Daily Market Report | 09/22/2023

US FINANCIAL MARKET

Stocks Rise at End of Bruising Week on Wall Street: Markets Wrap – Bloomberg, 9/22/2023

- Stocks rebounded from nearly oversold levels as bond yields fell, with traders weighing a subdued reading on business activity and the latest Fedspeak for clues on the outlook for monetary policy.

- The S&P 500 halted a three-day slide, while still heading toward its worst week since March.

- The S&P 500 rose 0.3%. The Nasdaq 100 rose 0.6%. The Dow Jones Industrial Average rose 0.1%.

- Big tech led gains after bearing the brunt of the recent selloff.

- Apple rose as its latest iPhones and watches went on sale.

- US-listed Chinese shares rallied on news Washington and Beijing are forming working groups to discuss economic and financial issues.

- General Motors and Stellantis face walkouts at 38 more facilities as talks with their workers’ union failed to make headway, even as Ford Motor was spared the escalation after making progress in the negotiations.

- Treasury 10-year yields dropped after briefly topping 4.5% for the first time since 2007.

- The yield on 10-year Treasuries declined five basis points to 4.44%

- The dollar fluctuated. The Bloomberg Dollar Spot Index fell 0.1%

- The yen came under renewed pressure after Bank of Japan Governor Kazuo Ueda tamped down speculation of a near-term interest rate hike, sticking with its ultra-easy stimulus.

- Oil rose, with Brent near $94 a barrel. Gold futures rose 0.4% to $1,948.10 an ounce

- A report showed US business activity stagnated in early September, driven by a further moderation in demand at service providers.

- Federal Reserve Bank of Boston President Susan Collins said further rate increases are possible and borrowing costs may need to stay higher for longer than previously expected.

- San Francisco Fed President Mary Daly and her Minneapolis counterpart Neel Kashkari were also set to speak on Friday.

- Global equity funds had outflows of $16.9 billion in the week through Sept. 20, according to a note from the bank citing EPFR Global data.

- US stock funds led the exodus, while in Europe, redemptions reached 28 weeks.

- Microsoft’s $69 billion acquisition of Activision Blizzard looks set to clear its final regulatory hurdle after the UK competition authorities signaled they will accept the latest concessions, ending a wait of more than a year and a half to complete the biggest ever gaming deal.

- Amazon.com, following other streaming platforms looking to further monetize their content, will run ads on its Prime Video service in key markets – a move that will help offset rising costs and provide a boost to an already robust advertising business.

- The Stoxx Europe 600 fell 0.1%.

- The United Auto Workers union plans to stage more strikes at General Motors and Stellantis by noon Friday, but will spare Ford Motor from more walkouts based on progress it has made in contract talks.

- UAW President Shawn Fain told members during a livestream address Friday morning that workers will walk out at 38 parts-distribution centers across 20 states.

- He said the union for now isn’t calling further walkouts at Ford factories because the company has sweetened its offer in recent days.

- The parts-distribution facilities ship service parts to dealerships.

- Crimping the flow of components from those centers is likely to disrupt GM and Stellantis dealers’ service operations, potentially leading to longer wait times for customers.

- “We do want to recognize that Ford is serious about reaching a deal. At GM and Stellantis, it’s a different story,” Fain said.

- He said Ford agreed to reinstate a cost-of-living adjustment that was eliminated in 2009 and enhanced profit-sharing, along with other offers.

- GM, referencing the posts, accused the union of not taking the talks seriously and planning a monthslong strike to support an “ideological agenda”.

- Ford also issued a statement, describing the messages as disappointing, given what is at stake for workers.

- Stellantis called the posts disturbing and accused the UAW of using its employees as pawns.

McDonald’s Franchisee Fees to Rise for First Time in Three Decades – Bloomberg, 9/22/2023

- McDonald’s is bumping up the fees it charges US and Canada franchisees to operate some restaurants.

- Owners who open new restaurants or buy locations previously run by McDonald’s will have to pay the parent 5% of sales, up from the current rate of 4%, according to a message signed by Chief Financial Officer Ian Borden that was reviewed by Bloomberg.

- This rate will also apply to restaurants the company buys and then sells to an operator.

- Franchisees will continue to pay 4% in many other cases, according to the document.

- Restaurants that change hands as a result of a transaction between franchisees won’t be subject to the new rate, and operators that sign new 20-year agreements won’t either.

- Transfers from current owners to next-generation family members are also unaffected.

