Daily Market Report | 11/02/2023

US FINANCIAL MARKET

Tech Giants Lead Stock Gains as Bond Yields Slide: Markets Wrap – Bloomberg, 11/2/2023

- Stocks rose and bond yields fell on speculation the Federal Reserve is done with interest-rate hikes.

- The pound gained after the Bank of England ruled out any possibility of letting up on its fight against inflation for the foreseeable future.

- The S&P 500 added about 1.5%, heading toward is best day since August.

- The Nasdaq 100 advanced for a fifth straight session.

- Tesla led gains in megacaps, rallying 5%.

- Qualcomm, the largest seller of smartphone chips, jumped on a bullish forecast.

- Apple — which is due to report earnings after the close — also climbed.

- Treasury 30-year yields fell 13 basis points to 4.8%. The dollar dropped.

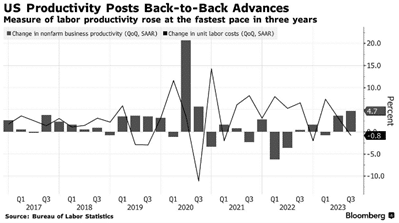

- In the run-up to Friday’s jobs report, data showed US labor productivity advanced by the most in three years, helping to alleviate the inflationary impact of recent wage growth.

- Continuing jobless claims rose for a sixth straight week, indicating those losing their jobs are starting to have more trouble finding new ones.

- Economists are forecasting non-farm payrolls rose by 180,000 in October following September’s gain of 336,000.

- While the Fed kept open the prospect of additional policy action on strong economic growth, Jerome Powell speculated that Treasury yields at lofty levels could instead help the central bank keep monetary conditions restrictive to wring out the inflationary excesses of this business cycle.

- As stock traders brood over what a period of still elevated interest rates might do to economic growth and equity valuations, some Wall Street optimists say there’s not much to worry about.

- Starbucks’s revenue beat expectations in the latest sign that diners aren’t quitting their lattes even in tough economic conditions.

- Palantir Technologies surged after the company reported the fourth consecutive quarter of profitability and highest earnings since its founding 20 years ago.

- PayPal Holdings climbed after the payments giant boosted its profit outlook and reported increased spending on its platforms.

- Eli Lilly beat Wall Street’s estimates for third-quarter revenue as its star diabetes drug Mounjaro outran expectations.

- Airbnb gave a disappointing outlook for the fourth quarter, citing “greater volatility” in the economic environment that it expects will slow demand for travel.

- Roku rallied after the streaming-video platform company reported third-quarter results that beat expectations.

PayPal Reports Increase in Consumer Spending, Names Miller CFO – Bloomberg, 11/2/2023

- PayPal Holdings said spending on its platforms accelerated in the third quarter as consumer confidence remained strong amid moderating inflation.

- The company also named Jamie Miller — a former EY executive — as its new chief financial officer, effective Nov. 6.

- PayPal said total payments volume rose 13% to $387.7 billion, surpassing analyst estimates.

- PayPal’s adjusted operating margin was 22.2% in the third quarter, declining 18 basis points, the San Jose, California-based company said.

- The company also reported that earnings per share increased 20% to $1.30, above the midpoint of the firm’s earlier guidance range. It subsequently said it expects EPS for the full year to grow 21% to $4.98.

Qualcomm Gives Upbeat Forecast in Sign Slump Finally Easing – Bloomberg, 11/2/2023

- Qualcomm, the largest seller of smartphone chips, gave a better-than-expected revenue forecast for the current quarter, indicating that the mobile-phone industry’s inventory glut may finally be receding.

- Revenue declined 24% to $8.63 billion.

- Analysts had estimated profit of $1.92 and sales of $8.51 billion.

- Handset related sales were down 27% to $5.46 billion.

- Chips for internet-connected devices slid 31% to $1.38 billion, while automotive sales jumped 15% to $535 million.

- For the current period, Qualcomm is projecting sales of $7.7 billion to $8.3 billion for its chip business.

- That’s ahead of the $7.8 billion average estimate.

- Sales will be $9.1 billion to $9.9 billion in the fiscal first quarter, Qualcomm said Wednesday in a statement.

- The midpoint of that range — $9.5 billion — was well ahead of the average analyst estimate of $9.26 billion.

