Daily Market Report | 10/18/2023

US FINANCIAL MARKET

Stocks Drop, Oil Climbs on Renewed Mideast Risks: Markets Wrap – Bloomberg, 10/18/2023

- Stocks were under pressure and oil climbed as Iran intensified its rhetoric against Israel after an explosion at a Gaza hospital that complicated diplomatic efforts to rein in the Middle East conflict.

- The S&P 500 fell 0.8%. The Nasdaq 100 fell 0.9%. The Dow Jones Industrial Average fell 0.6%.

- Megacaps led losses as Treasury yields rose, with Nvidia down 3% and Tesla sliding ahead of its results.

- Morgan Stanley sank about 7% as profit fell on an investment-bank slowdown.

- United Airlines Holdings tumbled 8% after warning the Israel-Hamas war and higher jet fuel costs would weigh on earnings.

- Procter & Gamble gained as sales beat estimates.

- West Texas Intermediate oil approached $90 a barrel, before paring some of its gains.

- Traders have been on alert in case Israel opts to launch a ground offensive into Gaza, potentially igniting a broader conflict that may draw in Iran, a key crude supplier, and other nations.

- US President Joe Biden said the Pentagon had shown him evidence indicating that the Israeli military was not likely behind a deadly blast at a Gaza City hospital that left hundreds dead.

- Traders also awaited comments from some Federal Reserve speakers and the central bank’s Beige Book for clues on the outlook for monetary policy.

- Fed Chair Jerome Powell is set to speak at the Economic Club of New York on Thursday.

- U.S. Bancorp said profit fell in the third quarter as the biggest US regional lender increased its provisions for credit losses.

- Ally Financial posted third-quarter profit that beat analyst estimates even as consumers struggled to make loan payments.

- ASML Holding orders plunged in the third quarter amid a sector-wide slump in the semiconductor industry that has left the company increasingly reliant on revenue from China.

- Abbott Laboratories narrowed its annual profit forecast as it beat estimates for quarterly results, citing growth in medical devices for heart disease and diabetes.

- The Stoxx Europe 600 fell 1.1%.

- The Bloomberg Dollar Spot Index rose 0.3%.

- The yield on 10-year Treasuries advanced seven basis points to 4.90%

Morgan Stanley Shares Plunge After Profits Drop on Slowdown – Bloomberg, 10/18/2023

- Morgan Stanley shares plunged after third-quarter earnings slid amid sluggish results from the firm’s investment bank and a miss in wealth management.

- Companywide revenue totaled $13.3 billion, slightly ahead of estimates.

- Revenue from the fixed-income trading business slumped 11% and, along with muted fees from dealmaking, caused a drop in net income.

- Revenue of $6.4 billion from the firm’s wealth-management business missed analysts’ estimates, and net new assets slumped to $35.7 billion, the lowest in more than three years.

- Morgan Stanley’s fixed-income trading business posted $1.95 billion in revenue, compared with estimates of $1.83 billion.

- In equities, it posted $2.51 billion of revenue.

- Fees from advising on deals slid by more than a third to $449 million.

- The wealth-management business reported a pretax margin of 26.7%.

- The bank also reported $6.8 billion of outflows in its investment-management unit.

- Net income for the quarter totaled $2.44 billion, or $1.38 a share.

- That came in higher than the $1.30 average estimate of analysts in a Bloomberg survey.

United Air Falls as War, Costs Drive ‘Bleak’ Profit Outlook – Bloomberg, 10/18/2023

- United Airlines Holdings’s shares fell the most in six months after the carrier warned that the suspension of flights to Tel Aviv and higher jet fuel costs would drag profit this quarter well below Wall Street’s expectations.

- Revenue was $14.5 billion, while analysts expected $14.4 billion.

- Adjusted pre-tax margin was 10.8%.

- United had an adjusted third-quarter profit of $3.65 a share, compared with an average $3.34 of analysts’ estimates compiled by Bloomberg.

- Fourth-quarter revenue will climb between 9% and 10.5%, United said, while analysts expect a 9.7% increase.

- Costs to fly each seat a mile, a gauge of efficiency, will increase 3.5% to 5% in the quarter, while capacity will climb 14% to 15.5% depending on the Tel Aviv situation.

- The airline forecast Tuesday that fuel prices will increase to an average $3.28 a gallon in the fourth quarter from $2.95 in the third.

- Adjusted earnings will be $1.80 a share in the fourth quarter if those flights remain grounded through Oct. 31, United said late Tuesday in a statement, compared with an average $2.10 from analysts’ estimates.

