Daily Market Report | 12/20/2023

US FINANCIAL MARKET

Treasuries Trim Gains, Stocks Edge Up After Data: Markets Wrap – Bloomberg, 12/20/2023

- US Treasuries held onto gains while stocks struggled to resume their climb after a fresh batch of data left traders measuring the chances a soft landing for the world’s largest economy.

- The yield on the US 10-year was down three basis points after reaching July levels before the reports, the benchmark rate is down more than 40 basis points this month.

- Sales of previously owned US homes edged higher in November off a 13-year low, National Association of Realtors data showed Wednesday, following earlier data showing mortgage rates fell to their lowest since June.

- Separately, US consumer confidence in December rose by the most since early 2021.

- Stocks edged higher with Nasdaq 100 advancing 0.3% after the tech-heavy benchmark notched record highs for three successive sessions.

- The S&P 500 rose 0.1%. The Nasdaq 100 rose 0.3%. The Dow Jones Industrial Average was little changed.

- Diminishing profits from FedEx, widely seen as a bellwether for US economic outlook, heightened concerns about an economic slump.

- The delivery company’s shares dropped 10% in New York trading.

- British 10-year debt led a global bond rally following data showing a slowdown in UK inflation.

- An auction of 20-year Treasuries this afternoon could also spur fresh moves in the market.

- A recent dovish pivot from the Fed set the stage for the latest leg of equity and bond rallies.

- Bond bulls got fresh encouragement Tuesday from Richmond Fed President Thomas Barkin, who suggested the US central bank would “respond appropriately” if recent progress on inflation continued.

- Investors will next seek guidance from upcoming US data readouts, including existing home sales figures on Wednesday, Thursday’s GDP print and Friday’s data on personal consumption expenditures — the Fed’s preferred inflation gauge.

- West Texas Intermediate crude rose 1% to $74.70 a barrel.

- Spot gold fell 0.4% to $2,032.69 an ounce.

FedEx Profit Falls Below Expectations on Drop in Air and Truck Cargo – Bloomberg, 12/20/2023

- FedEx reported profit below analyst expectations as cost cuts weren’t enough to make up for volume declines at the airfreight and trucking units amid a lingering cargo recession.

- Sales fell 2.6% to $22.2 billion.

- Analysts had predicted $22.4 billion.

- Ground units’ sales rose 2.9% to $8.6 billion and operating margins rose to 10.4% from 7.1% a year earlier on higher volume and revenue per package, showing that the courier still has pricing power even as the market cools from the pandemic highs.

- Cost per package declined 2%, FedEx said.

- The Express unit’s sales fell 5.6% on lower volume and a shift toward lower-yielding services.

- Adjusted operating margins tumbled to 1.3% from 3.1% a year earlier.

- At the Freight unit, sales dropped 3.8% while operating margins rose to nearly 21% from 18%.

- Adjusted earnings were $3.99 a share, the Memphis, Tennessee-based company said in a statement.

- Analysts had expected $4.19.

- The company lowered its sales forecast to a “low-single-digit percentage decline” from an earlier forecast of little changed.

- The company left unchanged its forecast of adjusted profit of $17 to $18.50 a share.

- Shares of General Mills sank Wednesday, after the consumer-foods company missed fiscal second-quarter revenue expectations and lowered its full-year outlook as sales volumes have recovered at a slower-than-anticipated pace.

- Sales declined 1.6% to $5.14 billion, to miss the FactSet consensus of $5.35 billion, as volume fell four percentage points to offset a three-percentage point increase in prices.

- Among the company’s business segments, North America Retail sales fell 2% to $3.31 billion, below the FactSet consensus of $3.47 billion.

- Pet sales declined 4% to $569.3 million and North America Food service sales were roughly flat at $582 million, while international sales increased 1.7% to $683.1 million.

- Cost of sales during the second quarter declined more than sales, down 4.0%, to lift gross margin to 34.4% from 32.7%.

- Excluding nonrecurring items, adjusted earnings per share rose to $1.25 from $1.10, to beat the FactSet consensus of $1.16.

- For fiscal 2024, the company said it now expects organic sales to be down 1% to flat from a year ago, compared with previous guidance of growth of 3% to 4%.

