Daily Market Report | 09/21/2023

US FINANCIAL MARKET

Wall Street Is Bracing for Fed's 'Hawkish Hold': Markets Wrap – Bloomberg, 9/20/2023

- Stocks, bonds and the dollar saw small moves, with traders betting the Federal Reserve will keep interest rates steady on Wednesday while hinting at the possibility of hiking again, if warranted.

- The S&P 500 edged higher. The Nasdaq 100 was little changed. The Dow Jones Industrial Average rose 0.4%.

- FedEx, a global economic bellwether, is due to report earnings after the close.

- Two-year US yields halted a four-day advance. The yield on 10-year Treasuries declined three basis points to 4.33%.

- The dollar fell against all of its developed-market peers. The Bloomberg Dollar Spot Index fell 0.2%

- Oil dropped, following a rally that briefly sent Brent above $95 a barrel and spurred inflation concerns.

- West Texas Intermediate crude fell 0.2% to $91 a barrel.

- The pound underperformed as the market pared bets on further Bank of England tightening after an inflation slowdown.

- The Federal Open Market Committee is expected to keep rates in a range of 5.25% to 5.5% — a 22-year high.

- The rate decision and committee forecasts will be released at 2 p.m. in Washington.

- Chair Jerome Powell will hold a press conference 30 minutes later.

- Wall Street will be focused on whether Fed officials' forecasts for interest rates, the so-called dot plot, show the committee seems determined to hike again.

- Pinterest climbed, with analysts positive on the social-networking company in the wake of its investor day event.

- Instacart's debut rally is fizzling out, just a day after it went public in one of this year's biggest US listings.

- The Stoxx Europe 600 rose 1%.

General Mills' Earnings Show Inflation, Supply-Chain Issues Easing – Wall Street Journal, 9/20/2023

- General Mills posted higher sales in its latest quarter, during which it said inflation and supply-chain pressures eased.

- Total sales hit $4.9 billion, just ahead of Wall Street analyst forecasts for $4.88 billion.

- The maker of Lucky Charms cereal and Bisquick pancake mix reported Wednesday that revenue rose 4% for the quarter ended Aug. 27, with the top line once again boosted by price increases.

- Sales volumes, meanwhile, slipped 2%, with shortfalls in its North American retail, pet and international segments.

- The company's pet-food business, which seemed to be rebounding last quarter, turned in flat sales as price increases were offset by lower volumes.

- The company's North American food-service business, which works with schools, hospitals and restaurants, saw volumes jump 7% during the quarter, driving the majority of that unit's revenue growth.

- Those higher prices helped lift the company's gross margin, though a jump in overhead costs cut into the bottom line.

- Stripping out one-time items, adjusted earnings came in at $1.09 a share, a penny per share above the consensus estimate of analysts surveyed by FactSet.

- Chief Executive Jeff Harmening said the quarter was characterized by "moderating inflation, stabilizing supply chains and a resilient but increasingly cautious consumer." General Mills maintained its guidance for the year, which calls for sales to rise 3% to 4%.

- For the quarter, General Mills reported a profit of $673.5 million, or $1.14 a share, down from $820 million, or $1.35 a share, in the same quarter a year ago.

Klaviyo IPO Forges $3 Billion Fortune for Harvard Physicist – Bloomberg, 9/20/2023

- The seemingly low-stakes world of text and email customer messaging will mint some big fortunes Wednesday, when marketing technology firm Klaviyo begins trading in New York.

- Andrew Bialecki founded the Boston-based firm in 2012.

- The platform enables businesses to create targeted marketing campaigns, track customer behavior, and analyze their performance.

- It grew rapidly, attracting investors including Summit Partners, Lone Pine Capital and Shopify.

- The company's $30 a share offering price values it at $9 billion based on its fully diluted share count.

- Klaviyo had net income of about $15 million on revenue of $321 million for the first six months of 2023, compared with a loss of $25 million on revenue of $208 million for the same period last year.

- Its initial public offering raised $576 million.

- Of the $455 million in primary capital it had raised before the company's IPO, the company says it spent only $15 million in the operation of its business.

Ford Averts Second Strike, Secures New Labor Contract in Canada – Wall Street Journal, 9/20/2023

- Ford Motor reached a new tentative labor deal late Tuesday with Canadian labor union Unifor, avoiding what could have been a second strike at the automaker's operations in less than a week.

- Contract talks with Unifor have been running parallel to those in the U.S. with the United Auto Workers union, an unusual overlap that has put pressure on Ford and its two Detroit rivals—General Motors and Chrysler-parent Stellantis—with two unions simultaneously pressing for more in pay and benefits.