- If fighting in the Middle East keeps the ban in place through the end of 2023, the airline’s profit will be as low as $1.50 a share.

- Procter & Gamble on Wednesday reported quarterly earnings and revenue that topped analysts’ expectations, despite volume falling for the sixth consecutive quarter.

- Revenue: $21.87 billion vs. $21.58 billion expected.

- The company’s organic revenue increased 7% in the quarter, helped by higher prices for P&G’s products.

- But the company’s volume shrank 1%.

- The company’s baby, feminine and family care segment reported its volume fell 3%.

- P&G’s grooming segment, which includes Venus and Gillette products, reported a 2% drop in volume.

- Earnings per share: $1.83 vs. $1.72 expected.

- The company also widened its outlook for fiscal 2024 revenue as it anticipates that foreign exchange rates could be a larger drag than previously expected.

- The company now projects revenue growth of 2% to 4%, rather than its prior forecast of 3% to 4%.

Elevance Signals 2024 Earnings Will Meet Analysts’ Expectations – The WSJ, 10/18/2023

- Elevance Health signaled that its results next year would be in line with analysts’ expectations, a projection likely to reassure investors worried about a recent blow to the company’s Medicare business.

- The insurer said the consensus estimate of around $37 in adjusted earnings per share for 2024 is appropriate.

- The endorsement of the number, without shading such as noting it might be the top end of future guidance, will likely soothe investor worries about 2024.

- But there are challenges. The company expects a dropoff of about 930,000 in Medicaid enrollment.

- On the upside, Elevance said it is expecting improved margins in its commercial insurance business, better Medicare earnings and momentum in its Carelon health-services arm.

- Analysts and investors are worried about a decline in Elevance’s Medicare quality ratings, which will affect results in 2025.

- Elevance CEO Gail Boudreaux said it was working aggressively to mitigate the impact of the reduced scores, which she said could reduce its quality bonus revenue by around $500 million in 2025.

- She said Elevance remains comfortable with its long-term goal of increasing adjusted EPS by 12% to 15% a year.

Abbott says market overestimating sales hit from weight-loss drugs – Reuters, 10/18/2023

- Abbott Laboratories said the market was over-estimating the hit to sales of its glucose monitoring products from growing popularity of weight-loss drugs, adding the treatments could end up boosting sales at its diabetes and nutrition businesses.

- FreeStyle Libre, Abbott’s CGM device used by diabetes patients, brought in sales of about $1.4 billion in the third quarter, up 30.5%, and accounting for nearly 14% of the company’s revenue.

- Abbott’s medical device sales rose nearly 17% to $4.25 billion, beating analysts’ estimates of $4.16 billion, according to LSEG.

- On an adjusted basis, the company earned $1.14 per share, above estimates of $1.10.

- Abbott also tightened its annual adjusted profit outlook to between $4.42 and $4.46 per share from its previous forecast of $4.30 to $4.50 per share.

U.S. Bancorp 3Q Revenue Boosted by Interest Income – Market Watch, 10/18/2023

- U.S. Bancorp posted a smaller profit in the third quarter but higher revenue as net interest income rose 10%.

- Total quarterly revenue rose to $7.03 billion from $6.33 billion last year, compared with analyst forecasts for $7.02 billion according to FactSet.

- Net interest income came in at $4.27 billion, up from $3.86 billion in the year-ago quarter and down slightly from last quarter.

- Average total deposits rose 12% year-over-year to $512.29 billion and were up from $497.27 billion in the second quarter.

- Stripping out merger and integration-related charges from its acquisition of MUFG Union Bank, earnings were $1.05 a share, above analyst forecasts for $1.01 a share according to FactSet.

- The company provisioned $515 million for credit losses, up from $362 million a year earlier but down from $821 million in the second quarter.

Ally Financial Posts Profit That Beats Estimates – Bloomberg, 10/18/2023

- Ally Financial posted third-quarter profit that beat analyst estimates even as consumers struggled to make loan payments.

- Ally reported $10.6 billion in total consumer auto originations for the third quarter, down from $12.3 billion a year prior.

- Net charge-offs in the quarter increased to $456 million from $276 million a year earlier.

- Net interest margin — or the difference between what a lender charges borrowers and pays depositors — fell to 3.24% from 3.81% a year earlier, missing analyst estimates of 3.33%.

- The Detroit-based auto lender reported $269 million of net income, or 88 cents a share, in the three months ended Sept. 30, according to a statement Wednesday.

