Daily Market Report | 09/26/2023

US FINANCIAL MARKET

S&P 500 Hits 3-Month Low as Economy Angst Climbs: Markets Wrap – Bloomberg, 9/26/2023

- The S&P 500 slid to a three-month low Tuesday as consumer confidence in the economy waned and investors factored in a protracted period of high interest rates.

- A selloff in government bonds paused while the dollar climbed.

- The S&P 500 lost 1.1% as the equities benchmark fell to the lowest since June after a report showed consumer confidence in the world’s biggest economy stalled this month, falling to 103 from a revised 108.7 in August, and missing the median estimate of 105.5 in a Bloomberg survey of economists.

- The Nasdaq 100 fell 1.1%. The Dow Jones Industrial Average fell 0.7%.

- Yields on Treasuries dropped back from decade highs.

- The yield on 10-year Treasuries was little changed at 4.53%.

- The Bloomberg dollar index edged higher following its strongest close since December.

- Oil resumed its climb, moving back above $90 a barrel.

- Separate reports also showed purchases of new homes fell to a five-month low while home prices in the US rose to a record high over the summer as buyers battled over a tight supply of listings.

- The Treasury’s auction of two-year notes will also be closely monitored.

- Tech giants, namely Apple, Microsoft, Amazon.com and Google-parent Alphabet dragged on the US stock benchmarks.

- The threat of tight policy is undoing some of the market’s biggest gains this year in high-flying tech stocks.

- These growth companies are prized for their long-term prospects but hold less appeal when future profits get discounted at higher rates.

- That’s reflected in growing short positions against the technology-heavy Nasdaq 100 Index.

- One Fed speaker after another in the past week has delivered emphatic messages that they will keep policy tighter for longer if the economy is stronger than expected.

- Federal Reserve Bank of Minneapolis President Neel Kashkari said he expects the US central bank will need to raise interest rates one more time this year.

- Jamie Dimon, chairman and chief executive of JPMorgan Chase, floated the idea US interest rates could reach 7%, a worst-case scenario that could catch consumers and businesses off-guard.

- Meanwhile, a warning that a US government shutdown would reflect poorly on America’s credit rating from Moody’s Investors Service kept traders focused on an end-of-month deadline.

- The Stoxx Europe 600 fell 0.5%.

- Gold futures fell 0.6% to $1,925.40 an ounce.

Dimon Warns 7% Fed Rate Still Possible, Times of India Says – Bloomberg, 9/26/2023

- Markets may be predicting the end of the Federal Reserve’s tightening cycle, but Jamie Dimon is still telling clients to prepare for a worst-case scenario of benchmark interest rates hitting 7% along with stagflation.

- “We urge our clients to be prepared for that kind of stress,” the JPMorgan Chase CEO said in an interview with the Times of India, saying a hard landing remains a risk for the US economy.

- “If they are going to have lower volumes and higher rates, there will be stress in the system,” Dimon said while visiting Mumbai for a JPMorgan investor summit.

- “Warren Buffett says you find out who is swimming naked when the tide goes out. That will be the tide going out.”

- “Going from zero to 2% was almost no increase. Going from zero to 5% caught some people off guard, but no one would have taken 5% out of the realm of possibility,” Dimon said.

- “I am not sure if the world is prepared for 7%.”

- Google’s path to dominating online search included hardball tactics with Apple and Samsung Electronics, two partners key to making its search engine the default choice on most smartphones worldwide.

- The case has provided a rare glimpse into how Google cemented its status as a major gateway to the internet, a position the Justice Department says it has maintained through illegal, restrictive agreements.

- Google pressed its advantage in conversations with Apple and other partners, according to evidence presented at trial, showing the kinds of tactics it used to maintain its market share in search.

- The company has defended the market position of its search engine by saying its product is superior.

- Apple began licensing Google’s search engine for the 2003 release of its Safari web browser.

- Google in 2005 offered Apple a portion of advertising revenue if it made the search engine the default choice on desktop computers.

- Two years later, Apple asked Google for an amendment to the contract that would allow it to present users with several options for the default search engine, according to an email presented by the Justice Department.

- In response, Google told Apple: “No default—no revenue share,” according to an internal email chain that included former Google CEO Eric Schmidt and co-founder Sergey Brin.

Walmart to Roll Out New Prepaid Phone Service From Boost Founder – Bloomberg, 9/26/2023

- Walmart is expanding its offerings of prepaid phone plans with MobileX, a wireless service launched earlier this year by Boost cofounder Peter Adderton.