- Excluding certain items, profit will be $2.25 to $2.45 a share in the current quarter, Qualcomm said, versus an average projection of $2.25.

- Most excess inventory has now been cleared out, and the company expects revenue from Chinese phone makers to jump 35% in the current period from the preceding three months.

- Eli Lilly on Thursday reported third-quarter revenue and adjusted earnings that topped estimates on strong demand for its diabetes drug Mounjaro, but slashed its full-year profit guidance due to charges primarily related to its recent acquisitions.

- Revenue: $9.50 billion vs. $8.95 billion expected.

- Mounjaro, the company’s Type 2 diabetes injection, posted $1.41 billion in sales for the quarter.

- Analysts had expected the drug to bring in $1.28 billion in worldwide sales, according to estimates compiled by FactSet.

- The lion’s share of Mounjaro revenue came from the U.S., where it raked in $1.28 billion, reflecting increased demand and higher realized prices due to decreased use of savings card programs.

- Revenue growth was also driven by sales of breast cancer pill Verzenio, which rose 68% to $1.04 billion for the quarter.

- Sales of Jardiance, a tablet that lowers blood sugar in Type 2 diabetes patients, climbed 22% to $700 million for the third quarter.

- Eli Lilly recorded pretax “in-process research and development” charges of $2.98 billion, which are primarily related to a slew of recent buyouts, including Dice Therapeutics, Versanis Bio and Emergence Therapeutics.

- Earnings per share: 10 cents per share adjusted vs. 13 cents loss per share expected

- The company lowered its 2023 adjusted earnings guidance to a range of $6.50 to $6.70, from a previous range of $9.70 to $9.90 per share.

- But Eli Lilly reiterated its full-year revenue forecast of between $33.4 billion and $33.9 billion.

Starbucks stock rises 10% as U.S. customers buy into pricier drinks – CNBC, 11/2/2023

- Starbucks reported quarterly earnings and revenue that topped analysts’ expectations, fueled by strong U.S. demand for pricier drinks.

- Revenue: $9.37 billion vs. $9.29 billion expected.

- The company’s same-store sales rose 8%, fueled by higher average checks and a 3% increase in customer traffic to its cafes.

- Analysts surveyed by StreetAccount were expecting same-store sales growth of 6.8%, but the company’s domestic locations outperformed.

- U.S. and North American same-store sales grew 8%.

- The average check in Starbucks’ home market rose 6%, while traffic ticked up 2%.

- Outside North America, same-store sales increased 5%, driven entirely by more customer visits.

- And in China, Starbucks’ second-largest market, same-store sales rose 5%. Customer traffic increased 8%, but the average ticket fell 3%.

- Earnings per share: $1.06 vs. 97 cents expected.

- Looking to fiscal 2024, Starbucks expects same-store sales growth of 5% to 7%, down from its long-term forecast of 7% to 9% same-store sales growth.

- Starbucks also maintained its earnings per share growth forecast of 15% to 20%.

- The company is forecasting that it will increase its global footprint by 7% in fiscal 2024.

- Its U.S. footprint is expected to grow 4%, while China’s will climb 13%.

MetLife beats quarterly profit estimates on robust investment income – Reuters, 11/2/2023

- MetLife on Wednesday reported a third-quarter profit that was above Wall Street expectations, as recovery in the U.S. markets boosted the insurer’s return from investments.

- Total revenue came in at $15.86 billion, compared with $22.28 billion a year earlier.

- MetLife’s quarterly net investment income surged nearly 35% to $4.82 billion.

- Adjusted earnings at MetLife’s retirement and income solutions unit jumped nearly 41% to $470 million, largely driven by higher recurring interest margins, higher variable investment income and volume growth, the company said.

- On an adjusted basis, the company earned $1.5 billion, or $1.97 per share, in the quarter ended Sept 30.

- Analysts had expected a profit of $1.94 per share, according to LSEG data.

Clorox Sales Top Estimates as Company Recovers From Hack – Bloomberg, 11/2/2023

- Clorox quarterly sales and profitability surpassed analysts’ estimates, surprising investors who had been bracing for a bigger impact from the cyberattack that has roiled the bleach and charcoal maker’s operations.

- The key measure of organic sales tumbled 18% in the three months ended Sept. 30, Clorox said Wednesday.