- On an adjusted basis, net income was 83 cents per share, compared with the 79-cent average estimate of analysts surveyed by Bloomberg.

J.B. Hunt Earnings Tumble on Falling Freight Rates – Wall Street Journal, 10/18/2023

- J.B. Hunt Transport Services’ profit sank in the third quarter, sending a warning sign across a freight sector coping with slack demand and weak pricing.

- Revenue fell 18% to $3.16 billion, missing the $3.17 billion expected by analysts polled by FactSet.

- The revenue decline was led by steep retreats in revenue per load at J.B. Hunt’s intermodal and truckload segments, where declining pricing offset slight increases in shipping volumes.

- Operating income in the intermodal business, which transports goods by truck and train and is J.B. Hunt’s largest business segment, fell 41% to $128 million.

- Freight volume edged up 1% in that segment, but revenue per load excluding fuel surcharges dropped 14% from the same period a year ago.

- The company also saw a 38% drop in volumes in its freight brokerage integrated capacity solutions segment and a 20% drop in stops in its final miles services business.

- The Lowell, Ark.-based shipping bellwether reported Tuesday that its profit tumbled more than 30% in the three months ended Sept. 30, hitting $187.4 million, or $1.80 a share, compared with $269.4 million, or $2.57 a share, a year earlier.

- Analysts polled by FactSet expected per-share earnings of $1.82.

Oil Jumps as Iran Steps Up Rhetoric With Call for Israel Embargo – Bloomberg, 10/18/2023

- Oil leaped higher after Iran called for an embargo against Israel by Muslim countries, following a deadly explosion at a Gaza hospital that raised the risk of wider hostilities in the Middle East.

- Brent futures rose as much as 3.5% to trade near $93 a barrel, before paring some of those gains.

- Iran’s foreign minister called for a full and immediate boycott of Israel by Muslim countries, including an oil embargo on the country.

- While Israel’s oil imports are small in the context of global supply and little comes from the Middle East, the comments were significant in that they marked verbal escalation over the war between Israel and Hamas, which is considered a terrorist organization by the US and European Union.

- The increasingly global nature of the oil market gives Israel plenty of scope to overcome any embargo, although much of its supply comes from Kazakhstan and Azerbaijan, two majority Muslim nations.

- It also imports from West African producers.

- Amazon is introducing an array of new artificial intelligence and robotics capabilities into its warehouse operations that will reduce delivery times and help identify inventory more quickly.

- The revamp will change the way Amazon moves products through its fulfillment centers with new AI-equipped sortation machines and robotic arms.

- It is also set to alter how many of the company’s vast army of workers do their jobs.

- Amazon says its new robotics system, named Sequoia after the giant trees native to California’s Sierra Nevada region, is designed for both speed and safety.

- Humans are meant to work alongside new machines in a way that should reduce injuries, the company says.

- It is unclear how the new system will affect Amazon’s head count, and the company declined to provide details about its expectations except to note that it doesn’t see automation and robotics as vehicles for eliminating jobs.

- Sequoia enables the company to put up items for sale on its website faster and be able to more easily predict delivery estimates, said David Guerin, the company’s director of robotic storage technology.

- The new program reduces the time it takes to fulfill an order by up to 25%, the company said, and it can identify and store inventory up to 75% faster.

- Amazon launched the system this week at one of its warehouses in Houston.

- X will start charging some new users a minimum annual fee to interact with the platform, a move that owner Elon Musk said will combat fake and spam accounts.

- The platform formerly known as Twitter started testing the new subscription model, called Not A Bot, on Tuesday for users creating new accounts on the web in New Zealand and the Philippines, according to a blog post from the company.

- New accounts will have to verify their phone number and pay $1 annually to post content, like posts, reply or do other key functions.

- “It’s the only way to fight bots without blocking real users,” Musk posted on X after the test was announced.

- “This won’t stop bots completely, but it will be 1000X harder to manipulate the platform.”

Chesapeake Considers Acquisition of Rival Southwestern Energy – Bloomberg, 10/18/2023

- Chesapeake Energy is considering an acquisition of rival natural gas producer Southwestern Energy, according to people familiar with the matter.

- Chesapeake has held on-and-off discussions with Southwestern for months about a potential combination, said one of the people, who asked to not be identified because the matter isn’t public.

- No final decision has been made, and Chesapeake could opt against pursuing a deal, the people said.

- The potential tie-up comes as US oil and gas producers increasingly seek to pair up to add scale and cut costs.

