Daily Market Report | 08/09/2023

US FINANCIAL MARKET

Nasdaq 100 Drops 1% in Run-Up to Key CPI Report: Markets Wrap – Bloomberg, 8/9/2023

- A slide in tech megacaps and higher energy prices weighed on stock trader sentiment ahead of key inflation data that will help shape up the outlook for the Federal Reserve’s next steps.

- The S&P 500 fell 0.4%. The Nasdaq 100 fell 1%. The Dow Jones Industrial Average fell 0.1%.

- Nvidia dropped 5% while Tesla was down by 2.5%.

- A 40% surge in European natural gas and an advance in oil to a nine-month high added to concern about further price pressures.

- Ten-year US yields hovered near 4.0% before another closely watched bond auction.

- Thursday’s consumer price index is expected to show that inflation increased at a 3.3% annual pace in July according to the median forecast of economists surveyed by Bloomberg.

- The core measure — which strips out volatile food and energy prices — is expected to ease slightly to 4.7%.

- Roblox dropped after reporting a daily active user count and hours played that fell short of analysts’ expectations.

- Lyft retreated after the company reported its slowest revenue growth in two years, overshadowing a better-than-expected outlook for earnings, as the company struggles to get its ridership back on track.

- WeWork slid after saying there’s “substantial doubt” about its ability to continue operating. The company cited sustained losses and canceled memberships to its office spaces.

- Penn Entertainment rose after Walt Disney’s ESPN has signed a long-term exclusive agreement with the casino operator, licensing its brand for sports betting and deepening the media giant’s ties to the growing online gambling business.

- The Stoxx Europe 600 rose 0.5%

- The Bloomberg Dollar Spot Index was little changed.

- West Texas Intermediate crude rose 1.3% to $84 a barrel.

- Gold futures fell 0.4% to $1,951.60 an ounce.

ESPN Is Getting Into Sports Betting With Penn Entertainment – Bloomberg, 8/9/2023

- Walt Disney’s ESPN has signed a long-term exclusive agreement with casino operator Penn Entertainment, licensing its brand for sports betting and deepening the media giant’s ties to the growing online gambling business.

- Penn will have the 10-year right to use the ESPN Bet name in the US, the company said in a statement Tuesday.

- Penn will rebrand its Barstool sportsbook with ESPN starting this fall.

- The company will continue to operate as theScore Bet in Canada.

- Penn also said Tuesday it’s selling all of its Barstool Sports subsidiary to David Portnoy, who founded the sports and pop culture media company, in exchange for a non-compete and other agreements.

- Penn has the right to get half of the proceeds received by Portnoy in any subsequent sale of Barstool.

- Penn will make cash payments totaling $1.5 billion over the 10-year term and grant ESPN $500 million of warrants to purchase Penn shares.

- ESPN will have the right to designate one, non-voting board observer at Penn.

- The casino company can extend the term for another 10 years by mutual agreement.

- Penn said the deal could generate between $500 million and $1 billion in annual earnings before interest, taxes, depreciation and amortization.

Rivian’s Losses Narrow as Production Speeds Up – Wall Street Journal, 8/9/2023

- Rivian Automotive delivered a stronger-than-expected second quarter and raised its production guidance slightly, as the electric truck and sport-utility vehicle maker showed progress in speeding up output at its Normal, Ill., factory.

- Revenue rose to $1.1 billion from $364 million in the year-ago quarter.

- Analysts on average expected the company to report revenue of $1 billion.

- The company said it increased customer vehicle deliveries 60% quarter-over-quarter to 12,640 vehicles, beating analysts’ estimate of 11,000 units, according to FactSet.

- Adjusted net loss per share was $1.08, lower than analysts’ average forecast of $1.41, according to FactSet.

- The Irvine, Calif.-based startup said Tuesday it was moving toward its goal of slowing its cash burn by renegotiating supplier contracts and increasing factory output.

- The company said its gross losses per vehicle shrank by about $35,000 as the cost of producing its R1T truck and R1S SUV fell.

- Cash on hand was $9.26 billion, down from $11.24 billion in the previous quarter.