- Walmart will be MobileX’s first and exclusive retail partner, the companies said in an announcement Tuesday.

- MobileX, which uses Verizon Communications’s network through a wholesale agreement, will be available on Walmart’s website and in stores starting Tuesday, the companies said.

- It will offer unlimited pay-as-you go plans starting at $14.88 per month, and a lower-cost plan with customizable offerings starting at $4.08 a month.

- An artificial intelligence-powered guide that can anticipate a customer’s data needs can customize plans tailored to their usage, the company said in a statement.

- MobileX offers 5 gigabytes of high-speed data with its $14.88 per month plan and 30 gigabytes of data on its $24.88 offer.

- Additional data costs $2.10 per gigabyte.

UPS to hire 100,000 holiday workers with Teamsters pay bump – CNBC, 9/26/2023

- UPS plans to hire more than 100,000 seasonal workers again this year to support the holiday shipping rush, the company announced Tuesday in a press release. This year, though, they’ll be starting with a higher pay.

- As a result of a contract agreement with the Teamsters union that was ratified last month, seasonal workers’ pay will start between $21 and $23 per hour, depending on the position.

- Package handlers and driver helpers will make $21 per hour, while delivery and tractor-trailer drivers will make $23 per hour during the holiday season, a UPS spokesperson said.

- Last year, package handlers’ starting pay was $15.50 per hour and delivery drivers made a minimum of $21 per hour.

- The company said it is hiring both full- and part-time positions, primarily drivers and package handlers.

- Some permanent positions are also available.

Blue Origin Taps Amazon Veteran Executive Limp as New CEO – Bloomberg, 9/26/2023

- Blue Origin, the closely held spaceflight company founded by Jeff Bezos, is replacing its chief executive officer with veteran Amazon.com executive Dave Limp.

- Current CEO Bob Smith is stepping down and will be succeeded by Limp, the company said Monday.

- Smith will hand over the reins as of Dec. 4, according to two emails sent to employees and seen by Bloomberg News.

- Limp has been one of Amazon’s highest profile leaders as head of its devices and services business, which builds the Alexa voice assistant, Echo smart speakers, Kindle e-readers, and Fire-branded streaming sticks and tablets, among other gadgets.

- He told Amazon employees last month he’d be retiring from the Seattle company before the end of the year.

- “Dave will join in December, and Bob will be here through January 2 to ensure a smooth transition,” the company said in a statement.

Ford Pauses Construction on Politically Divisive Battery Plant – Wall Street Journal, 9/26/2023

- Ford Motor is pausing construction of a $3.5 billion battery plant in Marshall, Mich., where it had planned to produce lower-cost cells using technology from a Chinese battery maker.

- The U.S. automaker said Monday it was halting work and limiting spending on the factory until it is confident in its ability to operate it competitively.

- The stoppage is effective immediately, and the company hasn’t made any final decisions about its planned investment.

- The unusual move comes as Ford has faced months of scrutiny from lawmakers about its work with Chinese battery-maker Contemporary Amperex Technology or CATL.

- The plant itself would be owned and operated by Ford.

- Several Republican-led committees in the House have opened investigations into the deal and planned project, arguing it would enable Chinese domination of the U.S. auto industry.

- “There are a number of considerations, all of which we’re evaluating in terms of our competitiveness,” a Ford spokesman said.

US ECONOMY & POLITICS

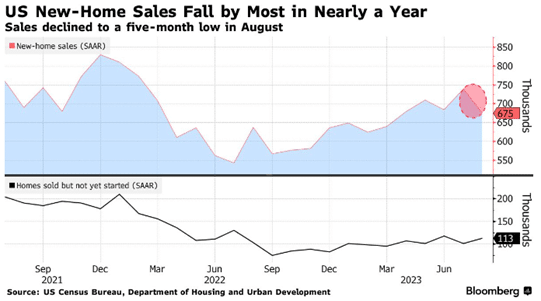

US New-Home Sales Fall to Five-Month Low Amid Elevated Rates – Bloomberg, 9/26/2023v

- US new-home sales fell in August to a five-month low as still-high prices and historically elevated mortgage rates took a toll on the housing market.

- Purchases of new single-family homes fell 8.7% to a 675,000 annualized pace following an upward revision to July’s figures, government data showed Tuesday, marking the largest drop in nearly a year.

- The median estimate in a Bloomberg survey of economists called for a 698,000 pace.

- The median sales price of a new home edged lower to $430,300, according to the Census Bureau’s report.

- The data showed there were 436,000 homes for sale as of the end of last month, the most since February.

- That represents 7.8 months of supply at the current sales rate.