- Chesapeake and Southwestern are two of the biggest players in Appalachia, a giant shale gas formation in the Northeastern US.

- They also operate in the Haynesville, another gassy basin in Louisiana along the Texas border.

Pimco Fund Walks Away From 20 Hotels With $240 Million of Debt – Bloomberg, 10/18/2023

- A joint venture tied to a Pacific Investment Management fund surrendered a portfolio of 20 hotels with a $240 million mortgage.

- The properties, located in cities including San Antonio and Carmel, Indiana, were forfeited in a deal that closed in September, according to commentary filed this week by the loan’s servicer.

- The Pimco portfolio, valued at $326 million when the debt was originated in 2017, was cut 16% to $272.8 million in a December appraisal.

- The hotels were owned by a 10-year-old Pimco real estate fund that had a 99% stake in a joint venture with a limited liability company linked to hotel operator Steven Angel, according to loan documents.

- Angel’s Fulcrum Hospitality manages more than $6 billion in assets, according to the company’s website.

- Pimco has also been raising money for a new commercial real estate debt fund that seeks to take advantage of market distress as $2 trillion of existing commercial real estate loans are set to mature within five years, according to a presentation to the Pennsylvania Public School Employees’ Retirement System.

- The Pimco Commercial Real Estate Debt Fund II closed to new investors in August after raising $3 billion in commitments, according to a person with knowledge of the fund’s closing, who asked not to be identified citing private information.

- The cellphone carrier that made its name accusing the competition of overcharging customers is now telling some subscribers to start paying more.

- T-Mobile this week informed some subscribers that they will automatically move to more expensive rate plans unless they opt out.

- Those moving to a new plan will usually pay $5 more a month per line for their new service.

- The affected older rate plans include T-Mobile ONE, Magenta, Magenta 55 and Simple/Select Choice.

- Many will be switched to a variety of the carrier’s Go5G brand, which launched earlier this year.

- Go5G plans start at $75 a month per phone line with taxes and fees included.

- “We’re always looking for ways to give our customers more from our services and simplify their experience,” a spokeswoman said in an email, “so we’re moving a small number who are on some select older rate plans to newer plans that will deliver them enhanced features or additional services.”

- The stars of the National Basketball Association are taking to the court as a new season begins next week.

- Behind the scenes, the league has started talks to secure the billions of dollars in media-rights fees that will help pay their huge salaries.

- As the NBA enters its first media negotiations in a decade, its biggest partners, Disney’s ESPN and Warner Bros. Discovery’s TNT—which together pay about $2.6 billion a year— aren’t looking to pony up big spending increases.

- The league is looking to bring additional parties to the negotiating table as it plots out its new deals, which would go into effect after the 2024-2025 season.

- For consumers, those deals could change significantly where games are broadcast.

- ESPN and TNT, which carry roughly 165 nationally televised games combined, are exploring signing up for smaller packages, said people familiar with the situation.

- That arrangement would help them hang onto a premier asset in American media without breaking the bank.

- Those companies already are in renewal talks with the NBA, with an exclusive negotiation period set to expire in April.

- If ESPN and TNT buy fewer games, that would allow the league to create a package for a streaming video player.

- Amazon and Apple already have expressed interest—and are looking for much more than a small slice of NBA games.

US ECONOMY & POLITICS

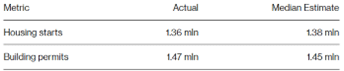

US Housing Starts Rise on Pickup in Multi-Family Projects – Bloomberg, 10/18/2023

- New US home construction rose in September, led by a pickup in multi-family groundbreakings.

- Residential starts increased 7% last month after falling by the most in over a year in August, according to government data released Wednesday.

- Multi-family dwellings rose more than 17% after also slumping the prior month.

- Applications to build — a proxy for future construction — fell to 1.47 million.

- Permits to build one-family homes ticked up to the highest level since May 2022, while multi-family authorizations declined to the lowest in nearly three years.

- Housing starts rose in all regions except the Northeast, where groundbreakings sunk to the lowest level in more than two years.

Republicans Delay Speaker Vote as Jim Jordan Struggles to Gain Support – Bloomberg, 10/18/2023

- Republican Jim Jordan’s hardball tactics cost him votes Tuesday in his campaign to be US House speaker, dragging out efforts to fill a congressional leadership vacuum into a third week.

- Twenty GOP holdouts withheld support from the ultra-conservative backed by former President Donald Trump on an initial ballot Tuesday.

- Republicans later postponed any more speaker votes until Wednesday at 11 a.m., a sign he wasn’t able to demonstrate momentum.