- Rivian adjusted its production forecast for the year to 52,000 vehicles, up from its previous guidance of 50,000.

- Rivian also lowered its guidance on capital expenditures to $1.7 billion in 2023 from $2 billion previously after it pushed back some expenses until next year.

Lyft Increased Revenue, Trimmed Loss During Tumultuous Quarter – Wall Street Journal, 8/9/2023

- Lyft raised its revenue and trimmed its loss last quarter, a tumultuous period that marked the departure of its co-founders from day-to-day management, the appointment of a new chief executive and the layoff of 24% of its staff.

- Revenue grew 3% to $1.02 billion.

- Lyft ended the quarter with 21.49 million active riders, up from 19.86 million in the same period a year earlier.

- Both figures were in line with the average estimates of analysts polled by FactSet.

- Lyft’s recorded adjusted earnings before interest, tax, depreciation and amortization of $41 million, better than analysts’ forecast of $28 million.

- Lyft projected third-quarter revenue between $1.13 billion to $1.15 billion, beating the $1.09 billion that analysts had expected.

- Lyft said it expects adjusted earnings before interest, taxes and other costs between $75 million and $85 million.

- Analysts had expected $50 million.

Roblox Plunges by Most in 9 Months as Daily Users Drop Off – Bloomberg, 8/9/2023

- Roblox plunged by the most in nine months after reporting that people were spending less time playing its games in the second quarter and missing Wall Street’s estimates.

- Bookings, which the company defines as sales plus the change in deferred revenue from online purchases, rose 1% from last quarter to $780.7 million.

- That was ahead of analysts’ projections of $770.6 million.

- Roblox customers spent 14 billion hours playing games in the three months ended June 30, below the 14.4 billion that analysts had expected.

- The number of daily active users on the platform fell 1% from last quarter, also missing analysts’ expectations and throwing into question whether Roblox is capable of achieving its ultimate goal of reaching a billion users.

- Upstart Holdings has struggled to contend with a tougher lending environment, and the company indicated Tuesday that its challenges are expected to continue.

- Revenue fell to $136 million from $228.2 million.

- The FactSet consensus was for $135.2 million.

- The company generated $144 million in fee revenue, compared with the $131 million that analysts were expecting.

- Upstart’s lending partners originated 109,447 loans across its platform in the second quarter, totaling $1.2 billion.

- Conversion on rate requests was 9%, down from 13% in the same period a year prior.

- On an adjusted basis, Upstart earned 6 cents a share, whereas analysts tracked by FactSet were modeling a 7-cent loss per share.

- For the third quarter, Upstart expects $140 million in revenue, while analysts had been anticipating $155 million.

- The company also models $5 million in adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), while analysts were looking for $9.6 million in adjusted EBITDA.

Jack in the Box 3Q Profit Rises on Higher Same-Store Sales – Market Watch, 8/9/2023

- Jack in the Box’s earnings climbed in its fiscal third quarter on higher same-store sales as customers spent more per visit.

- Sales slipped to $396.9 million from $398.3 million, above analyst projections for $393.9 million, according to FactSet.

- Same-store sales, which strip out store openings and closings, for its flagship Jack in the Box chain were up 7.9% during the quarter.

- Company-operated locations saw higher checks on average and more traffic, while franchise locations saw higher check sizes but a decline in traffic.

- Stripping out one-time items, adjusted earnings were $1.45 a share.

- Analysts surveyed by FactSet had been expecting $1.34 a share.

- Shares of Wendy’s slipped in premarket trading Wednesday, after the fast-food burger chain reported second-quarter profit that topped expectations but revenue that came up shy, while affirming the full-year outlook.

- Revenue grew 4.4% to $561.6 million, below the FactSet consensus of $566.2 million.

- Overall same-store sales growth of 5.1% missed the FactSet consensus for a 5.3% rise, as domestic growth of 4.9% missed expectations of a 5.8% rise while international growth of 7.2% beat expectations of a 6.6% increase.

- Excluding nonrecurring items, adjusted earnings per share rose to 28 cents from 24 cents and topped the FactSet consensus of 27 cents.