- The guidance range for growth in adjusted EPS, excluding the impact of currency movements, was revised to 4% to 5% from 4% to 6%.

- Masimo Chief Executive Officer Joe Kiani, head of the medical device maker that has put Apple’s smartwatch on the brink of a US ban, said he’d be open to settling with the company.

- The executive, speaking Tuesday on Bloomberg TV, said the “short answer is yes,” when asked if he’d settle, but he declined to say how much money he’d seek from Apple. Kiani said he would “work with them to improve their product.”

- “They haven’t called,” he said. “It takes two to tango.”

- The restriction only applies to Apple’s own retail channels.

- Best Buy, Target and other resellers can continue to offer the products.

Comcast Says Data of 36 Million Accounts Was Compromised in Breach – Wall Street Journal, 12/20/2023

- Comcast said nearly 36 million U.S. Xfinity accounts were compromised after hackers gained access to its systems through a vulnerability in third-party cloud-computing software.

- The cable giant said the compromised data includes usernames and “hashed” passwords—which had been scrambled and stored in a way that makes them unreadable by humans—as well as names, contact information, birth dates, the last four digits of users’ social security numbers and secret questions and answers.

- The breach occurred between Oct. 16 and Oct. 19, Comcast said, and was due to a vulnerability in software made by Citrix, which lets employees remotely access corporate networks and is widely used by large corporations.

- Comcast said it discovered suspicious activity on its systems on Oct. 25, more than two weeks after Citrix disclosed the software vulnerability on Oct. 10.

- The affected software has now been patched, Comcast said.

US ECONOMY & POLITICS

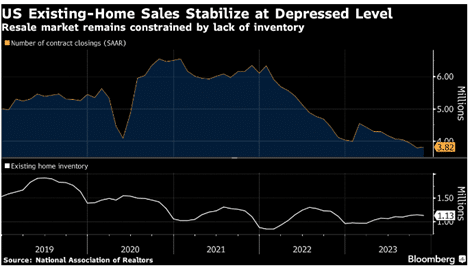

US Previously Owned Home Sales Edge Up From a 13-Year Low – Bloomberg, 12/20/2023

- Sales of previously owned US homes unexpectedly rose in November, led by a pickup in the South and representing a respite in a two-year downturn caused by higher borrowing costs and a lack of inventory.

- Contract closings increased 0.8% from a month earlier to a 3.82 million annualized rate, still near the lowest since 2010, according to National Association of Realtors data released Wednesday.

- The median forecast in a Bloomberg survey of economists called for a 3.78 million pace.

- Purchases were down 7.7% from a year ago on an unadjusted basis.

- The number of previously owned homes for sale dropped to 1.13 million.

- At the current sales pace, it would take 3.5 months to sell all the properties on the market.

- Realtors see anything below five months of supply as indicative of a tight resale market.

- The median selling price increased 4% from a year ago, the most since November 2022, to $387,600.

- NAR data showed 62% of homes sold were on the market for less than a month.

- Homes stayed on the market an average of 25 days in November, compared with 23 days a month earlier.

- Sales rose in two of four regions, led by a 4.7% advance in the South — the largest US region.

- Purchases also climbed in the Midwest, but dropped in the West to a record low.

- Single-family home sales increased 0.9% to a 3.41 million annual pace.

- Condominium and co-op sales were flat.

- First-time buyers made up a 31% of purchases, up from 28% in the prior month.

- Cash sales represented 27% of total sales.

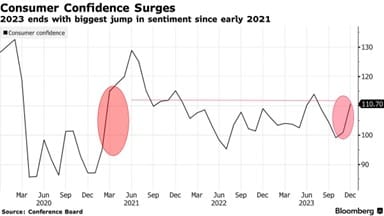

US Consumer Confidence Surges by Most Since Early 2021 – Bloomberg, 12/20/2023

- US consumer confidence rose in December by the most since early 2021 as Americans grew more upbeat about the labor market and inflation.

- The Conference Board’s index increased to 110.7 in December from a revised 101 reading in November, data published Wednesday showed.

- The median estimate in a Bloomberg survey of forecasters called for a 104.5 reading.

- Expected inflation a year ahead fell to the lowest level since late 2020.

