Daily Market Report | 12/14/2023

US FINANCIAL MARKET

Stocks Join Bonds Higher in Fed-Fueled Optimism: Markets Wrap – Bloomberg, 12/14/2023

- Wall Street extended its rally after dovish Federal Reserve signals unleashed a bullish pulse across global markets amid optimism the world’s largest economy will be able to avert a recession.

- Equities pushed higher — with the S&P 500 approaching its record and the Nasdaq 100 hovering near that mark — as the Fed pivoted toward reversing the steepest hikes in a generation after taming inflation without a major economic slowdown.

- The S&P 500 rose 0.3%. The Nasdaq 100 was little changed. The Dow Jones Industrial Average rose 0.2%.

- Jerome Powell’s lack of pushback against the dovish bets also helped renew the surge in Treasuries, with the 10-year yield below 4%.

- Both retail sales and jobless claims on Thursday reinforced the soft-landing narrative.

- A day after the Fed decision, European Central Bank President Christine Lagarde said policymakers mustn’t get complacent following the recent slump in inflation toward 2% — signaling that investor bets on imminent rate cuts may be premature.

- The euro climbed.

- And so did the pound after Bank of England Governor Andrew Bailey said “there is still some way to go” in the fight against inflation.

- From stocks to Treasuries, credit to commodities, everything was up after the Fed projected more rate cuts in 2024.

- The scope and intensity can be illustrated by a measure that tracks the lowest return of the five major exchange-traded funds following these assets.

- With gains of at least 1%, the pan-asset advance beat all other Fed days since March 2009.

- Valuations and technicals suggest stocks are vulnerable to a pullback in the short-term.

- The S&P 500 and Nasdaq 100 indexes have seen their relative strength index soar into overbought territory, typically seen as a signal that a decline is imminent.

- Intel, the biggest maker of personal computer processors, announced new chips for PCs and data centers that the company hopes will give it a bigger slice of the booming market for artificial intelligence hardware.

- Adobe gave a lukewarm outlook for sales in 2024, disappointing investors who expected new generative artificial intelligence tools would quickly boost the software company’s results.

- A personalized vaccine developed by Merck and Moderna helped prevent the recurrence of severe skin cancer for three years in promising new results from a study.

- The Bloomberg Dollar Spot Index fell 0.6%.

- The yield on 10-year Treasuries declined eight basis points to 3.94%.

- West Texas Intermediate crude rose 3.4% to $71.84 a barrel.

- Spot gold rose 0.6% to $2,039.16 an ounce.

Adobe shares slide on weaker-than-expected forecast for 2024 – CNBC, 12/14/2023

- Adobe shares dropped in extended trading Wednesday after the software maker posted a lighter-than-expected forecast for 2024.

- Revenue: $5.05 billion vs. $5.03 billion expected.

- Earnings per share: $4.27, adjusted vs. $4.14 expected.

- Adobe called for fiscal 2024 earnings per share of $17.60 to $18 on $ $21.3 billion to $21.5 billion in revenue.

- Analysts polled by LSEG had expected $18 in adjusted earnings per share and $21.73 billion in revenue.

Intel Unveils Server and PC Chips in Push to Join AI Gold Rush – Bloomberg, 12/14/2023

- Intel, the biggest maker of personal computer processors, announced new chips for PCs and data centers that the company hopes will give it a bigger slice of the booming market for artificial intelligence hardware.

- The lineup includes updated Xeon server chips — the second overhaul of that processor in less than a year — that use less electricity while boosting performance and memory, the company said in a statement Thursday.

- Intel’s new Ultra Core chips for laptops and desktop computers, meanwhile, will let PCs process AI functions directly.

- Intel’s new product with the most to prove may be the Gaudi 3, the latest installment of a line that competes with Nvidia’s industry leading H100.

- These chips — known as AI accelerators — help companies develop chatbots and other rapidly proliferating services.

- Gaudi 3 is on schedule for release in 2024.

- Warren Buffett’s Berkshire Hathaway boosted its stake in Occidental Petroleum this week.

- Berkshire snapped up about 10.5 million shares of the oil company between Monday and Wednesday for roughly $590 million, according to a filing with the Securities and Exchange Commission Wednesday night.

- Occidental on Monday announced a $10.8 billion deal to buy West Texas producer CrownRock.

Moderna Stock Surges After Positive Trial Results – Wall Street Journal, 12/14/2023

- Moderna shares rose more than 15% after the company and partner Merck disclosed positive trial results for an experimental mRNA-based treatment for skin cancer.