- Unifor and the company didn't disclose details of the tentative agreement, which covers about 5,600 members at Ford's Canadian facilities.

- The union said it would present details to members in meetings ahead of a ratification vote.

- Unifor, which is separate from the UAW, represents roughly 18,000 workers at GM, Ford and Stellantis in Canada.

- The union had said it was pressing Ford for improved pensions, higher wages, and some form of support to protect workers as the company transitions to making electric vehicles.

- Unlike in the U.S., where the UAW has taken an unorthodox approach to talks, Unifor has gone a more traditional route by targeting one automaker to reach a deal with first, with the intention of using that agreement as a template for the other two.

- The Canadian union extended its contracts at GM and Stellantis to continue bargaining with those two and will likely turn to one of them next, a union spokeswoman said Tuesday night.

UAW Strikes a Mercedes Parts Plant While Union Eyes More Targets – Bloomberg, 9/20/2023

- The United Auto Workers struck a plant that makes parts for Mercedes-Benz Group vehicles, as the union continued to weigh expanding the number of walk-out targets at Detroit's automakers.

- On Wednesday morning, the UAW posted on X that 190 workers at a ZF plant in Tuscaloosa, Alabama, that supplies front axles to Mercedes were now on strike.

- The job action followed a union social media post Tuesday evening with a Spartacus movie clip showing "UAW locals waiting to go out on strike" as the title character's fellow rebels in turn each stand and claim "I am Spartacus."

- President Shawn Fain has said more plants faced walkouts if General Motors, Ford Motor and Stellantis, the maker of Jeep and Chrysler models, didn't sweeten their offers.

- The carmakers said bargaining had continued on Tuesday.

- In Washington on Tuesday, the Biden administration continued to monitor the strike negotiations, but said Tuesday that acting Labor Secretary Julie Su and White House adviser Gene Sperling would not yet be traveling to Detroit to help the two sides.

- As equities soared in 2020 and consumers flocked to trading apps like Robinhood, Apple and Goldman Sachs were working on an investing feature that would let consumers buy and sell stocks, according to three people familiar with the plans.

- The project was shelved last year as the markets turned south, said the sources, who asked not to be named because they weren't authorized to speak on the matter.

- The effort, which has not been previously reported, would have added to Apple's suite of financial products powered by Goldman.

- Apple's conversations with Goldman began during that hype cycle in 2020, two sources said.

- Their work progressed, and an Apple investing feature was meant to roll out in 2022.

- One hypothetical use case pitched by executives involved the ability for iPhone users with extra cash to put money into Apple shares, one person said.

- But as markets were roiled by higher rates and soaring inflation, the Apple team feared user backlash if people lost money in the stock market with the assistance of an Apple product, the sources said.

- That's when the iPhone maker and Goldman switched directions and pushed the plan to launch savings accounts, which benefit from higher rates.

- Goldman Sachs is in advanced discussions to sell its specialty lender, GreenSky, to a group of investment firms, in a major step away from the Wall Street bank's failed experiment in consumer lending.

- The group includes Sixth Street, Pacific Investment Management and KKR, according to people familiar with the matter.

- A deal would be worth about $500 million, according to people familiar with the matter, less than one-third of what Goldman paid for the business just a year-and-a-half ago.

- Goldman paid roughly $1.7 billion for GreenSky, which specializes in extending loans to consumers for home renovations, hoping it would help the Wall Street giant be a bigger competitor in consumer lending and a "banking platform of the future," Chief Executive David Solomon told The Wall Street Journal at the time.

- Federal prosecutors are scrutinizing personal benefits Tesla may have provided Elon Musk since 2017—longer than previously known—as part of a criminal investigation examining issues including a proposed house for the chief executive.

- The U.S. Attorney's Office for the Southern District of New York also has sought information about transactions between Tesla and other entities connected to the billionaire, people familiar with the investigation said.

- Prosecutors have referenced the involvement of a grand jury.

- The new information indicates that federal prosecutors have a broader interest in the actions of Musk and Tesla than was previously known and that they are pursuing potential criminal charges.

- The Wall Street Journal reported last month that the Justice Department is investigating Tesla's use of company resources on a secret project that was described internally as a house for Musk.

- The house effort was known within the carmaker as "Project 42," and plans called for an expansive glass building to be constructed near Tesla's Austin-area factory and headquarters.

- The Securities and Exchange Commission has opened a separate civil investigation into the project, the Journal has reported.