- For 2023, Wendy’s affirmed its guidance range for adjusted EPS of 95 cents to $1 and for sales growth of 6% to 8%.

- Rocket Lab on Tuesday reported second-quarter results that largely met Wall Street’s expectations, and the company said it added contracts for 10 more launches in 2023 and 2024.

- Revenue grew 12% year over year in the second quarter to $62 million, versus $61.8 million expected by analysts surveyed by Refinitiv.

- Rocket Lab’s launch business saw $22.5 million in revenue in the second quarter, while its space systems unit brought in $39.6 million.

- Its contract backlog increased from the previous quarter, rising by $40.1 million to $534.3 million.

- The company reported a net loss of $45.9 million, or 10 cents per share, compared with a loss of 9 cents a share expected, according to analysts surveyed by Refinitiv.

- That was wider than the loss of 8 cents a share in the same quarter a year earlier.

- For the third quarter, Rocket Lab expects revenue to grow to between $73 million and $77 million.

- Super Micro Computer shares fell in the extended session Tuesday after the server company with AI sales forecast a weak outlook considering an expected spending surge to support artificial-intelligence technology.

- Revenue rose to $2.18 billion from $1.64 billion in the year-ago quarter.

- Analysts surveyed by FactSet had forecast $2.91 a share on revenue of $1.98 billion.

- For the first quarter, Super Micro estimates adjusted earnings of $2.75 to $3.50 on revenue of $1.9 billion to $2.2 billion, while Wall Street expects $3.21 a share on revenue of $2.2 billion.

- Adjusted earnings, which exclude stock-based compensation expenses and other items, were $3.51 a share, compared with $1.63 a share in the year-ago period.

- For the year, the company expects revenue between $9.5 billion to $10.5 billion, while analysts expect $9.88 billion.

WeWork Tumbles After Raising ‘Substantial Doubt’ About Future – Bloomberg, 8/9/2023

- WeWork shares plummeted more than 25% in extended trading after saying there’s “substantial doubt” about its ability to continue operating. The company cited sustained losses and canceled memberships to its office spaces.

- The co-working business will focus over the next 12 months on reducing rental costs, negotiating more favorable leases, increasing revenue and raising capital, WeWork said in a statement Tuesday.

- The warning comes mere months after WeWork struck a deal with some of its biggest creditors and SoftBank to cut its debt load by around $1.5 billion and extend other maturities. Its bonds trade at deeply distressed levels.

- The company’s 7.875% unsecured notes due 2025 last changed hands for 33.5 cents on the dollar, according to data from Trace.

Akamai Reports Strong Earnings and Boosts Its Forecast – Barron’s, 8/9/2023

- Akamai posted better-than-expected results for the June quarter, driven by strong performance in security software.

- The company also provided full-year guidance above previous Wall Street estimates.

- Akamai had revenue in the quarter of $936 million, up 4% from a year ago, and above the Wall Street consensus forecast of $930 million.

- For the quarter, the delivery segment had revenue of $380 million, down 9% from a year ago and below the Wall Street consensus of $386 million.

- Security software revenue, by contrast, rose 14% from a year earlier to $433 million, ahead of consensus at $420 million.

- Compute, which includes Akamai’s cloud computing business, had revenue of $123 million, up 16% from a year earlier, but a hair below consensus of $124 million.

- Under generally accepted accounting principles, Akamai earned 84 cents a share.

- For the September quarter, Akamai sees revenue of $937 million to $952 million, with adjusted profit of $1.48 to $1.52 a share; that’s ahead of the old Street consensus of $931 million in revenue and $1.41 a share in earnings.

- For the full year, Akamai sees revenue ranging from $3.765 billion to $3.795 billion, with adjusted profit of $5.87 to $5.95 a share; consensus had been $3.759 billion in revenue and profit of $5.73 a share.

- Akamai said it bought back $137 million of stock in the quarter.