- Sales fell in all regions except the Northeast.

- The report showed 90% confidence that the change in sales ranged from a 24.3% decline to a 6.9% gain.

Home Prices in US Hit Record High, Erasing Recent Decline – Bloomberg, 9/26/2023

- Home prices in the US climbed to a record high as the market bounces back.

- A national gauge of prices rose for a sixth straight month, increasing 0.6% in July from June, according to seasonally adjusted data from S&P CoreLogic Case-Shiller.

- So far this year, the national measure has climbed 5.3%.

- This year’s gains have offset the 5% decline in prices from last year’s peak in June 2022 to January 2023, when the market was slowing.

- The index measures a period where mortgage rates started to push back up toward 7%.

- The number of homes for sale in August was down 7.9% from a year earlier, according to Realtor.com.

- On a year-over-year basis, home prices nationally increased 1%.

- Chicago, Cleveland and New York posted the biggest annual gains in a 20-city measure of prices in July.

- Las Vegas and Phoenix were the worst performers, with declines of 7.2% and 6.6% respectively.

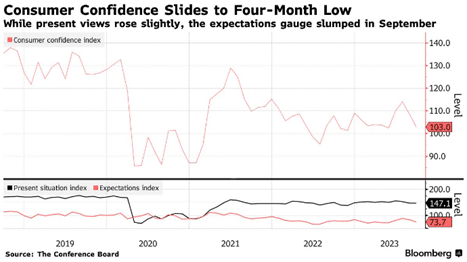

US Consumer Confidence Drops to a Four-Month Low on Outlook – Bloomberg, 9/26/2023

- US consumer confidence slumped to a four-month low in September, dampened by a deteriorating outlook for the economy and labor market.

- The Conference Board’s index declined to 103 this month from an upwardly revised 108.7 in August, data out Tuesday showed.

- The figure fell short of the median estimate of 105.5 in a Bloomberg survey of economists.

- The group’s gauge of current conditions rose slightly to 147.1.

- A measure of expectations — which reflects consumers’ six-month outlook — fell to 73.7, the lowest since May.

- The difference between the current “plentiful” and “hard-to-get” measures — a metric watched closely by economists as a gauge of labor-market strength — increased to 27.3.

- A gauge of expected inflation over the next year was little changed from the prior month.

- The share of consumers saying recession is “somewhat” or “very likely” to occur picked up.

- Buying plans for the next six months retreated for cars, homes and major appliances.

US Risks Its Top Credit Rating With Shutdown, Moody’s Warns – Bloomberg, 9/26/2023

- Moody’s Investors Service, the only remaining major credit grader to assign the US a top rating, has signaled that its confidence is wavering ahead of a potential government shutdown.

- While “debt service payments would not be impacted and a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength relative to other Aaa-rated sovereigns,” analysts led by William Foster wrote in a report Monday.

- The analysts stopped short of threatening a downgrade, but used unusually blunt language to express their concerns over the trajectory of Congressional negotiations to pass a short-term spending bill required to stop a government shutdown when the new US fiscal year begins in October.

- “A government shutdown would demonstrate the significant constraints that intensifying political polarization continue to put on US fiscal policymaking during a period of declining fiscal strength, driven by persistent fiscal deficits and deteriorating debt affordability,” Moody’s added.

Kevin McCarthy Stares Down GOP Holdouts in Critical Shutdown Vote – Wall Street Journal, 9/26/2023

- House Speaker Kevin McCarthy heads into a decisive day in his bid to avoid a government shutdown on Oct. 1, facing the twin questions of whether conservative holdouts will finally relent and what sort of pressure the Democratic-controlled Senate will apply.

- Dissident Republicans last week revolted against McCarthy’s attempt to pass an interim spending bill and then blocked him twice from attempting to advance a full-year defense-spending bill.

- Now, the GOP dissidents will determine whether on Tuesday to block a procedural vote on the defense bill plus another three of the 12 annual appropriations bills—or if they want to entertain McCarthy’s proposal to pass all four, followed by a single stopgap bill later in the week that would give House Republicans more time to enact full-year spending measures.

- “If we can overcome a couple of remaining obstacles,” said Rep. Clay Higgins (R., La.), a House Freedom Caucus member trying to win over some in his own faction, “then we’ll be in a very good position to come together as a conference with sufficient votes” to pass a short-term funding bill that reduces spending and includes border-security measures.

- McCarthy has had to walk a tightrope with holdouts. Any moves the California Republican makes could risk a government shutdown or an effort to oust him as House speaker—or both.