- Jordan, who spent the day pressing lawmakers for support, said he is gaining backing and will stay in the race.

- “We have narrowed it down,” he said of the opposition.

- But one Republican official familiar with Jordan’s campaign said late Tuesday Jordan appeared to be losing – rather than gaining – support.

- Republican Lori Chavez-DeRemer, who voted for McCarthy, said Jordan’s allies “are resorting to threats against anyone who refuses to back him.”

Fed to Propose Lowering Debit-Card Swipe Fees – Wall Street Journal, 10/18/2023

- The Federal Reserve is preparing a proposal that would lower the fees merchants pay to many banks when consumers shop with debit cards.

- Today, merchants pay large card issuers 21 cents plus 0.05% of the transaction amount, the level set by the Fed in 2011.

- The Fed on Tuesday said it would hold a meeting next week to vote on a proposal about revising the fee cap, without being more specific.

- The proposal would lower the cap, according to people familiar with the matter.

- The Fed would then start a public-comment period that would likely include heavy lobbying from card issuers and merchants and congressional discussion.

- It would require a final vote by the central bank’s governors to be implemented.

Why One Fed Official Is Ready to Stop Raising Rates – Wall Street Journal, 10/18/2023

- The Federal Reserve should extend its pause on interest-rate increases because of growing evidence that higher borrowing costs will slow the economy despite recent signs of hiring and spending strength, a top central bank official said.

- Philadelphia Fed President Patrick Harker in a Tuesday interview said he thinks the central bank can likely wait until early next year to decide whether rapid rate increases over the past 20 months have done enough to keep inflation heading lower.

- “This is a time where we just sit for a little bit. It may be for an extended period; it may not. But let’s see how things evolve over the next few months,” said Harker, who has a vote on interest-rate policy this year.

- While recent economic data have been surprisingly brisk, Harker said anecdotal, on-the-ground reports from business “contact after contact after contact is that things seem to be slowing down.”

- For example, bankers have reported more business loans are coming due and will need to be renewed at much higher rates.

- “They’re concerned that some of those businesses and their business models will not be able to survive those higher rates,” said Harker, a former university president.

- “If inflation were moving up in a sustained way, then I would behave very differently than if I saw just continuing strength in, say, retail sales for another month or so,” Harker said.

- “We’re not there yet, but we believe in lags,” he said.

- “So if we get into the range of, I don’t know, let’s call it 2.5%, [and] we’re continuing to move down, then something like that would at least have me considering whether or not it’s time for rates to start coming down.”

Health Insurance Premiums Now Cost $24,000 a Year, Survey Says – Bloomberg, 10/18/2023

- Health insurance premiums jumped this year amid a post-pandemic spike in costs of care, adding to the burden on employers and workers as inflation erodes broader buying power.

- The average employer-sponsored health insurance premium for US families rose 7% to almost $24,000 this year, according to an annual KFF survey of more than 2,000 US companies, compared with a 1% increase last year.

- Premiums for individual employer coverage rose at the same rate.

- Premiums for the estimated 153 million people in the US who get coverage through their employers go up each year, but the acceleration in 2023 is particularly threatening to employers amid rising prices for other goods and services.

- The cost of premiums is typically shared between employers and workers, with companies paying 71% on average for family coverage in KFF’s survey.

- The 7% increase was the biggest the survey reported since 2011, though Rae cautioned that it’s not statistically higher than some years, given the survey’s margin of error.

- “Clearly inflation is being passed on to premiums,” through elements like higher wages for health-care workers, Rae said.

- In recent years, technology has made a host of consumer transactions cheaper—from booking a vacation to buying stocks—but commission rates for selling a home haven’t really budged. That could soon change.

- A pair of class-action lawsuits challenging real-estate industry rules—including one that went to trial beginning this week—and continued pressure from U.S. antitrust officials are threatening to disrupt a compensation model that hasn’t meaningfully changed in decades.

- The plaintiffs in the class actions, who are home sellers in different regions of the country, say the longstanding industry rules amount to a conspiracy to keep costs high in violation of U.S. antitrust law.

- Buyers, they say, have little incentive to negotiate with their agents because they don’t pay them directly, while sellers are loath to experiment with a lower commission rate for fear that agents will steer clients away from their home.

- The National Association of Realtors, a defendant in both cases, says the current system helps first-time home buyers and those with modest means by sparing them a significant upfront cost when purchasing a home.

- Buyers might otherwise put themselves at a disadvantage by not having their own agent, the group says.