- Analysts had projected a 23% drop, according to data compiled by Bloomberg, and the company had previously said it could fall by as much as 26%.

- Gross margin and adjusted earnings per share also beat market expectations.

- A charge of 25 cents from the cyberattack includes supply-chain expenses such as the cost of destroying expired products, along with fines levied against the company by retail customers after Clorox wasn’t able to ship products.

- Clorox sees net sales for fiscal 2024, which began in July, falling by a mid-to-high-single-digit percentage, versus its previously projected range of flat to up 2%.

- Adjusted earnings, which exclude charges from the cyberattack, are expected to be in a range of $4.30 to $4.80 a share.

- That compares with analysts’ average estimate of $4.35.

Airbnb Misses Fourth Quarter Outlook, Citing Travel Volatility – Bloomberg, 11/2/2023

- Airbnb gave a disappointing outlook for the fourth quarter, citing “greater volatility” in the economic environment that it expects will slow demand for travel after a record summer season.

- Airbnb’s third-quarter revenue surpassed Wall Street’s expectations, jumping 18% from a year earlier to $3.4 billion.

- The company reported 113.2 million nights and experiences booked during the period, up 14% and slightly ahead of the average estimate.

- After benefiting from long-term, domestic stays in rural areas during the pandemic, more guests have returned to cities, Airbnb said, with high-density urban nights booked rising 15% in the third quarter from a year ago.

- International travel is also back, with cross-border nights booked increasing 17%.

- The Asia Pacific business has fully recovered to pre-pandemic levels.

- The average nightly price of a one-bedroom listing on Airbnb in September was $120, up 1% from a year earlier, while hotel prices have increased 10% to $153, according to the company.

- Revenue for the three months ending in December will be $2.13 billion to $2.17 billion, falling short of analysts’ average estimate of $2.18 billion, the company said Wednesday in a letter to shareholders.

- As a result, its full-year adjusted EBITDA margin will be about 150 basis points higher than the 35% in 2022, the company said.

- Excluding the benefit, adjusted net income was $1.6 billion.

Roku stock soars on third-quarter revenue beat, solid outlook – CNBC, 11/2/2023

- Shares of Roku soared after the company reported better-than-expected revenue for the third quarter.

- Revenue: $912 million vs $855.2 million expected.

- Active accounts also beat the Street, coming in at 75.8 million for the quarter, compared with StreetAccount estimates of 75.33 million.

- That’s a net increase of 2.3 million active accounts from the previous quarter.

- Loss per share: $2.33 vs. $2.12 expected.

- For the fourth quarter, Roku expects revenue of roughly $955 million, topping the $952 million expected by Wall Street, according to LSEG.

Palantir Surges as AI Demand Powers Record Quarterly Profit – Bloomberg, 11/2/2023

- Palantir Technologies surged the most in almost six months after the company reported the fourth consecutive quarter of profitability and highest earnings since its founding 20 years ago, citing strong demand for new artificial intelligence offerings.

- Palantir, famous for its work with intelligence agencies and its billionaire co-founder Peter Thiel, reported $72 million net income in the quarter ending Sept. 30 and a 17% rise in revenue, to $558 million.

- The number of US-based commercial customers at the company grew 37% in the third quarter to reach 181.

- Meanwhile, commercial revenue climbed 23% to $251 million.

- That outpaced revenue growth from government customers, which rose 12% to hit $308 million.

- The company’s revenue from governments missed analyst expectations of $319 million.

- The Denver-based data analysis company said Thursday it expects adjusted operating income for the year in the range of $607 million to $611 million, beating an average of analyst estimates of $577 million.

- The company also said it expects 2023 revenue of about $2.22 billion, narrowly outpacing analyst expectations.

Etsy shares slip on light revenue and forecast decline in gross merchandise sales – CNBC, 11/2/2023

- Shares of Etsy fell in extended trading Wednesday after the company released third-quarter results that missed analysts’ estimates for revenue, and forecast a decline in gross merchandise sales, or GMS.

- Revenue: $636 million vs. $641 million expected by LSEG.

- GMS, which measures the total number of goods sold over a certain period, came in at $3 billion.

- Services revenue, which includes advertising, grew 16% in Etsy’s third quarter.

- Earnings per share: 64 cents vs. 51 cents expected by LSEG, formerly known as Refinitiv.