- Drug-makers had taken a hit on Wednesday after Pfizer warned revenue could fall next year, though Moderna recovered to trade slightly higher after Federal Reserve-related optimism lifted markets broadly.

- Moderna reported quarterly results well short of analyst expectations last month as demand for its Covid-19 vaccine wanes.

Oil-Demand Growth to Weaken Next Year, IEA Says – Wall Street Journal, 12/14/2023

- Global oil-demand growth is expected to weaken next year, reflecting the slowdown in major economies in the wake of higher interest rates, according to the International Energy Agency.

- The Paris-based organization said Thursday in its monthly report that demand growth is expected to halve to 1.1 million barrels a day next year, with average demand seen at 102.8 million barrels a day.

- The outlook for 2024 was raised by 130,000 barrels a day compared with previous estimates.

- Economic growth worldwide is set to slow to 2.6% in 2024 from 3% in 2023, with China’s growth expected to record a sharp decline to 4.2% from 5%, according to the IEA.

- The organization lowered its oil-demand growth outlook for 2023 by 90,000 barrels a day to 2.3 million barrels a day, taking total demand to an average of 101.7 million barrels a day.

- This follows a slowdown in oil-demand growth to 1.9 million barrels a day in the fourth quarter of the year from 2.8 million barrels a day in the third quarter due to weaker-than-anticipated growth in Europe, Russia and the Middle East.

- Record supply from the U.S., Brazil and Guyana, along with surging Iranian flows, are expected to lift world output by 1.8 million barrels a day to 101.9 million barrels a day in 2023, according to the organization.

- Russian crude exports declined by 200,000 barrels a day in November to 7.2 million barrels a day, with revenue falling by $2.4 billion to just over $10.3 billion.

- The Organization of the Petroleum Exporting Countries on Wednesday left its expectations for global oil demand unchanged for 2023 and 2024 at 2.5 million barrels a day and 2.2 million barrels a day, respectively.

US ECONOMY & POLITICS

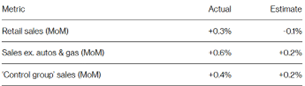

US Retail Sales Unexpectedly Rise in Solid Start to Holidays – Bloomberg, 12/14/2023

- US retail sales unexpectedly picked up in November as lower gasoline prices allowed consumers to spend more to kick off the holiday shopping season.

- The value of retail purchases, unadjusted for inflation, increased 0.3%, Commerce Department data showed Thursday.

- Excluding gasoline, sales rose 0.6%.

- In retail sales, eight out of 13 categories posted increases, led by restaurants and bars — the only service-sector category in the report — as well as sporting goods stores and online retailers.

- Gasoline sales dropped nearly 3% as pump prices continued to fall in the month.

- Meantime, department-store sales declined by the most since March, reflecting tepid Black Friday shopping.

- So-called control group sales — which are used to calculate gross domestic product — advanced 0.4% after stalling in the prior month.

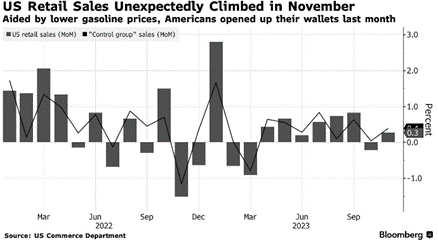

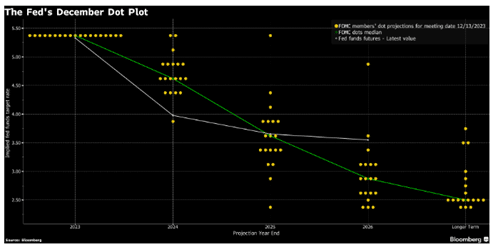

Fed Prepares to Shift to Rate Cuts in 2024 as Inflation Eases – Bloomberg, 12/14/2023

- The Federal Reserve pivoted toward reversing the steepest interest-rate hikes in a generation after containing an inflation surge so far without a recession or a significant cost to employment.

- While Chair Jerome Powell said Wednesday policymakers are prepared to resume rate increases should price pressures return, he and his colleagues issued forecasts showing that a series of cuts would be likely next year.

- Powell said the topic came up at their meeting, where the Fed decided to keep rates at a 22-year high for a third straight time.

- “That begins to come into view and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today,” Powell said.