- Zach Kirkhorn, who was Tesla's chief financial officer before stepping down last month, was among those who raised concerns internally about the project.

Marlboro Maker Hits Reset on $2 Billion Bet on Medicine – Wall Street Journal, 9/20/2023

- Philip Morris International's push into healthcare is faltering, prompting the tobacco giant to consider options such as selling a stake in its biggest pharmaceuticals unit.

- The deals inserted the Marlboro maker into the market for inhalers and other treatments for respiratory diseases that are linked to cigarette smoking.

- Philip Morris's struggles came into view over the summer, when the company took a $680 million charge on its wellness and healthcare business and postponed its ambitious revenue goals for the business.

- Now, Philip Morris is considering the possible sale of a stake in its biggest pharmaceuticals unit, as it searches for a new partner to help it make the business work.

- Philip Morris acquired that business, an inhaled-medication company called Vectura Group, in a $1.24 billion deal after winning a bidding war against private-equity firm Carlyle Group.

- Philip Morris has had discussions with Deutsche Bank on a range of options to try to grow its wellness and healthcare division, according to people familiar with the matter.

- The tobacco company said it is looking to bring on a partner to help operate and grow Vectura's drug manufacturing outsourcing business, possibly through a sale of a majority or minority stake in that business.

- Other options include a licensing or royalties deal or a commercial partnership, Philip Morris said.

- Budweiser owner Anheuser-Busch said it has stopped cutting the tails off its famous Clydesdale horses after months of pressure from animal-rights activists who say the practice is cruel.

- The brewing giant's concession to activists comes as it tries to navigate its way through the culture wars, after a consumer backlash over a promotion with transgender influencer Dylan Mulvaney buffeted sales.

- The Budweiser Clydesdales rank among America's best-known corporate icons and are one of AB's oldest and most consistently used marketing motifs.

- Budweiser owns dozens of Clydesdales that reside at its breweries in St. Louis, and has a further 75 at its Warm Springs breeding ranch in Boonville, Mo.

- It has used the Clydesdales for marketing since 1933, when it sent a beer wagon drawn by six horses across the East Coast delivering Buds in celebration of the end of prohibition.

US ECONOMY & POLITICS

Fed Leaves Rates Unchanged, Signals Another Hike This Year – Bloomberg, 9/21/2023

- The Federal Reserve left its benchmark interest rate unchanged while signaling borrowing costs will likely stay higher for longer after one more hike this year.

- The US central bank's policy-setting Federal Open Market Committee, in a post-meeting statement published Wednesday in Washington, repeated language saying officials will determine the "extent of additional policy firming that may be appropriate."

- Fed Chair Jerome Powell said officials are "prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we're confident that inflation is moving down sustainably toward our objective."

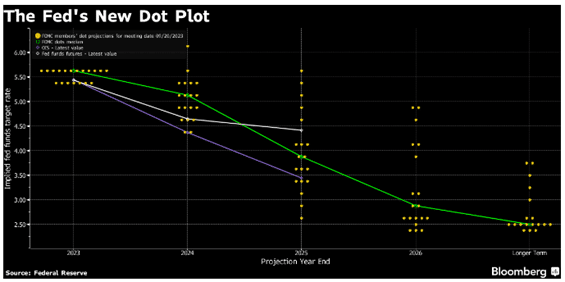

- The FOMC held its target range for the federal funds rate at 5.25% to 5.5%, while updated quarterly projections showed 12 of 19 officials favored another rate hike in 2023, underscoring a desire to ensure inflation continues to decelerate.

- He emphasized the Fed will "proceed carefully" as it assesses incoming data and the evolving outlook and risks, echoing remarks he made at the Fed's annual symposium in Jackson Hole, Wyoming last month.

- "We're fairly close, we think, to where we need to get," Powell said.

- They now expect it will be appropriate to reduce the federal funds rate to 5.1% by the end of 2024, according to their median estimate, up from 4.6% when projections were last updated in June.

- They see the rate falling thereafter to 3.9% at the end of 2025, and 2.9% at the end of 2026.

- Powell said Wednesday a "soft landing" is not the Fed's baseline expectation for the US economy, but it is the primary objective as it seeks to contain inflation.

US Jobless Claims Fall to 201,000, Lowest Level Since January – Bloomberg, 9/21/2023

- Applications for US unemployment benefits fell to the lowest level since January last week, indicating a healthy labor market that continues to support the economy.

- Initial jobless claims dropped by 20,000 to 201,000 in the week ending Sept. 16, returning to within striking distance of the lowest level in more than five decades, according to Labor Department data out Thursday.