Mortgage demand falls to the lowest level since 1995 as interest rates near 8% – CNBC, 10/18/2023

- Mortgage rates last week rose for the sixth straight week, causing demand for home loans to drop to the lowest level since 1995.

- Total application volume fell 6.9% compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

- Applications for a mortgage to purchase a home dropped 6% week to week and were 21% lower than the same week one year ago.

- Applications to refinance a home loan fell 10% for the week and were 12% lower than a year ago.

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.70% from 7.67% and points decreased to 0.71 from 0.75 (including the origination fee) for loans with a 20% down payment.

EUROPE & WORLD

Shares of critical chip firm ASML drop after new U.S. curbs, outlook warning – CNBC, 10/18/2023

- Chip equipment firm ASML reported a year-on-year rise in profit in the third quarter and beat analyst estimates, but forecast 2024 revenue will be flat.

- Net sales: 6.67 billion euros ($7.1 billion) versus 6.71 billion euros expected

- Net profit: 1.89 billion euros versus 1.8 billion euros expected

- ASML net bookings in the third quarter totaled 2.6 billion euros, a 42% plunge from the previous quarter, as its customers cut back on spending.

- Still, ASML has reaffirmed its guidance for net sales to increase 30% year-on-year for 2023.

- Wennink added that the company is taking a more “conservative view” of 2024 and expects a revenue number similar to 2023.

Adidas shares climb after boost from Yeezy sales, guidance raise – CNBC, 10/18/2023

- Adidas on Tuesday hiked its full-year guidance and posted stronger-than-expected third-quarter earnings, aided by sales of its Yeezy inventory.

- Third-quarter operating profit came in at 409 million euros, down from 564 million for the same quarter in 2022.

- The German sportswear giant, in a surprise preliminary estimates release, projected a full-year operating loss of 100 million euros ($106 million), a significant improvement on its previous forecast of a 450 million euro loss, and expects revenues to decline at a low-single-digit rate for 2023.

- “Including the positive impact from the two Yeezy drops in Q2 and Q3, the potential write-off of the remaining Yeezy inventory of now around € 300 million (previously: € 400 million) and one-off costs related to the strategic review of up to € 200 million (unchanged), adidas now expects to report an operating loss of around € 100 million in 2023 (previously: loss of € 450 million),” the company said.

- “While the company’s performance in the quarter was again positively impacted by the sale of parts of its remaining Yeezy inventory, the underlying adidas business also developed better than expected,” Adidas said in its earnings report.

ABB slips as engineer flags Q4 slowdown and China challenges – Reuters, 10/18/2023

- ABB flagged a slowdown in revenue growth in the fourth quarter and reported a continued decline in orders in China, sending its shares lower even as the Swiss engineering group posted third-quarter earnings broadly in line with forecasts.

- Revenues at the company, which competes with Germany’s Siemens and France’s Schneider Electric rose 8% on a comparable basis to $8 billion, slightly below analysts’ forecast for $8.1 billion.

- ABB reported a 13% increase in its operational earnings before interest, tax and amortization (EBITA) to $1.392 billion during the three months to Sept. 30, broadly in line with a company-gathered consensus of forecasts.

- ABB said its order intake fell 2% during the quarter with double-digit growth in the United States, its biggest market, and growth in India and elsewhere in Asia partially helping to offset a decline in China, ABB’s second-largest market, and Europe.

- He said orders in Europe declined because of a softening of the underlying market, accentuated by a high comparable last year due to timing of larger orders booked.

- For the whole of 2023, the group said it expected a low double-digit rise in comparable revenue, and an operational margin of 16.5% to 17.0%.

- Previously, it had forecast revenue growth of at least 10% and an operational margin above 16%.

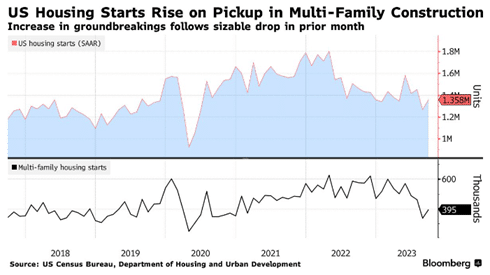

China’s Growth Beats Forecasts as Consumer Spending Improves – Bloomberg, 10/18/2023

- China’s economy gained momentum last quarter as people ramped up spending on everything from restaurants and alcohol to cars, offsetting a drag from the property crisis and putting Beijing’s annual growth goal well within reach.

