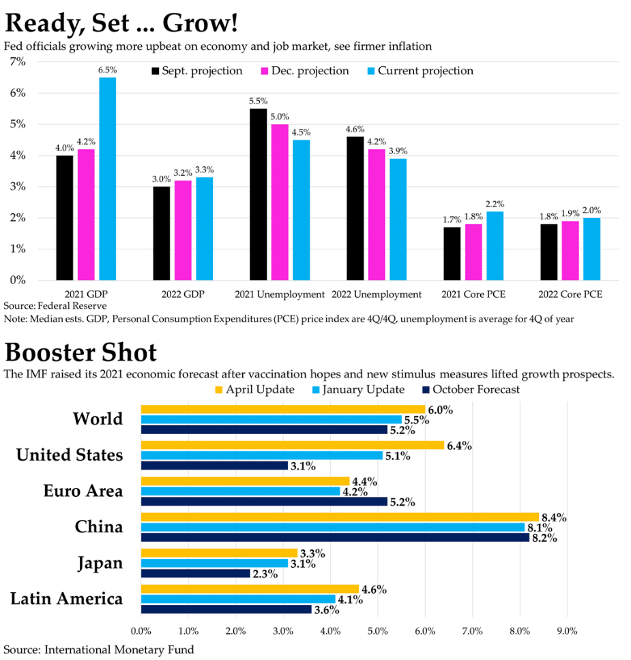

The result of the fiscal and health initiatives has been a swath of upgrades to forecasts from major consultancies. The Federal Reserve is now expecting the United States economy to grow 6.5%, measured from the fourth quarter of last year to the same period of this year, the fastest such pace since 1983 and up from their December forecast of 4.2%. The International Monetary Fund is expecting a global growth rate of 6% this year, the quickest since the organization's founding in 1980, and now sees the global economy – in nominal terms – just $700 billion below potential in 2024 compared to its pre-pandemic forecasts.

At present there is substantial clarity over the near-term economic recovery, while the $350 billion in State and Local Aid provided in the ARP is likely to act as further stimulus given that the expected tax shortfalls at state level largely didn't materialize. The shutdown-related layoffs of the spring disproportionately affected low wage workers which are a much smaller portion of tax revenues. According to the California Franchise Tax Board, California derives just 2.5% of income tax revenues from the bottom 60% of earners. The state is now predicting a $26 billion surplus for the 2020-2021 budget year and about $42 billion of the ARP is earmarked for California state government, counties and cities.

Fiscal Policy and Taxes

Looking forward, President Biden has two more significant fiscal initiatives on the agenda. The first is President's "American Jobs Plan" (AJP), a $2.2 trillion bill addressing infrastructure, the care economy, jobs training, semiconductor manufacturing and clean energy subsidies paid for by a proposed increase in the U.S. corporate tax rate from 21% to 28%. The second initiative is the "American Families Plan" (AFP), a $1.8 trillion bill with a universal Pre-K system, tuition free community college, national paid leave and a permanent expansion to the Child Tax Credit provided in the ARP – which would be paid for with about $1.6 trillion in tax increases on individuals – the most substantial components being an increase in the top capital gains rate to 43.4% including a 3.8% Medicare tax and an elimination of the step up in basis at death.

We think the passage of both initiatives is likely but the final legislation still has question marks and there are 3 scenarios for passing the proposals in our view.

- One, all-encompassing reconciliation bill with the American Jobs Plan and American Families Plan.

- Two separate, smaller reconciliation bills dealing with each individually.

- Bipartisan pieces of legislation covering traditional infrastructure, manufacturing and R&D with the remainder passing in a reconciliation bill.

We think the second scenario is the most likely given the lack of bipartisan support for both proposals, but note that there are several moving pieces that could alter final form legislation. Senate Republicans have proposed a $568 billion alternative infrastructure bill with more money dedicated towards traditional infrastructure uses, while the Problem Solvers Caucus has endorsed an increase in the gas tax – a position that has traditionally been a political non-starter due to its disproportionate impact on low income groups. Also threatening approval is the emergence of a group of at least 20 Democrats in the House threatening to vote against the plan without a full repeal of the State and Local Tax (SALT) deduction cap introduced in 2017's Tax Cut and Jobs Act. Meaningful Republican support is highly unlikely in our view considering that of the 40 congressional districts with the largest SALT deductions disallowed under the Trump tax law, 39 are represented by Democrats.