- The figure was below all estimates in a Bloomberg survey of economists.

- Continuing claims, which are a proxy for the number of people receiving unemployment benefits, declined to 1.66 million in the week through Sept. 9.

- The four-week moving average of initial claims, which smooths out some of the volatility, dropped to 217,000, the lowest level since February.

- On an unadjusted basis, claims were little changed. Applications fell in Indiana and California, while they increased in New York and Georgia.

US Existing-Home Sales Fall to Seven-Month Low on Rates, Supply – Bloomberg, 9/21/2023

- Sales of previously owned US homes declined in August to the lowest since the start of the year, restrained by limited inventory and historically high mortgage rates.

- Contract closings decreased 0.7% from a month earlier to a 4.04 million annualized pace, National Association of Realtors data showed Thursday.

- The median estimate in a Bloomberg survey of economists called for a pace of 4.1 million.

- Sales were down 15.4% from a year earlier on an unadjusted basis.

- The number of homes for sale edged lower to 1.1 million, the smallest August inventory in data back to 1999.

- At the current sales pace, it would take 3.3 months to sell all the properties on the market.

- Realtors see anything below five months of supply as indicative of a tight market.

- The median selling price rose 3.9% from a year earlier to $407,100, one of the highest readings on record.

- Sales fell in the West and South and were unchanged in the Northeast. Purchases increased in the Midwest.

- Single-family home sales declined 1.4% to an annualized 3.6 million pace — the slowest since January — while condominium and co-op sales picked up.

- First-time buyers made up a historically low 29% of purchases in August, down from 30% a month earlier.

- Cash sales represented 27% of total sales.

Bullard Says Rates May Need to Rise Further Amid Strong Growth – Bloomberg, 9/21/2023

- Former Federal Reserve Bank of St. Louis President James Bullard said the central bank may need to raise interest rates further and hold them higher to guard against the risk of a reacceleration of inflation.

- "I think that may be a good thing to do as insurance to make sure that core inflation especially continues to come down at an appropriate pace so the committee can get back to 2% inflation in a reasonable time frame," Bullard, now the dean of Purdue University's business school, said Thursday during an interview with Bloomberg TV's Michael McKee.

- Bullard said "it makes a lot of sense" that policymakers emphasized rates will need to stay higher for longer, given the strength of the economy and sturdy labor market.

- "The prospects for a soft landing are very good, but you haven't landed until you get inflation back to 2%," he said.

- As Ukrainian President Volodymyr Zelensky returns to the U.S. capital in a bid to shore up American support for his embattled country, a group of Republican lawmakers is vowing to oppose another aid package.

- In a letter viewed by The Wall Street Journal, the group says it is rejecting President Biden's request for an additional $24 billion in security, economic and humanitarian aid.

- The lawmakers said they have concerns about the more than $100 billion in funding Congress already has approved, complained that the administration supports an "open-ended commitment" to Ukraine and criticized what they say is an unclear strategy.

- It is signed by 23 House members and six senators, led by Sen. J.D. Vance (R., Ohio) and Rep. Chip Roy (R., Texas), and addressed to Shalanda Young, the director of the White House Office of Management and Budget.

- On Thursday, Zelensky is scheduled to meet with President Biden at the White House as well as lawmakers from both parties on Capitol Hill.

- He is expected to make the case for more support as Ukraine tries to sustain a counteroffensive against Russian forces.

- One of the letter's signatories, Sen. Rand Paul (R., Ky.), said in a speech on the Senate floor Wednesday that he wouldn't consent to expediting any spending bill that provides any more U.S. aid to Ukraine, citing the large federal budget deficit.

- "It's as if no one has noticed that we have no extra money to send to Ukraine," Paul said.

- "Our deficit this year will exceed $1.5 trillion. Borrowing money from China to send it to Ukraine makes no sense."

EUROPE & WORLD

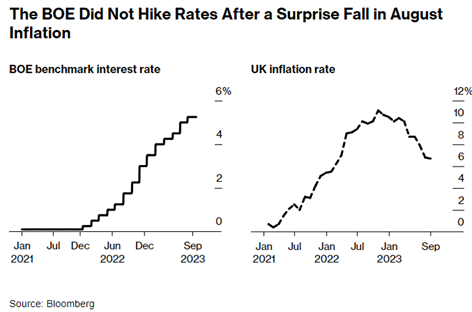

BOE Keeps Rates Unchanged for First Time in Almost Two Years – Bloomberg, 9/21/2023

- The Bank of England halted for now the most aggressive cycle of interest-rate rises in more than three decades as concerns about inflation gave way to signs the economy is slipping into a recession.