- “Existing owner/operator equity in existing restaurants will not be impacted,” according to the memo, which also said the rate hadn’t changed in about 30 years.

- Apple is issuing smaller raises to its retail employees this year, marking a deceleration from atypically large pay hikes during the pandemic, according to people familiar with the matter.

- The company is disclosing average annual raises this week of roughly 4%, a return to the levels from 2020 and earlier, said the people, who asked not to be identified because the information is private.

- The latest range was typically between 2% and 5%, they said.

- The increases also apply to AppleCare technical support employees, who got raises in the same range.

Amazon to Run Ads in Prime Video Shows and Movies – Wall Street Journal, 9/22/2023

- Amazon said it plans to start running advertisements in shows and movies on its Prime Video platform, the latest streaming service to turn to advertising amid mounting losses in the sector.

- The company said in a blog post Friday it would play ads for its U.S. viewers beginning early next year.

- Amazon has been looking for ways to generate more revenue from entertainment and cover the costs of creating its shows and movies.

- As a stand-alone streaming service, Prime Video currently costs $8.99 a month.

- Amazon said it would offer an ad-free option, which will cost subscribers an extra $2.99 a month for Amazon Prime members in the U.S.

- The company said Friday it would aim to have “meaningfully fewer ads than linear TV and other streaming TV providers.”

- The company said the rollout will begin in the U.S., U.K., Germany and Canada in early 2024, followed by France, Italy, Spain, Mexico and Australia later in the year.

Goldman Sent Inaccurate Data to the SEC on 163 Million Trades – Bloomberg, 9/22/2023

- Goldman Sachs Group agreed to pay a $6 million fine on Friday for sending inaccurate or incomplete trading data to the Securities and Exchange Commission covering at least 163 million transactions over a decade.

- The information contained in more than 22,000 data files known as blue sheets that firms routinely send to regulators, according to the SEC.

- The regulator said that Goldman’s submissions had 43 different types of errors.

- Goldman admitted to the findings in the regulator’s settlement order.

JPMorgan Is Adding India to Its Emerging-Markets Bond Index – Bloomberg, 9/22/2023

- JPMorgan Chase will add Indian government bonds to its benchmark emerging-market index, a keenly awaited event that could drive billions of foreign inflows to the nation’s debt market.

- The index provider will add the securities to the JPMorgan Government Bond Index-Emerging Markets starting June 28, 2024.

- The South Asian nation will have a maximum weight of 10% on the index, according to a statement Thursday.

- Index inclusion follows “the Indian government’s introduction of the FAR program in 2020 and substantive market reforms for aiding foreign portfolio investments,” the team led by the firm’s global head of index research, Gloria Kim, said in a statement.

- Almost three-quarters of benchmark investors surveyed were in favor of India’s inclusion in to the index, they said.

- The inclusion may also prompt flows of as much as $30 billion, according to HSBC Holdings.

- Authorities in India have been largely uncompromising in making changes to tax policies that would make it easier for the securities to be added to global indexes.

Canada’s Stelco Holdings is said to weigh bid for U.S. Steel, Bloomberg reports – Reuters, 9/22/2023

- Canada’s biggest steelmaker Stelco Holdings is pursuing a bid for U.S. Steel, adding to a growing list of suitors for the iconic American company, Bloomberg News reported on Thursday, citing people familiar with the matter.

- Stelco is seeking to purchase the entire company as it looks to increase its portfolio of steelmaking assets and boost its share of the market for supplying metal to the automotive sector, according to the report.

US ECONOMY & POLITICS

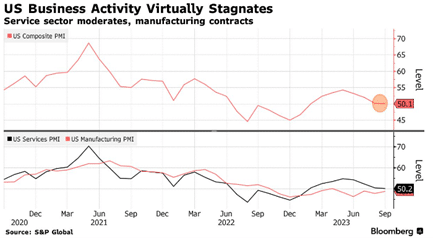

US Business Activity Stagnates on Subdued Demand for Services – Bloomberg, 9/22/2023

- US business activity stagnated in early September, driven by a further moderation in demand at service providers.

- The S&P Global flash composite output index decreased 0.1 point to 50.1 in September, the lowest level since early this year, the group reported Friday.

- While the manufacturing sector shrank at a slower rate, business activity at service providers crept even closer to stagnation — at 50.2.

- New orders and expectations of future activity both slumped to the worst this year.