- Etsy said it expects GMS to decline slightly on a year-over-year basis for its fourth quarter.

DoorDash Jumps on Record Orders, Stronger Outlook – Bloomberg, 11/2/2023

- DoorDash surged as much as 10% after reporting a record volume of customer orders in the quarter and raising its outlook for the year, underscoring its dominance in the food and retail delivery markets.

- The company reported 543 million orders in the third quarter, it said in a statement Wednesday, far exceeding analysts’ expectations.

- Gross value of those orders — a key metric for online delivery firms — was $16.8 billion, higher than the $15.9 billion estimated.

- It also forecast $17 billion to $17.4 billion in gross order value for the fourth quarter, raising its projections of that metric for the year.

Cummins 3Q Revenue Rises 15% – Market Watch, 11/2/2023

- Cummins saw its revenue climb double-digits, driven by a jump in North American sales.

- Net sales rose to $8.43 billion from $7.33 billion.

- Analysts polled by FactSet had expected $8.18 billion.

- The power systems company posted net income of $656 million, or $4.59 a share, for the quarter ended Sept. 30, from $400 million, or $2.82 a share, a year earlier.

- Analysts polled by FactSet had expected $4.70 a share.

- The company said that while full-year revenues are at the high end of its expectations, it is seeing signs of moderating demand in some markets.

Zillow Tops Estimates, Says It Can ‘Thrive’ in Industry Turmoil – Bloomberg, 11/2/2023

- Zillow Group reported third-quarter earnings that beat expectations, as revenue from selling marketing services to real estate agents held up in an anemic housing market.

- The company reported revenue of $496 million, according to a statement Wednesday.

- That was higher than the average analyst estimate of $481 million in data compiled by Bloomberg.

- Revenue from the company’s core residential business decreased 3% from a year earlier to $362 million, even as the industrywide value of home transactions decreased by 14%.

Moderna stock falls as sinking Covid vaccine demand drives steep loss – CNBC, 11/2/2023

- Moderna on Thursday posted a steep loss for the third quarter as it recorded a large write-down due to unused doses of its Covid vaccine, its only marketable product, and unveiled plans to scale back production of the shot.

- Revenue: $1.83 billion vs. $1.40 billion expected.

- Cost of sales for the quarter came in at $2.2 billion.

- That included a $1.3 billion charge for vaccines that have exceeded their shelf life and a contract manufacturing wind-down cost of $500 million, among other costs.

- The biotech company generated third-quarter sales of $1.83 billion, with sales of its Covid shot dropping 44% from the same period a year ago.

- Loss per share: $9.53. That may not be comparable to the $1.93 per share expected by analysts.

- The company said the loss was primarily driven by $3.1 billion in mostly non-cash charges related to tax allowances and changing its manufacturing footprint.

- The resizing, which resulted in $1.4 billion in charges during the third quarter, aims to make the company’s Covid vaccine profitable in 2024 and beyond, Moderna CEO Stéphane Bancel said in a statement.

- Moderna expects roughly $4 billion in sales in 2024, mostly in the second half of the year, mainly due to global Covid shot sales and the launch of its vaccine against respiratory syncytial virus, or RSV.

- Wall Street analysts had expected $6 billion next year.

Aflac beats estimates for quarterly profit on higher premium income – Reuters, 11/2/2023

- Insurance provider Aflac on Wednesday reported third-quarter profit above estimates, helped by higher premium revenue from its U.S. unit and strong gains on its investments.

- Its U.S. unit earned net premiums of $1.4 billion for the quarter, up 3.2% from year earlier.

- Adjusted earnings for the quarter rose 20% to $1.1 billion.

- On an adjusted basis, Aflac earned $1.84 per share in the quarter, compared with analysts’ estimates of $1.48 per share, according to LSEG data.

Electronic Arts lifts annual profit forecast on ‘FC 24’ strength – Reuters, 11/2/2023

- Electronic Arts on Wednesday beat analysts’ estimates for quarterly net bookings and profit and raised its annual earnings projection, betting that its revamped soccer franchise “FC 24” would help maintain the momentum in its sports videogame unit.

- EA said “FC 24”, its first soccer game without the “FIFA” branding in nearly three decades, had more than 14.5 million active accounts within the first four weeks of launch.

- EA reported a 4% rise in net bookings to $1.82 billion for the September quarter.