Amazon In Talks to Be Anchor Investor in Arm IPO, Reuters Says – Bloomberg, 8/9/2023

- Amazon.com is in talks to join other tech companies as an anchor investor in Arm Ltd.’s initial public offering, according to a person familiar with the situation, part of preparations for a deal that could raise as much as $10 billion.

- Amazon is one of several tech companies that have talked to Arm about backing the offering, which is expected next month, said the person, who asked not to be identified because the deliberations are private. Arm, a chip designer that counts the world’s biggest tech firms as its clients, also has held discussions with Intel and Nvidia.

- Representatives for Amazon and Arm declined to comment. Reuters previously reported on the talks with Amazon.

- Amazon, with its sprawling Web Services operation, is one of Arm’s largest clients, favoring Arm-based chips because of their cost and efficiency.

- The technology is relied on by 40,000 Amazon customers.

Verizon Raises Prices Again as Wireless Customer Growth Slows – Bloomberg, 8/9/2023

- Verizon Communications is raising prices on some existing wireless plans to help boost revenue and offset slumping subscriber growth.

- Starting with September bills, customers on Mix and Match plans will pay $3 more for single lines and $5 extra for multiple lines, Chief Financial Officer Tony Skiadas said Wednesday during at an investor conference.

- Last month the carrier marked up its wireless home internet prices by $10.

- Rival AT&T this month began charging $2.50 more per month for its top-tier wireless plan.

- The United Auto Workers president took aim Tuesday at Jeep maker Stellantis, criticizing the car company for demanding concessions at the bargaining table that he described as a “slap in the face” to union-represented auto workers.

- The move marked an unusually public escalation between the UAW and the global automaker, only weeks after negotiations for a new four-year labor contract began in late July.

- Shawn Fain, the newly elected head of the union, said Stellantis is pressing for a number of givebacks, including on medical benefits and workers’ profit-sharing bonuses.

- He also said, during a Facebook livestream event with union members, that Stellantis wants to introduce new wage levels, while the UAW is trying to eliminate pay tiers altogether.

- To punctuate his frustration, he made a show of throwing the company’s proposals into a trash can.

NYSE, Nasdaq Battle for New Listings in Sign of IPO Awakening – Wall Street Journal, 8/9/2023

- The fight between the New York Stock Exchange and Nasdaq to win new stock listings is raging again, in another sign the market for initial public offerings is perking up after a long slumber.

- The Nasdaq recently won grocery-delivery company Instacart’s listing, set to take place before year-end, according to people familiar with the matter.

- The exchange also successfully wooed Arm, the big chip designer.

- NYSE snagged the listings of marketing-automation platform Klaviyo and trendy German shoe manufacturer Birkenstock.

- Nasdaq and NYSE compete for all big IPOs, using inducements such as expensive marketing and advertising packages, fancy coming-out parties and opening- and closing-bell ringing privileges.

US ECONOMY & POLITICS

U.S. to Ban Some Investments in China – Wall Street Journal, 8/9/2023

- The U.S. is set to ban private-equity and venture-capital investments in some Chinese technology companies under an executive order the Biden administration will release Wednesday, escalating Washington’s efforts to prevent Beijing from developing cutting-edge technology for its military.

- The executive order is expected to cover direct investments in three technology sectors: semiconductors, quantum computing and artificial intelligence.

- It would prohibit investments in some forms of those technologies, while requiring Americans doing business in China to inform the U.S. government about investments in the three high-tech sectors more broadly.

- Investors that violate those rules may face fines and be forced to divest themselves of their stakes, according to people familiar with the order.

- Before enforcing the new rules, the Biden administration is expected to accept feedback on them.

- They are expected to apply to future transactions and won’t cover portfolio investments in Chinese stocks and bonds, according to the people.

- The rules are expected to technically also apply to investments into other adversaries such as Russia, but they are expected to only practically affect U.S. investment into China.

New York State to Debut First Cybersecurity Strategy – Wall Street Journal, 8/9/2023

- The state of New York will debut its first cybersecurity strategy, including plans to modernize government networks, provide digital defenses at the county level and regulate critical infrastructure.