Hunter Biden Sues Rudy Giuliani Over Release of Personal Data – Wall Street Journal, 9/26/2023

- President Biden’s son, Hunter Biden, sued Rudy Giuliani and his longtime lawyer in federal court Tuesday, alleging that the two unlawfully invaded his privacy by accessing, disseminating and “generally obsessing over” his personal data in their efforts to smear the Biden family.

- In a 15-page lawsuit, Hunter Biden’s lawyers escalated their response to prominent allies of former President Donald Trump who said they had been involved in disseminating the contents of his laptop in 2020.

- The lawsuit, filed in federal court in California, pointed to statements from Giuliani and his lawyer, Robert Costello, to argue that the former New York City mayor and his lawyer have effectively admitted to violating federal and California state law.

- While Giuliani and Costello “are entitled to their baseless opinions about Plaintiff and the Biden family—and they are also free to share those opinions on their podcasts and with whomever else cares about what they have to say—they are not entitled to violate federal and state anti-computer hacking laws to advance their personal and political agendas.

- Yet that is precisely what they have been doing with impunity, and what they will continue to do absent judicial relief,” Biden’s lawyers wrote in the lawsuit filed Tuesday.

Shutdown Would Blindfold Fed in Piloting Course on Rates – Wall Street Journal, 9/26/2023

- Federal Reserve officials are walking a tightrope to tame inflation without creating a needlessly severe economic slowdown.

- If that isn’t tricky enough, they might have to do it blindfolded if there is an extended government shutdown.

- If Congress doesn’t pass a stopgap funding measure before Sunday, a shutdown of certain agencies could delay the routine release of fresh economic data on wages, employment, inflation and output.

- A shutdown that lasts more than two weeks could deprive officials of information they would use to decide whether to raise rates at their next meeting, Oct. 31-Nov. 1.

- In early 1996, the release of the December 1995 employment report was delayed by two weeks because of a 21-day shutdown.

- The consumer-price index, a widely followed inflation gauge, was almost three weeks late.

- It was released the day after the Fed’s January 1996 policy meeting, when officials cut interest rates.

- Williams, who is now New York Fed president, cited alternate data sources to backfill one government data report on inflation that was late.

- For example, the Fed’s staff economists calculate a measure of private employment using data from the payroll processing company ADP.

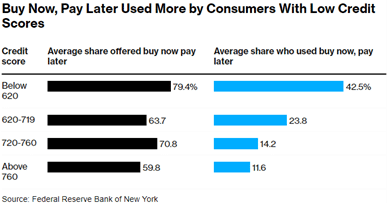

Buy Now, Pay Later Plans Seen More Among ‘Fragile’ Consumers – Bloomberg, 9/26/2023

- Americans with lower credit scores and those who have a harder time accessing loans are more likely to be pitched — and to use — “buy now, pay later” payment plans, according to research from the Federal Reserve Bank of New York.

- Tendency to use the plans, which allow consumers to pay off purchases over time, could derive from a range of factors, researchers wrote in a blog post published Tuesday.

- Among them: how the users are targeted, what they are buying, the location of the purchases and greater awareness about the option.

- “We find both the availability and use of BNPL to be fairly widespread but see disproportionate take-up among consumers with unmet credit needs, limited credit access and greater financial fragility,” wrote Felix Aidala, Daniel Mangrum, and Wilbert van der Klaauw.

- They found buy now, pay later payment plans are more likely to be offered to women, young consumers and people with higher incomes, as well as people with credit scores below 620.

- While only 17% of those surveyed met one of three criteria – having a credit score of less than 620, reported having a credit application rejected, or were delinquent on a loan over the past year – that group made up about 33% of BNPL users.

- And while 66% of all respondents who have ever been offered a buy now, pay later plan said they could come up with $2,000 for an emergency, that was true of only 52% of people who have used the flexible payment plans.

UAW strike: Biden, Trump seek blue-collar votes in swing state Michigan – CNBC, 9/26/2023

- Strikes by the United Auto Workers union against General Motors, Ford Motor and Stellantis will get the presidential treatment this week in Michigan. Twice, in fact.

- President Joe Biden is expected to visit a picket line Tuesday in the Great Lake State following a public invitation Friday from UAW President Shawn Fain.

- Former President Donald Trump, the frontrunner among Republicans in the 2024 presidential race, is scheduled to hold a rally Wednesday night at an auto supplier in Clinton Township, Michigan.

- Each 2024 presidential candidate is trying to win over blue-collar voters such as Darius Collier, one of roughly 18,300 autoworkers currently on strike who’s “indifferent” about the candidates themselves.