- That was higher than the estimates of $1.78 billion, according to LSEG data.

- Adjusted profit of $1.46 per share also beat estimates of $1.25.

- The company said it now expected earnings per share of between $4.10 and $4.66 for the year ending in March, compared with its previous forecast of $3.42 to $3.92.

Albemarle cuts annual forecast on slumping lithium prices – Reuters, 11/2/2023

- Albemarle, the world’s largest producer of lithium for electric vehicle batteries, trimmed its annual forecast on Wednesday and reported a lower-than-expected quarterly profit amid slumping prices for the ultralight metal.

- Worries have been mounting that global EV demand is softening and not keeping pace with aggressive growth targets set by automakers and regulators.

- Excluding one-time items, Albemarle earned $2.74 per share.

- By that measure, analysts expected earnings of $3.99 per share, according to IBES data from LSEG.

- The company now expects the volume of lithium it sells this year to increase at least 30% from last year’s levels, but for prices to increase only 15%, well short of the strong growth Wall Street had come to expect.

- For the year, the company trimmed its net sales forecast to a range of $9.5 billion to $9.8 billion.

- Albemarle previously expected $10.4 billion to $11.5 billion.

SolarEdge shares sink after company offers weak Q4 guidance – CNBC, 11/2/2023

- Shares of SolarEdge tumbled on Wednesday after hours, following the solar product manufacturer’s soft guidance for its fourth quarter amid demand struggles in the renewable energy sector.

- Revenue: $725 million vs. $768 million expected by LSEG.

- Loss per share: 55 cents vs. 89 cents per share expected by LSEG, formerly known as Refinitiv.

- For its coming fourth quarter, the solar producer reported expected revenue of between $300 million to $350 million.

- For the overall solar sector, it expects revenue to be between $275 million and $320 million.

Nikola Bets on Hydrogen Truck as Battery-Fire Fallout Expands – Bloomberg, 11/2/2023

- Nikola is betting on a newly launched hydrogen big rig to regain its footing as the company said it wouldn’t deliver any electric trucks for the rest of the year following recent battery fires.

- The manufacturer has 277 non-binding orders from 35 customers for the fuel cell-powered version of its semi truck, which formally launched in late September, Nikola said Thursday in a statement that also detailed quarterly earnings.

- The company didn’t specify when it plans to fulfill those agreements.

- Nikola will replace all of the battery packs with “an alternative solution,” a process that will cost $61.8 million.

- The company said it expected to resume deliveries in the first quarter of 2024.

- Along with Thursday’s disclosures, Nikola announced an adjusted loss of 30 cents a share for the third quarter of 2023, worse than the loss expected by analysts.

Disney to Pay Comcast at Least $8.61 Billion for Hulu Stake – Bloomberg, 11/2/2023

- Walt Disney expects to pay at least $8.61 billion to buy Comcast’s one-third of the Hulu streaming service.

- Under a previous deal between the companies, the total value of Hulu will be no less than $27.5 billion, minus any capital contributions payable by Comcast to Disney, according to a statement Wednesday.

- Nov. 1 marks the start of negotiations in a process that could last months.

- The final price will be settled through an appraisal process and is likely to involve up to three investment banks, the companies said previously.

- Disney expects a deal to be completed next year.

- The value of Hulu, which has about 50 million subscribers, is far higher than the $27.5 billion floor that was previously agreed to by the companies, Comcast Chief Executive Officer Brian Roberts has said.

Six Flags, Cedar Fair Strike Big Theme-Park Merger – Wall Street Journal, 11/2/2023

- Six Flags and Cedar Fair are joining forces in a roughly $2 billion all-stock deal to form a powerhouse in the regional theme-park industry.

- Six Flags shareholders will receive 0.58 share of common stock in the new company for each share they own, company executives told The Wall Street Journal.

- Cedar Fair unit holders will receive one share for each unit they own. The company is structured as a master limited partnership.

- The combined company, which will have an equity value of around $3.5 billion, will retain Six Flags as its corporate name and trade under Cedar Fair’s ticker, FUN.

- It will be based in Charlotte, N.C., near Cedar Fair’s Carowinds theme park.

- Cedar Fair shareholders will own about 51% of the combined company upon closing, and both companies will get six members on a 12-person board.