- The strategy, which Gov. Kathy Hochul is expected to announce today, comes as an array of cyberattacks have battered New York, with the state’s Division of Homeland Security and Emergency Services responding to 57 cyber incidents in 2022.

- These include a monthslong shutdown of municipal systems in Suffolk County, and attacks on schools and healthcare systems across the state.

- Kathryn Garcia, director of operations for New York state, said that the growing sophistication of hackers and the threats they pose to both state and national security prompted the creation of the strategy.

- “Many of the pieces of the strategy plan are already in flight, but we also know that we are only as strong as our weakest link,” she said.

- The strategy focuses on five areas, including upgrading state networks to support modern security technology such as multifactor authentication.

- The plan also calls for the state to work with county governments and federal agencies on cybercrime investigations and information sharing.

- In addition, the state plans to focus on developing its cybersecurity workforce and educating New York residents and companies about cybersecurity.

EUROPE & WORLD

China Slides Into Deflation as Consumer, Factory Prices Drop – Bloomberg, 8/9/2023

- China slid into deflation in July, adding pressure on policymakers to step up monetary and fiscal support even as signs that the decline in prices is temporary may limit any stimulus.

- The consumer price index dropped 0.3% last month from a year earlier, the National Bureau of Statistics said Wednesday, marking its first decline since February 2021. Economists surveyed by Bloomberg had predicted a 0.4% decline in prices.

- Producer prices fell for a 10th consecutive month, contracting 4.4% in July from a year earlier, slightly worse than expected.

- The core inflation measure, which excludes volatile food and energy costs, picked up to 0.8% from 0.4%, a sign of underlying — although subdued — demand in the economy.

- A breakdown of the consumer inflation figures showed prices for household goods, food and transport contracted, while prices of services spending, like recreation and education, climbed.

- Using the gross domestic product deflator — a measure of economy-wide prices — China was in deflation in the first half of the year.

- Sony on Wednesday reported a 31% fall in profit in the first fiscal quarter as its life insurance unit dragged on its bottom line, but the company raised full-year sales forecasts on the back of expected strength for its PlayStation gaming business.

- Revenue: 3 trillion Japanese yen ($20.7 billion) versus 2.46 trillion yen expected.

- Sony sold 3.3 million units of the PlayStation 5 in its April-June quarter, up 38% year-over-year.

- Operating profit: 253 billion Japanese yen versus 251.24 billion yen expected.

- Profits from Sony’s financial services branch plunged by 61% in the fiscal first quarter — which the company attributed to changes in interest rates related to variable life insurance.

- Sony reported a 6% decrease in revenue and a 68% slump in profit at its pictures division.

- Nevertheless, Sony raised its revenue forecast for the full year by 6% to 12.2 trillion yen, thanks to strength in its PlayStation gaming unit.

- Sony made a 7% upward revision to its sales forecast for games and network services to 4.2 trillion yen.

- Its forecast for profit remained unchanged at 270 billion yen.

- The company previously said it expects to sell a record 25 million PlayStation 5 units in the current financial year, which ends on March 2024 — compared with 19.1 million units in the previous year.

- It said that sales at its imaging sensors unit would come in at 1.6 trillion yen for the full year.

- Profit for the unit is expected at 180 billion yen, down from an earlier forecast of 200 billion yen.

Coupang Sustains Profit Streak, Sees Logistics Investments Pay Off – Bloomberg, 8/9/2023

- Coupang, the online retailer popular in South Korea for early and one-day delivery, posted its fourth straight quarterly profit after investments in logistics and membership programs helped shore up margins.

- Net revenue climbed 16% to $5.8 billion, in line with analysts’ estimates.

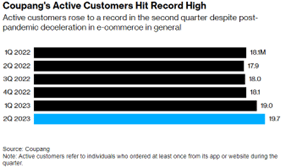

- Coupang’s active customers, or customers who ordered at least once directly from its app or website during the quarter, rose to a record 19.7 million during the second quarter, up 10% from a year ago.

- The company has been trying to increase retention with member perks after raising monthly fees last year to 4,990 won ($3.80) from 2,900 won, and it rolled out new discounts on Coupang Eats.