The non-partisan Joint Committee on Taxation estimates that repealing the SALT cap would cost approximately $88.7 billion in 2021 Federal revenue, which is a substantial hole to plug as legislation passed through reconciliation cannot expand deficits beyond the timeline of the bill – which is 8 years for the AJP. The Tax Policy Center estimates that more than half of the benefits of a SALT cap repeal would go to households earning more than $1 million a year, with 70% going to households making more than $500,000, which could alienate more progressive members in the House. With the historically narrow margins in the House, President Biden can only afford 3 defections.

Ultimately, we expect both sets of legislation to pass with limited modifications. The corporate tax rate will likely settle around 25%, which would result in a hit of a little under 9% to the S&P 500 profitability in 2022 according to estimates by Goldman Sachs, while enough Democrat Senators have voiced opposition to the capital gains hike to suggest the maximum ends up lower than proposed.

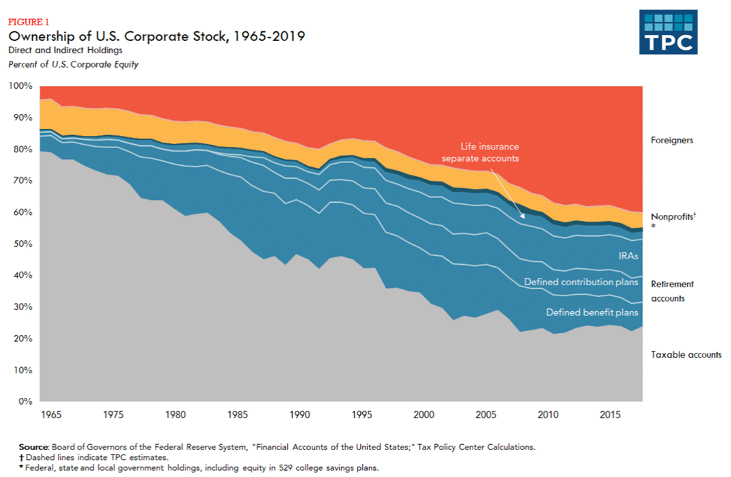

An analysis by Robert McClelland, a senior fellow at the Tax Policy Center, found that only 2.7% of taxpayers had an Adjusted Gross Income (AGI) of over $1 million. However, that group of taxpayers accounted for 62% of capital gains. In regards to the elimination of the step up in basis, his analysis found that only 3% of families have unrealized gains above the $1 million threshold. In our view, the ultimate effects will be limited in scope considering less than a quarter of U.S. corporate equities are owned in retirement accounts, according to estimates by the Tax Policy Center. The impact of a capital gains hike today is substantially different than it would have been in the past.

Monetary Policy and Inflation

With the very real possibility of an additional $4 trillion in spending, a large part of the economic debate has been around the prospect of inflation and the impact of the historic fiscal response to the pandemic. To be sure, the Federal Reserve Bank of New York's monthly Survey of Consumer Expectations has showed that consumers are expecting a pickup in near-term inflation.

In our view, the inflation debate is, at present, a little early because it discounts 4 significant aspects of the conversation.

- The Federal Reserve wants It has substantially more capacity to combat an inflationary environment than deflationary.

- COVID-19 was one of the largest shocks to the global economic system and supply chain in a non-war period while demand recovered substantially quicker than expected.

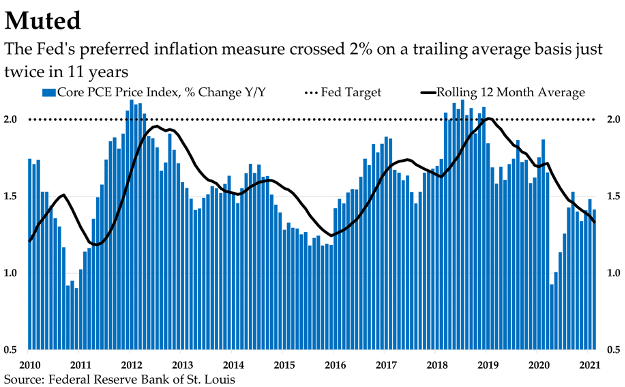

- Inflation has been well below the Federal Reserve's target for over a decade.

- Inflation experienced by everyday consumers and inflation that the Fed monitors are different in key ways[1].

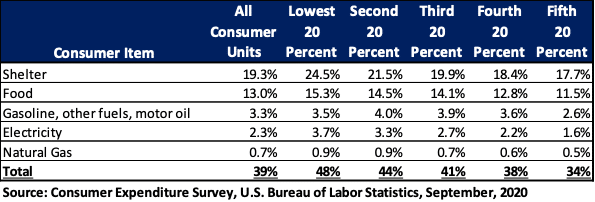

The Federal Reserve does not use the Consumer Price Index (CPI) to monitor inflation in the economy, which is a key difference from how most consumers view inflation. Instead, they use the Personal Consumption Expenditures (PCE) Price Index, excluding Food and Energy – which are highly volatile categories that are influenced by outside forces such as geopolitical events. By excluding them from the calculation the Federal Reserve gets a "Core" inflation number which is better representative of the underlying inflation in the economy.