- The new group will have 27 amusement parks and 15 water parks across 17 states, Canada and Mexico, giving it the scale and resources it will need to compete with bigger rivals such as SeaWorld, Disney and Comcast’s Universal.

Toyota Recalls More Than 1.8 Million RAV4s Over Battery Fire Risk – Wall Street Journal, 11/2/2023

- Toyota Motor is recalling more than 1.8 million RAV4 vehicles over a potential fire risk, the company said.

- Batteries in certain RAV4 cars from the model years 2013 to 2018 are too small which could cause them to shift during forceful turns and possibly catch fire, the carmaker said in a statement Wednesday.

- Toyota said it would notify affected car owners by the end of the year if their vehicle is included in the voluntary recall.

- The company said it was working on a fix to the battery problem and would later repair the cars free of charge.

Uber, Lyft to pay $328 million to settle New York wage theft claims – Reuters, 11/2/2023

- Uber and Lyft will pay a combined $328 million to settle claims by New York’s attorney general that the ride-sharing companies systematically cheated drivers out of pay and benefits.

- Attorney General Letitia James said Uber will pay $290 million and Lyft will pay $38 million to resolve her office’s multi-year investigation into the companies, calling it the largest wage theft settlement in her office’s history.

- Drivers will also be guaranteed minimum hourly rates and paid sick leave.

- They will also be given notices and in-app chat support to address questions about earnings and other working conditions.

Ford reports lower US vehicle sales in October – Reuters, 11/2/2023

- Ford reported a 5.3% drop in total U.S. vehicle sales in October against the backdrop of the recent United Auto Workers (UAW) union strike at some of its facilities.

- The automaker posted total sales of 149,938 vehicles in October, compared with 158,327 units last year.

- Sales of its highly profitable F-series pickup trucks fell 5.1% to 53,509 units.

US ECONOMY & POLITICS

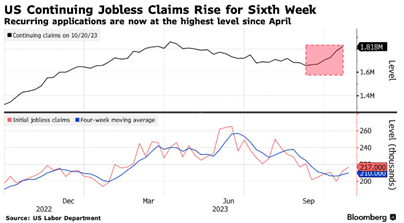

US Continuing Jobless Claims Rise for Sixth Week – Bloomberg, 11/2/2023

- Recurring applications for unemployment benefits rose for a sixth straight week, indicating those losing their jobs are starting to have more trouble finding new ones.

- Continuing jobless claims, a proxy for the number of people receiving unemployment benefits, increased to 1.82 million in the week ended Oct. 21, the highest level since April, according to Labor Department data out Thursday.

- Initial claims also rose, to 217,000 in the week ending Oct. 28.

- Economists project the US to have added some 180,000 positions in October, which would still be above the pre-pandemic trend in job growth.

- On an unadjusted basis, initial claims edged up to 196,767.

- Claims rose the most in Michigan, California and North Carolina, and fell in New York.

US Productivity Grows by Most Since 2020, Labor Costs Decrease – Bloomberg, 11/2/2023

- US labor productivity advanced by the most in three years, helping to alleviate the inflationary impact of recent wage growth.

- Productivity, or nonfarm business employee output per hour, rose at a 4.7% annualized rate in the third quarter after climbing 3.6% in the prior period, data from the Bureau of Labor Statistics showed Thursday.

- Unit labor costs, or what a business pays employees to produce one unit of output, decreased at a 0.8% rate after climbing 3.2% in the second quarter.

- Despite high borrowing costs, business investment has held firm, supporting long-term economic growth.

- As a result, hourly compensation growth decelerated to a still-firm 3.9% rate.

Powell Touts Tight Financial Conditions, Causing Them to Loosen – Bloomberg, 11/2/2023

- For a lesson in the real-time pitfalls of Federal Reserve messaging, consider the market reaction to Jerome Powell’s commentary on the role of Wall Street in subduing inflation.

- Stocks and Treasuries rose after the central bank held interest rates steady and the Fed chair name-checked rising bond yields in helping to tighten financial conditions — potentially serving as a substitute for additional interest-rate hikes down the road.

- Policy-sensitive two-year yields, cited by Powell this week, duly plummeted after his remarks, along with those on longer-dated bonds.

- That has helped to ease the latest gut-wrenching Treasury rout that has rippled through the global economy — hitting asset prices, squeezing home buyers and raising the cost of doing business for Corporate America and beyond.