Fed’s Collins Says Rates May Need to Stay Higher for Longer – Bloomberg, 9/22/2023

- Federal Reserve Bank of Boston President Susan Collins said further interest-rate increases are possible and borrowing costs may need to stay higher for longer than previously expected for the US central bank to achieve its 2% inflation goal.

- “I expect rates may have to stay higher, and for longer, than previous projections had suggested, and further tightening is certainly not off the table,” Collins said Friday in remarks prepared for an event hosted by the Maine Bankers Association.

- Collins, who does not vote in monetary policy decisions this year, said she “fully” supported the guidance offered in Fed officials’ quarterly economic projections, and said that the current phase of policy will require “considerable patience.”

- Collins said inflation has moderated, but progress has been uneven and more time is needed to be sure price gains are on a steady downward path.

- While many households and businesses who built up savings or locked in lower rates on loans have been shielded against the Fed’s rate increases, demand is likely to cool as those savings are spent and debt-market activity picks up, she said.

- “The risk of inflation remaining persistently high must be weighed against the risk that activity will slow more than expected,” Collins said.

Fed’s Cook Sees Signs of AI Improving US Labor Productivity – Bloomberg, 9/22/2023

- Federal Reserve Governor Lisa Cook said the use of artificial intelligence in the economy presents many unanswered questions for policymakers though there is some evidence that it could improve labor productivity.

- “The impact of AI on the economy and monetary policy will depend on whether AI is just another app or something more profound,” Cook said in remarks prepared for delivery at the National Bureau of Economic Research’s conference on artificial intelligence in Toronto Friday.

- “Empirical evidence is still patchy, but there is work showing that generative AI improves productivity in a variety of settings.”

- Cook predicted that greater use of AI will be similar to the spread of computation in the workplace and could present “a difficult transition for some workers.”

- “Any large change in the labor force will generate disruptions and challenges that will need to be addressed to help workers adapt and thrive,” she said.

- President Biden says he hasn’t given up on large-scale student-loan forgiveness. But the administration’s latest debt cancellation plan is far from a sure thing.

- The new debt forgiveness plan, which relies on a different legal authority, is likely to face similar legal challenges to the ones that killed the original effort.

- One option being considered by administration officials, according to people familiar with the discussions: using the Higher Education Act to forgive debt for specific groups of borrowers, instead of everybody all at once.

- The more targeted approach would build on the administration’s efforts to cancel debt for disabled people and those who work in public service or were defrauded by for-profit schools.

- Some in the administration think the proposal, which would include tailored legal and economic rationales for each group, could dampen legal attacks and help nearly as many borrowers as across-the-board debt elimination.

McCarthy Ambushed as Republican Hardliners Change Course on Spending Plan – Bloomberg, 9/22/2023

- House Speaker Kevin McCarthy’s latest plan to avert a government shutdown was ambushed Thursday by a pair of ultraconservatives, ratcheting up the risk of an Oct. 1 federal funding lapse with Republicans still fighting among themselves.

- Hours later, McCarthy sent lawmakers home until Tuesday, a decision that leaves little time to negotiate with Senate Democrats.

- Republican leaders said they would give “ample notice” if they called a vote before then.

- Two GOP dissidents — Marjorie Taylor Greene, once a reliable McCarthy ally, and Eli Crane — surprised McCarthy by voting against bringing up a defense spending bill on Thursday.

- Greene said she opposed the inclusion of $300 million in Ukraine aid — a move that caught the speaker by surprise.

- “I’ve told him everything that I’ve told everybody else,” Greene told reporters. “I’m completely transparent in every conversation I have.”

Sen. Bob Menendez Indicted on Federal Bribery Charges – Wall Street Journal, 9/22/2023

- Sen. Bob Menendez and his wife were indicted on bribery and related offenses Friday, connected to the New Jersey lawmaker’s relationship with three businessmen.

- Federal prosecutors in Manhattan alleged that Menendez, a Democrat, and his wife accepted hundreds of thousands of dollars in bribes in exchange for using the senator’s influence to benefit the businessmen and the Egyptian government.

- The bribes included cash, gold, a luxury vehicle and payments toward a home mortgage, according to the indictment.

- A spokeswoman for Menendez and a lawyer for his wife didn’t immediately respond to requests for comment.

- Menendez’s spokeswoman has previously said the senator was confident the matter would be successfully resolved.