However, by excluding the Food and Energy categories the Fed misses a large part of what consumers spend money on every day. The Bureau of Labor Statistics' 2019 Consumer Expenditure Survey shows that the average consumer spends 19% of their income on these categories with that percentage decreasing as income rises. This means that, similar to the effects of the downturn and recovery from the COVID lockdowns, inflation is K-shaped. For low-income individuals, high inflation in food prices – or $4 per gallon of gasoline – has substantially larger impact than it does for their high-income counterparts.

This isn't to say that inflation certainly isn't on the horizon, rather that inflation is – from a capital markets perspective – unlikely to meaningfully accelerate in a way that materially affects the primary purchasers of equities or makes the Federal Reserve take action soon. 70% of the growth in household wealth last year went to the top 10% of households while the Federal Reserve's new inflation goal is purposefully flexible, aiming for an average inflation rate of 2%. This means inflation could potentially overshoot for years to make up for the lack of inflation over the last decade without the Federal Reserve being in a position where they have to raise interest rates. This combined with "Base Effects" – that inflation was unusually low in the first half of last year – leads us to view the likelihood of a near term change in policy as extremely unlikely. We expect zero interest rate policy to be here for some time.

Conclusion

-

- Monetary policy is, in our view, the largest underpinning in this rally and with interest rates at current levels there are few alternatives to equities for investors to place their money that offers reasonable rates of return compared to the risks involved.

- Equity valuations are elevated, but bond yields are still well below inflation expectations with additional downside in the form of a looming risk of higher interest rates – which erodes principal and introduces uncertainty to bond ownership.

- In our opinion, the Federal Reserve would much rather an economy that progressively grows into its valuation rather than removing the backstop in a market trading largely on expectations – which, in our view, could cause more problems to the recovery than would a pickup in inflation.

- Currently, the Federal Reserve is expecting to start raising rates in 2024 which – with an accurate realization of current growth forecasts – should put the economy in a healthy enough spot to absorb a reinstatement of fixed income as a meaningful alternative to equities.

[1] The PCE includes a broader range of expenditures than CPI. It's weighted according to data provided in business surveys, rather than the less reliable consumer surveys used to weight the CPI. And it uses a formula that adjusts for changes in consumer behavior that occur in the short term, something the standard CPI formula doesn't do.

For our clients with Strategic Asset Management (SAM) accounts where we manage with full discretion. Depending on your individual situation, objectives and type of accounts, we may lean towards building slightly higher cash or near cash equivalent positions as we evaluate both volatility and values in line with our current outlook. This will give us an opportunity to mitigate volatility and take advantage of opportunities around our generally positive outlook for the second half of the year.

For our clients who hold brokerage accounts, if you are interested in a similar fee-based strategy, please contact your advisor.

If you are not yet a client and are interested in learning more about our services, please contact our LPL Registered Administrative Assistant, Milo Reyes, at (949) 660-8777 extension 129 or Ramilo.Reyes@lpl.com to schedule an appointment.

E. Dryden Pence III

Chief Investment Officer

LPL Financial Registered Principal

CA Insurance License # 0F82198

Ali Arik, Ph.D

Senior Analyst,

LPL Financial Registered

Administrative Associate

Ian Venzon

Analyst,

LPL Registered

Administrative Associate

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All investing involves risk including potential loss of principal. Tactical allocation may involve more frequent buying and selling of assets and will tend to generate higher transaction cost. Investors should consider the tax consequences of moving positions more frequently.

The Standard & Poor's 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Pence Wealth Management ("PWM") is a sophisticated financial services practice within LPL Financial, LLC ("LPL Financial") comprised of multiple financial professionals that provide a series of services including personal investment advisory, third party managed advisory and brokerage services. Pence Wealth Management, Inc. is an investment adviser registered with the State of California to provide financial planning services. The financial professionals affiliated with PWM are registered with and offer securities and investment advisory services through LPL Financial, member FINRA/SIPC and a registered investment adviser. As of 4/1/2021, the total assets serviced by PWM through LPL Financial consist of $1.7 billion in advisory assets and $300 million in brokerage assets.

Dryden Pence is a registered representative with and offers securities and advisory services though LPL Financial, LLC ("LPL Financial") member FINRA/SIPC and a registered investment adviser. Mr. Pence may offer financial planning services through Pence Wealth Management ("PWM"), a registered investment advisor. Pence Wealth Management and LPL Financial are separate entities.