- While the Fed kept open the prospect of additional policy action on strong economic growth, Powell speculated that Treasury yields at lofty levels could instead help the central bank keep monetary conditions restrictive to wring out the inflationary excesses of this business cycle.

California Says Electric Cars Now Make Up a Fifth of Auto Sales – Bloomberg, 11/2/2023

- One out of every five cars sold in California is now powered by a battery, registration data released Wednesday by the California New Car Dealers Association shows.

- In the first nine months of 2023, electric vehicles accounted for 21.5% of cars sold in California, a figure that’s more than doubled in the past two years.

- When combined with hybrid, plug-in hybrid and fuel-cell vehicles, the year-to-date figure is 35.4%.

- Battery-powered cars make up only 7.4% of the overall US auto market, the California report said.

- Tesla’s lead in the California electric-vehicle market has slipped this year, according to the state registration data.

- Its overall market share fell to 62.9% in the first nine months of 2023, compared to its 71.8% share the year before.

- Mercedes-Benz Group and BMW both gained ground among EV sellers.

- Gasoline- and diesel-powered vehicles known as ICE, for their internal combustion engines, made up 62.3% of new vehicle registrations in California during the period.

- That’s a drop from 71.6% in 2022.

- Toyota Motor remains the best selling brand in California overall, with 15% market share year to date.

- Tesla is second with 13.5% thanks to strong sales of the Model Y.

EUROPE & WORLD

Shopify shares surge 20% on earnings beat, rosy guidance – CNBC, 11/2/2023

- Shopify stock jumped more than 20% on Thursday morning after the Canadian e-commerce company reported third-quarter results that beat expectations, and gave a strong forecast for the remainder of the year.

- Revenue: $1.71 billion vs. $1.67 billion expected.

- Gross merchandise volume, or the total volume of merchandise sold on the platform, rose 22% to $56.2 billion during the quarter.

- Analysts surveyed by FactSet had forecast GMV of $54.2 billion.

- Earnings per share: 24 cents, adjusted, vs. 14 cents expected.

- Shopify said it expects 2023 revenue to grow at a mid-twenties percentage rate on a year-over-year basis, driven by fourth-quarter revenue growth in the high teens.

Novo Nordisk Sales Soar, Fortifying Grip on Obesity Drug Market – Bloomberg, 11/2/2023

- Novo Nordisk sales surged in the third quarter and double-digit growth should carry into 2024, driven by burgeoning demand for its obesity and diabetes blockbusters.

- Revenue jumped 38% to 58.73 billion kroner ($8.3 billion) excluding some items, the Danish drugmaker said Thursday, strengthening its grip on an obesity market estimated to hit $100 billion by 2030.

- Operating profit also rose 47% during the period.

- Wegovy sales hit nearly 10 billion kroner during the period, ahead of expectations even as it continues to battle with supply issues.

- About 95% of sales of Wegovy are in the US, where the pharma group is struggling to keep up with demand.

- Novo is currently treating about 500,000 US patients.

Ferrari Lifts Guidance as Limited Series Deliveries Rise – Bloomberg, 11/2/2023

- Ferrari raised its outlook as shipments of limited-edition models such as the €2 million ($2.1 million) Daytona SP3 boosted third-quarter profit.

- Sales reached €1.54 billion, beating the €1.47 billion average of estimates compiled by Bloomberg.

- In the quarter earnings increased 37% to €595 million, helped by customization services.

- That compares with an average analyst estimate of €560.8 million.

- It predicts sales of about €5.9 billion, up from an earlier forecast of around €5.8 billion.

- The company now sees adjusted earnings before interest, taxes, depreciation and amortization of at least €2.25 billion from a previous estimate of as much as €2.22 billion, according to a statement Thursday.

BOE Keeps Rates Unchanged, Pushing Back on Talk of Cuts – Bloomberg, 11/2/2023

- The Bank of England left its benchmark lending rate at a 15-year high, with Governor Andrew Bailey saying it was “much too early” to be thinking about cuts.

- The central bank’s Monetary Policy Committee voted 6-3 to maintain the key rate at 5.25%.

- Dissenters pushed for another quarter-point increase to choke off what they saw as persistent upward pressures on prices, according to minutes of the decision released Thursday.