- Updated quarterly forecasts showed Fed officials expect to lower rates by 75 basis points next year, a sharper pace of cuts than indicated in September.

- While the median expectation for the federal funds rate at the end of 2024 was 4.6%, individuals’ expectations varied widely.

- In another shift, the committee also acknowledged that inflation “has eased over the past year but remains elevated.”

- In addition, most participants now see the risks to price growth as broadly balanced.

- The updated projections also showed lower inflation forecasts for this year and next, with the Fed’s preferred price gauge excluding food and energy now seen increasing 2.4% in 2024.

- Policymakers anticipate further reductions in the fed funds rate to end 2025 at 3.6%, according to the median estimate of 19 officials.

U.S. jobless claims plunge to lowest level since mid-October – Market Watch, 12/14/2023

- Initial jobless claims fell by 19,000 to 202,000 in the week ending Dec. 9, the U.S. Labor Department said Thursday.

- Economists polled by The Wall Street Journal had estimated new claims would hold steady at 220,000.

- Last week claims rose a revised 2,0000 to 221,000.

- That compared with the initial estimate of a rise of 1,000 to 220,000.

- The number of people already collecting jobless benefits in the week ended Dec. 2 rose by 20,000 to 1.876 million.

- On an unadjusted basis, claims fell 46,316 to 248,299 in the latest week.

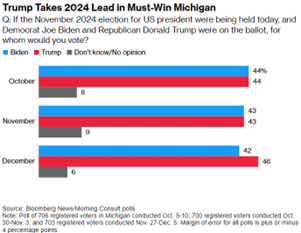

Trump Pulls Ahead in Michigan as Union, Women Voters Sour on Biden – Bloomberg, 12/14/2023

- Donald Trump has pulled ahead of President Joe Biden in must-win Michigan as voters remain pessimistic about the US economy, a Bloomberg News/Morning Consult poll shows.

- Trump led Biden 46% to 42% in the poll conducted Nov. 27-Dec. 5, after they were tied in the same survey done in October and early November.

- Trump’s lead is just within the poll’s margin of error of 4 percentage points.

- The former president now leads in the monthly tracking poll of all seven swing states that will decide the 2024 presidential election.

- Biden has lost support among suburban women in Michigan and voters aged 18 to 34.

- Inflation appears to be costing Biden support among women.

House Votes to Back Opening of GOP Impeachment Probe of Biden – Wall Street Journal, 12/14/2023

- The House narrowly approved opening an impeachment probe into President Biden on Wednesday, hours after his son, Hunter Biden, defied a congressional demand to testify on Capitol Hill, marking a sharp escalation in the battle between the White House and Republicans.

- The House voted 221-212 along party lines to formally authorize Republicans’ impeachment probe, which party leaders initiated several months ago, hoping to add legal and political muscle to the investigation into whether the president had ties to his son’s overseas business dealings.

- While GOP lawmakers have obtained testimony that Joe Biden before becoming president occasionally met with his son’s business associates, they haven’t uncovered support for those claims or established that he profited from his family’s overseas endeavors.

- Democrats criticized the vote as a political stunt and an effort to exact retribution on behalf of former President Donald Trump, who was impeached twice by the House before being acquitted by the Senate.

EUROPE & WORLD

ECB Holds Rates With Inflation Sinking But Hastens Bond Exit – Bloomberg, 12/14/2023

- The European Central Bank kept interest rates on hold for a second meeting with inflation tumbling but said it will step up its exit from €1.7 trillion ($1.8 trillion) of pandemic-era stimulus.

- The deposit rate was left at a record 4% — as predicted by all 59 economists in a Bloomberg survey — with the ECB reiterating that this level will make a “substantial contribution” to returning consumer-price growth to its 2% goal.

- Officials, meanwhile, said they’d accelerate the end of reinvestments under the PEPP bond-buying program.

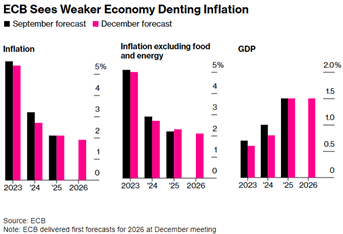

- That will put all policy tools into tightening mode, even as fresh projections showed a weaker economy softening the inflation outlook.

- “The risks to economic growth remain tilted to the downside,” President Christine Lagarde told reporters Thursday in Frankfurt, though she suggested that dangers for prices are more balanced.

- “Growth could be lower if the effects of monetary policy turn out stronger than expected,” she warned.