- Gross domestic product for the three months ended September expanded 4.9% year-on-year and 1.3% from the previous quarter, far exceeding economists’ expectations as government stimulus efforts appeared to take root.

- The figures got a boost from bumper retail sales growth last month, which recorded the biggest jump since May.

- The nation is “very confident” that it can reach an annual growth goal of about 5% for 2023, National Bureau of Statistics Deputy Head Sheng Laiyun said at a briefing Wednesday discussing the data.

- GDP will need to grow more than 4.4% in the final three months of the year to hit that target.

- Property investment contracted 9.1% in the first nine months of the year, data showed Wednesday.

- Home sales by floor area fell 6.3% year-to-date, while construction of new housing starts plunged almost 24%.

- Industrial output rose 4.5% in September from a year earlier, above the median estimate of a 4.4% increase.

- Retail sales expanded 5.5% in September; median forecast was 4.9%.

- Fixed-asset investment increased 3.1% in the first nine months of the year compared to the same period in 2022, lower than the median forecast of 3.2%.

- The jobless rate was 5% at the end of September, improving from August.

Israel Lays Out Case It Didn’t Attack Gaza Hospital – Wall Street Journal, 10/18/2023

- Israel on Wednesday offered what it said was proof that it wasn’t responsible for the deadly explosion at a Gaza hospital compound, an incident that has caused widespread outrage in the Middle East and complicated a visit to Israel by President Biden.

- Israelis and Palestinians blame each other for the explosion at Al-Ahli Arab Hospital in Gaza City Tuesday night.

- The Hamas-run Gaza Health Ministry said Wednesday that the blast killed 471 people, a number that couldn’t be independently verified.

- On Wednesday, protesters gathered in Iran, Jordan, Kuwait, Egypt, Tunisia and in the West Bank, where they clashed with security forces from the Palestinian Authority.

- In Lebanon and Iraq, protesters tried to break through security barriers leading to the U.S. and French Embassies, chanting “death to America” and “death to Israel.”

- After landing in Israel on Wednesday, Biden said he was “deeply saddened and outraged” by the explosion.

- “Based on what I’ve seen, it appears as though it was done by the other team,” he said.

- “But there’s a lot of people out there not sure, so we’ve got a lot—we’ve got to overcome a lot of things.”

- Rear Adm. Daniel Hagari, Israel’s chief military spokesman, told a news conference that there had been no Israeli strike in the hospital area and that the explosion was caused by a misfired rocket launched by the Palestinian militant group Islamic Jihad.

- Hagari shared what he said was an intercepted conversation between two unidentified Hamas operatives saying the rocket was fired by Islamic Jihad militants from a cemetery near the hospital.

US vetoes UN Security Council action on Israel, Gaza – Reuters, 10/18/2023

- The United States vetoed a United Nations Security Council resolution on Wednesday that would have called for humanitarian pauses in the conflict between Israel and Palestinian Hamas militants to allow humanitarian aid access to the Gaza Strip.

- The vote on the Brazilian-drafted text was twice delayed in the past couple of days as the United States tries to broker aid access to Gaza.

- Twelve members voted in favor of the draft text on Wednesday, while Russia and Britain abstained.

- Washington traditionally shields its ally Israel from any Security Council action.

- The draft resolution also urged Israel – without naming it – to rescind its order for civilians and U.N. staff in Gaza to move to the south of the Palestinian enclave and condemns “the terrorist attacks by Hamas.”

- Chinese jet fighters have performed reckless maneuvers close to American and other military aircraft almost 300 times in the past two years under a centrally directed campaign of coercion, the Pentagon said.

- Offering new video footage and photos, the U.S. gave the most detailed account yet of dangerous encounters involving Chinese jet fighters and leveled its most direct accusation that the incidents are orchestrated by senior Chinese leaders.

- In maneuvers over the East China Sea and South China Sea this summer, one Chinese jet fighter deployed flares near a U.S. aircraft and another performed an aerobatic roll around a U.S. aircraft.

- Several flew as close as a few dozen feet to U.S. planes, according to the accounts, images and video from the Pentagon.

- American military officials say aggressive behavior by Chinese fighter pilots reflects a pattern of increasing assertiveness by China across the Asia-Pacific region.

- More than 180 of the close encounters with jet fighters have involved American aircraft over the past two years, but China has confronted other nations as well.

- On Monday, a Chinese jet fighter flew close to a Canadian patrol aircraft over the East China Sea and released flares, according to video footage of the incident.