- Michigan voters helped both Biden and Trump in winning the White House during the past two presidential elections in 2020 and 2016, respectively.

EUROPE & WORLD

Alibaba’s Logistics Arm Files for $1 Billion-Plus IPO – Bloomberg, 9/26/2023

- Cainiao Smart Logistics Network, the logistics arm of Alibaba Group Holding, has filed for its Hong Kong initial public offering, potentially making it among the first of the Chinese ecommerce leader’s units to go public.

- Citic Securities, Citigroup and JPMorgan Chase are joint sponsors of the offering, according to the preliminary prospectus posted on the stock exchange website Tuesday.

- The first-time share sale could raise at least $1 billion, people familiar with the matter have said.

- Hangzhou-based Alibaba intends to retain more than 50% of the unit’s shares and keep Cainiao as a subsidiary, the filing said.

- Separately, Alibaba is putting the Hong Kong IPO of its Freshippo grocery chain on the backburner amid weak sentiment for consumer stocks in China.

- Cainiao, which means “rookie” or “amateur” in Chinese, promises to deliver packages in China within 24 hours and anywhere else in the world in 72 hours.

- The company now considers international express delivery a major driver for growth and serves over 100,000 merchants and brands to deliver more than 1.5 billion cross-border ecommerce parcels a year, it said in its prospectus.

- Revenue from Alibaba Group accounted for 30% of Cainiao sales over the past three fiscal years and average daily parcel volume increased from 0.7 million in 2017 to 4.8 million in 2023, it said.

- Cainiao’s revenue for the three months ended June 30 rose 34% to 23.16 billion yuan ($3.2 billion).

- The company reported net income of 391 million yuan for the quarter, compared with a net loss of 338 million yuan the same time last year.

- Adjusted EBITDA, a measure of operating profit that strips out one-off items and the effects of stock awards, increased 185% from a year earlier to 1.81 billion yuan.

- The Commerce Department on Monday targeted 28 companies from China, Russia and other countries with export restrictions, dialing up pressure on foreign actors that could undermine American national security interests.

- The addition to the export blacklist included nine firms implicated in violating existing export controls through a scheme to supply a Russian company with components to build unmanned aerial vehicles for Russia’s intelligence agency, the Commerce Department said.

- U.S. companies are barred from selling to entities on the blacklist unless exporters secure a license from the U.S. government.

- The action is the latest in a series of efforts by the Biden administration to clamp down on the transfer of goods and technology with military applications to companies and other entities in China, Russia and other countries through export controls measures.

- Commerce Secretary Gina Raimondo said last week more than 700 Chinese companies are now on the export control list, with more than one-third of them added under the Biden administration.

- “We need more export enforcement agents. We need more tech experts,” Raimondo told a House hearing this month as she pressed lawmakers to provide more funding for the department’s Bureau of Industry and Security, which oversees export controls.

- “Increasingly, national security is about technology and keeping our edge over China.”

- Military parades featuring new ballistic missiles, tanks and soldiers marching in formation are a common site on the Korean Peninsula, but in recent years they have been limited to North Korea.

- On Tuesday, for the first time in a decade, South Korea held its own military parade, as tensions rise in the region and the government in Seoul takes a more confrontational approach to its relations with Pyongyang.

- On a rainy afternoon, South Korea’s homegrown ballistic missiles, autonomous underwater vehicles and reconnaissance drones rolled through the streets of downtown Seoul.

- The parade also included weapons that have become some of the country’s top arms exports during the Ukraine war, such as K9 self-propelled howitzers, K2 tanks and Chunmoo multiple-rocket launchers.

- The weather prevented a scheduled flyover of American F-35 and South Korean KF-21 jet fighters, but crowds lined the streets wearing raincoats and holding umbrellas.

- For the first time, more than 300 combat troops from U.S. Forces Korea marched alongside the South Korean military.

Factmonster – TODAY in HISTORY

- Thomas Jefferson was appointed America’s first Secretary of State. – 1789

- The Federal Trade Commission was established. – 1914

- United Nations troops recaptured Seoul, the capital of South Korea, from the North Koreans. – 1950

- Richard M. Nixon and John F. Kennedy took part in the first televised presidential debate. – 1960

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Historical performance is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Any economic forecasts set forth may not develop as predicted. All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Material presented is excerpts derived from third party content and you may need a subscription to access the full the content. The views and opinions expressed are those of the authors and do not necessarily reflect the views of Pence Wealth Management or LPL Financial. Prior to making any investment decision please consult your financial advisor regarding your specific situation.