- The company is earmarking about $400 million in new ventures, such as expanding in Taiwan, streaming and meal delivery businesses, Kim said.

- That’s up from its previous guidance of $225 million.

- Net income was $145 million for the second quarter, compared with a loss of $75.5 million a year earlier, the US-listed company said Tuesday in a statement.

Taiwan’s TSMC to Build First European Chip Plant in Germany – Wall Street Journal, 8/9/2023

- Taiwan Semiconductor Manufacturing Co. will build its first European chip factory with support from the German government, the latest move to make the continent less dependent on high-tech imports out of Asia.

- TSMC said it had approved a $3.8 billion investment in the factory in Germany, with total investments in the plant expected to exceed 10 billion euros, equivalent to $11 billion, including government support.

- The German Economics Ministry said the government would support the project subject to approval by the European Union, which has eased limits on government subsidies for semiconductor projects.

- The widely anticipated decision comes weeks after Berlin said it would pay €10 billion to support a €30 billion investment by Intel, the U.S. chip maker, in two plants in Magdeburg, in eastern Germany—among the biggest foreign investments ever made in the country.

Meta, Alphabet and Other Tech Firms Face New Data Rules in India – Wall Street Journal, 8/9/2023

- India’s Parliament on Wednesday passed a data-protection bill years in the making that the government says is needed to regulate big tech firms and protect citizens, but that rights groups say gives New Delhi too much power.

- The bill, called the Digital Personal Data Protection Act, says firms must get consent from users before collecting their personal data and says they must use it for the stated purposes.

- It allows the government to limit the transfer of data outside India and penalizes firms for breaking the rules.

- “Many platforms and many companies…have been collecting personal data of citizens, not just in India but all around the world,” said the junior technology minister, Rajeev Chandrasekhar, in a video posted on X, previously known as Twitter, last week, when the legislation was introduced in the lower house of India’s Parliament.

- Technology companies “essentially creating business models by misusing and exploiting digital personal data of citizens is something that this bill intends to address.”

U.S.-Saudi Deal Sets Path to Normalize Kingdom’s Ties With Israel – Wall Street Journal, 8/9/2023

- U.S. and Saudi Arabia have agreed on the broad contours of a deal for Saudi Arabia to recognize Israel in exchange for concessions to the Palestinians, U.S. security guarantees and civilian nuclear help, according to U.S. officials.

- U.S. officials expressed cautious optimism that, in the next nine-to-12 months, they can hammer out the finer details of what would be the most momentous Middle East peace deal in a generation. But they warn that they face long odds.

- The stepped up efforts come after Saudi Crown Prince Mohammed bin Salman met in Jeddah two weeks ago with Jake Sullivan, Biden’s national security adviser, in a bid to accelerate talks.

- Negotiators have now moved to discussing specifics, including addressing Saudi requests that the U.S. help them develop a civilian nuclear program and offer iron clad security guarantees.

- The Saudis are also seeking significant concessions from Israel that would help promote the creation of a Palestinian state.

- In return, the U.S. is pressing Saudi Arabia to impose limits on its growing relationship with China.

Factmonster – TODAY in HISTORY

- Henry David Thoreau’s Walden, recounting his experiment in solitary life on the shores of Massachusetts’ Walden Pond, was published. – 1854

- Jesse Owens became the first American to win four gold medals in one Olympics. – 1936

- The United States exploded a nuclear bomb over Nagasaki, Japan, killing an estimated 74,000 people. – 1945

- Singapore proclaimed its independence from Malaysia. – 1965

- Vice president Gerald Ford was sworn in as president following Nixon’s resignation. – 1974

- Jerry Garcia, lead singer and guitarist of the Grateful Dead, died. – 1995

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Historical performance is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Any economic forecasts set forth may not develop as predicted. All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Material presented is excerpts derived from third party content and you may need a subscription to access the full the content. The views and opinions expressed are those of the authors and do not necessarily reflect the views of Pence Wealth Management or LPL Financial. Prior to making any investment decision please consult your financial advisor regarding your specific situation.