- Canada’s defense minister called the Chinese action dangerous and reckless, while a Chinese Foreign Ministry spokeswoman said Canada “has sent warplanes halfway around the world to stir up trouble and make provocations at China’s doorsteps.”

- With one war raging in Ukraine and another unfolding in the Middle East, Chinese leader Xi Jinping is promoting his signature foreign-policy project as a force for unity, cooperation and prosperity around the globe.

- At a summit convened here to celebrate the Belt and Road Initiative, the picture looked more fractured.

- “We don’t do ideological confrontation, we don’t do geopolitical rivalry and we don’t do bloc politics,” he said, taking aim at unilateral sanctions, economic decoupling and other tools that Beijing accuses the U.S. of exploiting to contain its rivals.

- “What has been achieved in the past 10 years demonstrates that Belt and Road cooperation is on the right side of history.”

- Invited to speak directly after Xi, Russian leader Vladimir Putin praised what he said were the trillion-dollar infrastructure program’s efforts to build a “fairer, multipolar world and system of international relations,” according to a translation by Chinese state broadcaster CGTN.

- “The Chinese side supports the Russian people taking the path of their own choice for national rejuvenation, defending national sovereignty, security, and development interests,” Xi told Putin, according to Chinese state media.

US Targets Hamas’ Financial Network, Key Members With Sanctions – Bloomberg, 10/18/2023

- The US sanctioned several individuals associated with Hamas’ “secret” investment portfolio as well as two senior members of the organization’s leadership in a move designed to limit the group’s ability to raise funds following its attack on Israel.

- Six of the individuals are accused of running an investment portfolio worth hundreds of millions of dollars with companies in Turkey, Algeria, Sudan, the United Arab Emirates and other countries.

- The network uses front companies to disguise its activities and generates revenue used to support senior Hamas officials, allowing them to live in luxury, Treasury said in a statement Wednesday.

- The US also sanctioned two senior members of Hamas’ leadership and a virtual currency exchange based in Gaza.

- The investments and networks allow Hamas — which is categorized as a terrorist organization by the US and European Union — to raise money independently of the support the group receives from Iran, Treasury said.

Putin Sends Jets With Hypersonic Missiles to Patrol Black Sea – Bloomberg, 10/18/2023

- Russian President Vladimir Putin said he’s ordered fighter jets armed with hypersonic missiles to begin round-the-clock patrols over the Black Sea, ratcheting up tensions with the US amid the war in Ukraine and the spiraling crisis in the Middle East between Israel and Hamas.

- Putin told reporters in Beijing after talks Wednesday with Chinese President Xi Jinping that he’d ordered MiG-31 aircraft armed with Kinzhal missiles that “have a range of more than 1,000 kilometers at a speed of Mach 9” to conduct permanent missions over neutral waters in the Black Sea.

- “This is not a threat, but we will exercise visual control — control with weapons — over what is happening in the Mediterranean Sea,” Putin said.

- The US has moved two aviation groups into the Mediterranean in response to the Israel-Hamas war, and its recent delivery of ATACMS long-range missiles to Ukraine showed Washington was getting more deeply involved in the conflict there, he said.

- “All this is heating up the atmosphere” against the backdrop of the conflict in the Middle East, the Kremlin leader said.

- Putin said the US made a “mistake” in supplying Ukraine with ATACMS to help Kyiv’s counteroffensive aimed at reclaiming occupied territory seized by Russia in the invasion.

- The missiles “just prolong the agony” for Ukraine, and Russia will “certainly be able to repel these attacks,” he said.

Factmonster – TODAY in HISTORY

- Ferdinand II of Aragón married Isabella of Castile, uniting Spain and making it a dominant world power. – 1469

- The boundary between Maryland and Pennsylvania, the Mason-Dixon line, was agreed upon. – 1767

- The United States took possession of Alaska from Russia. – 1867

- The first Balkan War broke out. – 1912

- The U.S. Olympic Committee suspended two black athletes for giving a “black power” salute during a victory ceremony at the Mexico City games. – 1968

- Gilad Shalit, a 25-year-old Israeli soldier, is released after being held for more than five years by Hamas. He is exchanged for 1,000 Palestinian prisoners. Shalit had been held in Gaza since Palestinian militants kidnapped him in 2006. – 2011

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Historical performance is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Any economic forecasts set forth may not develop as predicted. All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Material presented is excerpts derived from third party content and you may need a subscription to access the full the content. The views and opinions expressed are those of the authors and do not necessarily reflect the views of Pence Wealth Management or LPL Financial. Prior to making any investment decision please consult your financial advisor regarding your specific situation.