EUROPE & WORLD

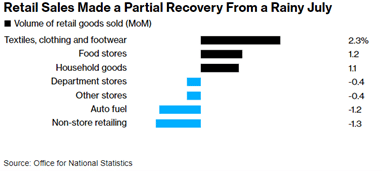

UK Retail Sales Rebound as Shoppers Return From Wet July – Bloomberg, 9/22/2023

- UK retail sales rebounded in August as the return of more settled weather brought consumers back into the shops.

- The volume of goods sold in stores and online rose 0.4% in August, the Office for National Statistics said Friday.

- It followed a revised 1.1% drop in July, when cool and rainy conditions reduced activity.

- Economists had expected a gain of 0.5% in the latest month.

- The sharp decline in July means retail sales are on track to be a drag on third-quarter gross domestic product, unless September shows a gain of 1.4% or more.

- That reflects headwinds on the economy coming from high inflation and interest rates, and a cost-of-living squeeze that’s only starting to relent.

- The value of sales in August was 17% above pre-pandemic levels in February 2020, while the volume of those sales 1.5% below.

- Food stores bounced back from soggy sales in July, with volumes rising 1.2%.

- A recovery in clothing retailers helped non-store sales climb 0.6% even as the cost-of-living crisis suppresses spending.

- Microsoft cleared the biggest regulatory hurdle in its $75 billion pursuit of Activision Blizzard after U.K. authorities said in a preliminary decision that the modified deal for the games giant had resolved most of its antitrust concerns.

- The U.K. Competition and Markets Authority said Friday that a new deal submitted by Microsoft should lessen any harm to competition in cloud gaming.

- It said it would ask other companies in the market for feedback on the proposal before issuing a final decision.

- “We will continue to work toward earning approval to close,” Microsoft Vice Chair and President Brad Smith said.

- The agency had set an initial deadline of Oct. 18 to review the new proposal, the same day that an extended deadline for Microsoft’s merger agreement with Activision is due to expire.

BOJ’s Ueda Tamps Down Speculation of Rate Hike, Pressuring Yen – Bloomberg, 9/22/2023

- Bank of Japan Governor Kazuo Ueda tamped down speculation of a near-term interest rate hike after the central bank chose to stick with its ultra-easy stimulus, a decision that renewed downward pressure on the yen.

- The BOJ kept its negative interest rate and the parameters of its yield curve control program intact on Friday in an outcome predicted by all 46 economists surveyed by Bloomberg.

- It also maintained a pledge to add to its stimulus without hesitation if needed, a vow that offers yen bears a reason to keep betting against it.

- “Because we aren’t in a state where inflation accompanied by wage growth — sustainable and stable inflation — is in sight, we’re patiently continuing with monetary easing under the current framework,” he said.

- “If I were to say as a governor that there’s absolutely no chance we could see that possibility by the end of the year, it would in a way create a strong impediment for our discussions,” Ueda said. “Saying that would create a risk.”

- The U.S. Commerce Department on Friday is issuing final rules to prevent semiconductor manufacturing subsidies from being used by China and other countries deemed to pose American national security concerns.

- The regulation is the final hurdle before the Biden administration can begin awarding $39 billion in subsidies for semiconductor production.

- The landmark “Chips and Science” law provides $52.7 billion for U.S. semiconductor production, research and workforce development.

- The regulation, first proposed in March, sets “guardrails” by limiting recipients of U.S. funding from investing in expanding semiconductor manufacturing in foreign countries of concern like China and Russia, and limits recipients of incentive funds from engaging in joint research or technology licensing efforts with foreign entities of concern.

- When Disney abruptly laid off more than 300 people in Beijing in late March, it said the move was meant to save money as part of ongoing layoffs.

- Privately, Disney executives had additional reasons for the staff cuts.

- Disney Chief Executive Bob Iger was scheduled to meet the following week with Republican Rep. Mike Gallagher, who chairs a congressional committee focused on U.S. competition with China.

- The Beijing team, which specialized in technology that allows Disney’s streaming services to offer viewers personalized recommendations, had access to some U.S. customer data, according to people familiar with the matter.

- Disney’s lawyers voiced concerns that the Beijing team’s access to such data would be seen as a potential red flag by the committee, even though the data had been accessible by staff there for years, some of these people said.

- The layoffs and Disney’s previously unreported efforts to assuage potential concerns in Washington about China’s influence represent another chapter in its at-times thorny relationship with the country.

- In addition to being the world’s second-largest market for theatrical movie releases, China is home to hundreds of millions of customers for Disney’s theme parks, TV shows and consumer products.