- Meanwhile a gauge of current conditions rebounded from the lowest reading in more than two years.

- Labor-market sentiment improved from November.

US 30-Year Mortgage Rate Slides to 6.83%, Lowest Since June – Bloomberg, 12/20/2023

- US mortgage rates slid for a fifth-straight week, reaching the lowest level since June in a welcome sign for potential home buyers.

- The contract rate on a 30-year fixed mortgage dropped by 24 basis points to 6.83% in the week ended Dec. 15, Mortgage Bankers Association data showed Wednesday.

- The rate on five-year adjustable mortgages also decreased.

- At the same time, the group’s index of home-purchase applications eased 0.6% from the highest level since August.

- Combined with a decline in refinancing, the MBA’s overall index of mortgage applications decreased 1.5%, the first drop since the end of October.

Colorado Trump Ban Puts Supreme Court in Hot Seat – Wall Street Journal, 12/20/2023

- The Colorado ruling disqualifying former President Donald Trump from the ballot puts a novel and highly sensitive set of constitutional questions before the Supreme Court, likely forcing the justices to intervene directly in a presidential election in a way not seen since Bush v. Gore in 2000.

- The 4-3 decision by the Colorado Supreme Court’s justices will almost certainly be reviewed by the high court, legal experts said, and Trump’s campaign has said it would lodge an appeal.

- The Colorado justices put their ruling on hold until Jan. 4, anticipating further litigation.

- If Trump appeals before then, the hold will continue until the Supreme Court rules.

- Section 3 of the Civil War-era 14th Amendment says that acts of insurrection can disqualify someone from office.

- Only in Colorado, however, has such a case been decided against Trump.

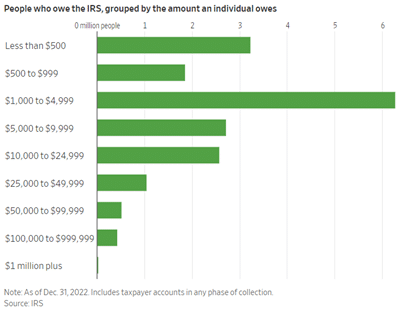

IRS Zaps Nearly $1 Billion in Penalties for Taxpayers – Wall Street Journal, 12/20/2023

- Americans who owe back taxes will be given an incentive to pay up after the Internal Revenue Service said Tuesday it would waive nearly $1 billion in late-payment penalties.

- Roughly 4.6 million individual taxpayers who owe for tax years 2020 and 2021 will be eligible for the penalty relief.

- The IRS is extending the olive branch because it stopped sending out many collection letters during the pandemic.

- The penalty relief applies to taxpayers who owe under $100,000 in taxes for 2020 or 2021 who received an initial balance due notice on or before Dec. 7, 2023.

- The relief expires for debts not paid by April 1, 2024.

- Eligible taxpayers will receive a special notice in early January reflecting their new balances due, the IRS said.

- Those who already paid these penalties will get a refund or credit on their IRS account as early as this week, Werfel said.

- As of year-end 2022, 18.6 million individual taxpayers owed the IRS $316 billion in overdue taxes, up from 16.8 million owing $308 billion in September 2019.

EUROPE & WORLD

Alibaba CEO Takes Direct Control of Domestic E-Commerce Businesses – Wall Street Journal, 12/20/2023

- Alibaba Group Chief Executive Eddie Wu will take direct control of the company’s domestic e-commerce arm, the latest management shuffle at the e-commerce giant as it struggles with new competition from the likes of PDD Holdings.

- Alibaba said Wednesday that its board has approved Wu’s appointment as chief executive of Taobao and Tmall Group, the company’s domestic e-commerce business, effective immediately, according to an exchange filing.

- Wu is replacing Trudy Dai, previously Taobao and Tmall Group CEO and one of Alibaba’s founding members.

- The change-up represents the latest leadership moves at the e-commerce titan, which after dominating China’s e-commerce market for years, has now stumbled on several fronts.