Meta’s Threads Launches in Europe – Wall Street Journal, 12/14/2023

- Meta Platforms rolled out Threads in Europe, months after the Facebook and Instagram parent launched the microblogging app in the U.S.

- Meta Chief Executive Mark Zuckerberg announced the launch Thursday on Threads, writing that “we’re opening Threads to more countries in Europe.”

- Users in the EU can choose to create a Threads profile connected to their Instagram account, or use it without a profile to search accounts, browse and share content via link copying or platform sharing, but without the ability to create a post or interact with content, Meta said in a statement.

- “We’re excited to see more people using Threads and will continue to listen to community feedback to further improve the experience for everyone,” the company said.

Israeli Military Steps Up Raids in Flashpoint West Bank City – Wall Street Journal, 12/14/2023

- Israeli forces are engaged in one of their most extensive operations in the West Bank city of Jenin in years, laying siege to a densely populated refugee camp in what they say is an attempt to root out militant units there, while continuing their campaign against Hamas fighters in Gaza.

- Palestinian health authorities say at least 11 people have been killed as the operation entered its third day Thursday, while the Israeli military said it had detained hundreds of people and searched over 400 buildings, seizing weapons and uncovering what it said were bomb-making facilities.

- Electricity, water and internet coverage in parts of the city were cut, and bulldozers destroyed infrastructure, residents said.

- The United Nations said Israeli forces surrounded hospitals and restricted movements of people in and out of the area, including ambulances.

Snubbed by the U.S. on Aid, Ukraine Turns to Bickering Europe – Wall Street Journal, 12/14/2023

- Ukrainian President Volodymyr Zelensky, having failed to secure new commitments for weapons from the U.S. this week, shifted his attention to Europe, where a fight deepened Thursday over how to keep Ukraine’s government running during its war with Russia.

- European Union financial aid, while less visible than guns and ammunition, is no less vital for Ukraine’s survival.

- The EU has provided Kyiv with billions of euros in crucial funding that has allowed it to keep hospitals, schools and power plants running, pay veterans’ benefits and rebuild homes.

- A four-year budget package valued at more than $54 billion is at the center of disputes among EU leaders who gathered for a scheduled summit amid acrimony over the bloc’s approach to Ukraine.

- Not long ago, the gathering was envisioned as a chance for the EU to cement its long-term commitment to Ukraine in its struggle against Russia, by not only agreeing on a multiyear financial-aid package but also formally inviting Kyiv to start negotiations toward becoming a member of the 27-country bloc.

- Both those objectives are now in doubt, although there were hints of a potential compromise on Thursday morning as EU leaders arrived in Brussels.

- Zelensky had proposed to attend the summit in person to make his case.

- U.S. national security adviser Jake Sullivan arrived in Israel on Thursday for the Biden administration’s latest bout of high-stakes diplomacy in the Middle East, amid mounting disagreements between President Biden and Prime Minister Benjamin Netanyahu.

- The trip comes just days after Biden offered his most pointed criticism of the Israeli government since the Israel-Hamas war started in October.

- Describing Israel’s government as the most conservative in the state’s history, the president warned that the country was losing support on the world stage and appeared to take issue with what he called its “indiscriminate bombing” of Gaza.

- But despite Biden’s repeated insistence that the U.S. would back Israel unconditionally, the two countries are at odds over the region’s future.

- The U.S. has said that postwar Gaza should be run by the Palestinian Authority, which controls parts of the West Bank, and that discussions should resume on a comprehensive peace settlement between Israel and the Palestinians.

- Netanyahu has rejected the U.S. plan, and is betting his political survival on opposing the Authority’s role in postwar Gaza and blocking the emergence of any Palestinian state.

Factmonster – TODAY in HISTORY

- George Washington died at age 67. – 1799

- Alabama became the 22nd state in the United States. – 1819

- Norwegian explorer Roald Amundsen became the first man to reach the South Pole, beating an expedition led by Robert F. Scott. – 1911

- The Soviet Union was dropped from the League of Nations. – 1939

- DNA synthesized for the first time. – 1967

- Israel formally annexed the Golan Heights. – 1981

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Historical performance is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Any economic forecasts set forth may not develop as predicted. All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Material presented is excerpts derived from third party content and you may need a subscription to access the full the content. The views and opinions expressed are those of the authors and do not necessarily reflect the views of Pence Wealth Management or LPL Financial. Prior to making any investment decision please consult your financial advisor regarding your specific situation.