- A Ukrainian cruise missile Friday slammed into the headquarters of the Russian Black Sea Fleet in the occupied city of Sevastopol, the latest of a series of strikes that aim to dent Russia’s naval power.

- The missile destroyed the top floors of the fleet’s monumental headquarters, with plumes of black smoke billowing into the sky as the building caught fire, according to videos posted by local residents and Russian media.

- Ukraine has been targeting Sevastopol, which Russia seized along with the rest of the Crimean peninsula in 2014, almost every night in recent weeks with drones or missiles.

- The Russian-appointed governor of Sevastopol, Mikhail Razvozhaev, said no civilian areas had been damaged by the attack.

- The Russian Ministry of Defense, which routinely minimizes or denies Russian losses, said a service member was missing after the attack on what it described as the “historic headquarters” of the fleet.

- The ministry said Russian air defenses intercepted five missiles. Central Sevastopol remained cordoned off.

US Expands Deportation Shield to 14,600 More Afghan Migrants – Bloomberg, 9/22/2023

- The Biden administration is expanding the number of Afghans eligible for temporary protected status, shielding them from deportation and allowing them to seek work permits.

- Under the decision the Department of Homeland Security announced Thursday, 14,600 additional Afghans who arrived in the US between March 15, 2022 and Wednesday will be eligible for the protections, which will be extended to May 2025.

- Roughly 3,000 Afghans currently have temporary protected status and would be allowed to retain it, the department said.

- The policy was put in place last year, months after the US’s disastrous exit from the country led thousands of Afghans to flee the now-ruling Taliban.

Greater Migrant Surge Headed for U.S. Border – Wall Street Journal, 9/22/2023

- Large groups of migrants from Venezuela are swamping Eagle Pass, Texas, and there are signs it could get worse.

- Nearly 2,100 miles southeast of the border city of 28,000 people, record numbers of migrants are trekking through the Darién Gap, the dense jungle separating South America from Panama with one goal in mind: to get to the U.S.

- On Wednesday, the Biden administration said 470,000 Venezuelans already in the U.S. would be granted permission to work, which some migrants and government officials in the region said would encourage even more Venezuelans to make the journey.

- Mexican authorities say that rising migrant arrivals in Panama are an indication that many more will reach the U.S.-Mexico border.

- The number of migrants is swelling as they make their way north across Central America and Mexico, with others from Honduras and Guatemala joining the trek.

- In Mexico, thousands of migrants have been jumping on cargo trains to reach communities on the border, including Piedras Negras opposite Eagle Pass and Ciudad Juárez across from El Paso, Texas.

3M Agrees to Pay Nearly $10 Million Over Sale of Products to Iran – Wall Street Journal, 9/22/2023

- 3M has agreed to pay more than $9.6 million to settle a probe by the U.S. Treasury Department into sales to an Iranian entity controlled by the country’s law enforcement forces.

- Treasury’s Office of Foreign Assets Control said that between September 2016 and September 2018, a 3M subsidiary allegedly sold reflective license plate sheeting to a sanctioned Iranian entity, police foundation Bonyad Taavon Naja.

- The sales occurred even after outside due diligence staff had flagged potential problems, OFAC said.

- 3M came forward to disclose the conduct and cooperated throughout the investigation, OFAC said, adding the company had fired several employees and cut off a Germany-based intermediary involved in the sales.

- 3M East, the Switzerland-based subsidiary, sent 43 shipments of the product to the German reseller knowing the products were destined for a customer in Iran, the agency alleged.

- The transactions covered by the alleged violations were valued at around $10 million.

Factmonster – TODAY in HISTORY

- Nathan Hale was hanged by the British as a spy during the Revolutionary War. – 1776

- Congress authorized the office of Postmaster-General. – 1789

- The French Republic was proclaimed. – 1792

- President Abraham Lincoln issued the preliminary Emancipation Proclamation, proposing to free all slaves of rebel states as of Jan. 1, 1863. – 1862

- The Persian Gulf conflict between Iran and Iraq erupted into full-scale war. – 1980

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Historical performance is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Any economic forecasts set forth may not develop as predicted. All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Material presented is excerpts derived from third party content and you may need a subscription to access the full the content. The views and opinions expressed are those of the authors and do not necessarily reflect the views of Pence Wealth Management or LPL Financial. Prior to making any investment decision please consult your financial advisor regarding your specific situation.