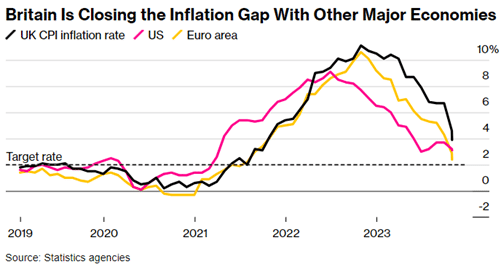

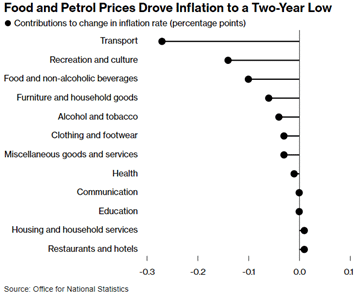

UK Inflation Slows More Than Forecast, Fueling Rate-Cut Bets – Bloomberg, 12/20/2023

- UK inflation slowed far more than economists forecast in November, a surprise that prompted traders to boost bets the Bank of England will soon have to abandon its higher-for-longer narrative on interest rates.

- Consumer prices rose 3.9% from a year earlier, down from 4.6% in October, according to data released by the Office for National Statistics on Wednesday.

- The slowdown was much sharper than the 4.3% economists had expected.

- The 10-year gilt yield fell as much as 11 basis points to 3.54%.

- Consumer prices fell 0.2% between October and November, the biggest decline for the month since 2014.

- Core inflation — which strips out volatile food and energy costs — eased to 5.1% from 5.7%, while services inflation fell to 6.3%, down from 6.6%.

- Food prices rose 9.2% from a year earlier, down from 10.1% in October.

- Auto fuel prices were down 10.6% after dropping 2.4% on the month.

- Factory gate prices dropped 0.2% compared to a year earlier, below the 0.5% slump predicted by economists.

- The 2.6% tumble in input costs that producers pay for raw materials and fuel was unchanged from the previous month.

Hamas Starts Planning for End of War With Israel – Wall Street Journal, 12/20/2023

- Hamas’s political leaders have been talking with their Palestinian rivals about how to govern Gaza and the West Bank after the war ends, a fraught negotiation that threatens to put them at odds with the militant wing fighting Israel.

- The talks are the clearest sign that Hamas’s political faction is starting to plan for what follows the conflict.

- “We don’t fight just because we want to fight. We are not partisans of a zero-sum game,” Husam Badran, a member of Hamas’s Doha-based political bureau, told The Wall Street Journal during an interview at a villa on the outskirts of the Qatari capital.

- “We want the war to end,” he said.

- Now, after more than two months of war, and about 20,000 Palestinian casualties in Gaza, according to health authorities there, Hamas’s political wing is talking about an end to the conflict.

- “We want to establish a Palestinian state in Gaza, the West Bank and Jerusalem,” Badran said.

Israel Offers One-Week Cease-Fire in Exchange for More Hostages – Wall Street Journal, 12/20/2023

- Israel has offered a one-week cease-fire in exchange for dozens of hostages still being held by Hamas, Egyptian officials said Wednesday, as Israeli forces stepped-up operations in the southern Gaza city of Khan Younis, believed to be the hiding spot of the group’s military leader.

- Israel wants Hamas to release 40 of roughly 100 hostages—including all the remaining women and children that the militants abducted from Israel during the Oct. 7 attacks—as well as elderly male hostages who need urgent medical treatment, the Egyptian officials said.

- In return, the Israeli military would pause its ground and air operations in Gaza for a week and allow further humanitarian aid to enter the enclave, the officials said.

- Hamas leaders, some of whom were in Egypt for talks on Wednesday, are demanding a two-week break in the fighting, the officials said.

Factmonster – TODAY in HISTORY

- Samuel Slater built the nation’s first cotton mill in Pawtucket, R.I. – 1790

- The United States purchased the Louisiana territory from France for $15 million. – 1803

- South Carolina became the first state to secede from the Union. – 1860

- The United States invaded Panama and installed a new government but failed to capture General Manuel Antonio Noriega. – 1989

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Historical performance is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Any economic forecasts set forth may not develop as predicted. All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Material presented is excerpts derived from third party content and you may need a subscription to access the full the content. The views and opinions expressed are those of the authors and do not necessarily reflect the views of Pence Wealth Management or LPL Financial. Prior to making any investment decision please consult your financial advisor regarding your specific situation.