- Bailey and his fellow policymakers agreed that a “restrictive” policy stance would be needed “for an extended period of time” to curb Britain’s rate of inflation, which remains triple the target and the highest in the Group of Seven nations.

- At the same time, they warned that the economy would stagnate over the coming year, raising doubts about how long they could hold rates at the current level.

- The market responded by betting the BOE would have to ease policy more aggressively in the second half of next year.

- A decline in borrowing costs could provide some political relief for Prime Minister Rishi Sunak, who must call an election by January 2025.

- Traders are more than fully pricing in two quarter-point cuts by the end of 2024.

- Investors also cut back expectations for a final increase this February, with the odds of that falling to just one in three, according to swaps tied to policy-meeting dates.

- Israel’s military has largely cut off Gaza City from the rest of the enclave, trapping hundreds of thousands of people in what is turning into a total siege as some 400 U.S. citizens wait to see if they will be able to leave the Gaza Strip.

- Israeli ground operations have effectively encircled Gaza City, the United Nations humanitarian agency said in an update released early on Thursday local time.

- The move prevents the delivery of humanitarian aid, which has been trickling into the enclave from the southern border with Egypt, to people in the north, including 300,000 internally displaced people, the agency said.

- If the Israeli encirclement of Gaza City holds, it would intensify a siege in which Israel cut off all supplies of food, water, fuel, medicine and other essential items.

- Even with a small amount of humanitarian aid reaching southern Gaza, hunger is already spreading in the enclave, with Palestinians growing increasingly desperate in their search for bread and other essential foods.

- Isolating the north would also mark a new phase in Israel’s military operation, deepening the country’s invasion of the Strip and heralding the beginning of what Israeli officials say will be a long and intense ground campaign aimed at removing Hamas from power.

Foreign Nationals Start to Leave Gaza at Egyptian Border – Wall Street Journal, 11/2/2023

- Foreign nationals and wounded Palestinians crossed into Egypt from Gaza on Wednesday, Egyptian and U.S. officials said, with more than 400 people—including some Americans—allowed to leave in a major diplomatic breakthrough.

- President Biden said he expected that more American citizens would be allowed to leave the embattled enclave over the coming days.

- The State Department said U.S. officials were in contact with about 400 Americans who want to leave.

- Egyptian officials said later Wednesday there were about 45 injured among those who crossed via Rafah.

- “We’ll see more of this process going on in the coming days,” Biden said in Minnesota on Wednesday.

- Shell launched a $3.5 billion share buyback program after third-quarter earnings rose on higher refining margins, oil prices and sales, but slightly missed market expectations.

- The London-based company on Thursday reported adjusted earnings of $6.22 billion for the quarter, up from $5.07 billion in the preceding quarter, but slightly missing market expectations of $6.25 billion provided by Vara Research.

- The company said the quarter’s trading gains were driven by higher refining margins, realized oil prices, liquefied natural gas trading and higher upstream production, which all offset lower integrated gas volumes.

- Total oil and gas production decreased by 9%, mainly due to more planned maintenance at the Prelude platform offshore Australia, at its Trinidad and Tobago operations, and production-sharing contract effects in the Pearl GTL plant in Qatar.

- The oil-and-gas major launched a $3.5 billion share buyback to complete by the time its fourth-quarter results are released, following buybacks of $3 billion during the third quarter.

- In addition, Shell declared a stable dividend per share payout of 33.10 cents.

Factmonster – TODAY in HISTORY

- North Dakota and South Dakota became the 39th and 40th states, respectively. – 1889

- Howard Hughes flew the Spruce Goose on its first and only flight. – 1947

- Harry S. Truman defeated Thomas E. Dewey to the surprise of pollsters and newspapers, in the greatest presidential upset in history. – 1948

- Jimmy Carter defeated Gerald Ford, becoming the first U.S. president from the deep South since the Civil War. – 1976

- Velma Margie Barfield, a convicted murderer became the first woman to be executed since capital punishment was reinstated in 1976. – 1984

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Historical performance is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Any economic forecasts set forth may not develop as predicted. All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Material presented is excerpts derived from third party content and you may need a subscription to access the full the content. The views and opinions expressed are those of the authors and do not necessarily reflect the views of Pence Wealth Management or LPL Financial. Prior to making any investment decision please consult your financial advisor regarding your specific situation.