- The central bank held its key rate at 5.25%, ending a series of 14 successive hikes since December 2021, when rates were just 0.1%.

- Five members of the Monetary Policy Committee voted to leave rates unchanged and four wanted to raise them to 5.5%.

- Governor Andrew Bailey, who had the casting vote, chose to hold.

- "Inflation has fallen a lot in recent months and we think it will continue to do so," Bailey said Thursday in statement released with the decision.

- "That's welcome news. But there is no room for complacency. We need to be sure inflation returns to normal and we will continue to take the decisions necessary to do just that."

- Repeating its former guidance, the committee said rates would be "sufficiently restrictive for sufficiently long" and "further tightening in monetary policy would be required if there were evidence of more persistent pressures."

- "We are starting to see the tide turn against high inflation, but we will continue to do what we can to help households struggling with mortgage payments," Hunt said in a statement from the Treasury.

- The BOE cut its GDP growth forecast for the third quarter to 0.1% from 0.4%, the minutes showed.

- Underlying growth in the second half of 2023 is also likely to be weaker than the 0.25% expected in August.

- Over the 12 months from October, it plans to reduce its gilt portfolio by £100 billion to £658 billion.

- Last year, it unwound £80 billion.

- That implies £50 billion of active gilt sales on top of the £50 billion of maturing assets.

Contamination Is Found at Novo Nordisk Plant in U.S. – Wall Street Journal, 9/21/2023

- Novo Nordisk found bacteria in batches of the main ingredient for a diabetes pill that is a cousin to popular diabetes and weight-loss drugs and was made at a North Carolina plant earlier this year, according to a federal inspection report reviewed by The Wall Street Journal.

- The Food and Drug Administration inspected the Clayton, N.C., plant in July, and issued a report saying that Novo Nordisk had failed to investigate the cause thoroughly and that the plant's microbial controls were deficient.

- The plant makes the drug ingredient semaglutide, which is used in the diabetes pill Rybelsus.

- Semaglutide is also the main ingredient in Novo Nordisk's popular injections Ozempic and Wegovy, but the company said the semaglutide for those products isn't made at the same plant.

- The Danish company said the Clayton plant is still running and producing for the market, and wouldn't share details of its interactions with the FDA.

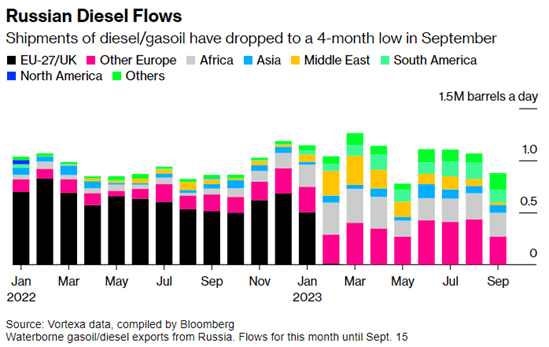

Russia Temporarily Bans Diesel Exports; European Prices Jump – Bloomberg, 9/21/2023v

- Russia temporarily banned exports of diesel in a bid to stabilize domestic supplies, driving European prices higher in already tight global fuel markets.

- So far this year, Russia was the world's single biggest seaborne exporter of diesel-type fuel, narrowly ahead of the US, according to Vortexa data compiled by Bloomberg.

- The country shipped more than 1 million barrels a day during January to mid-September, with Turkey, Brazil and Saudi Arabia being among the main destinations.

- The ban, which also applies to gasoline, comes into force on Sept. 21, and doesn't have a final date, according to the government decree.

- Diesel prices in Europe jumped on concern the measure will aggravate global shortages.

- There are exemptions for minor supplies, including deliveries to trade alliance partners from some former Soviet republics, as well as intergovernmental agreements, humanitarian aid and transit, the decree said.

- Under the decree, fuel cargoes already accepted for shipment by Russian Railways or those with loading papers for seaborne transportation can still be exported.

- That indicates diesel flows will only gradually decline, while these cargoes are shipped.

Saudi Crown Prince Says Deal With Israel Is Closer 'Every Day' – Bloomberg, 9/21/2023

- Saudi Arabia is getting closer "every day" to a landmark deal normalizing diplomatic relations with Israel, Crown Prince Mohammed bin Salman said.

- The de facto Saudi ruler, known as MBS, also said his country will be compelled to seek a nuclear bomb if its arch-rival Iran obtains one.

- "If they get one, we have to get one," he said in excerpts released by Fox News from an interview it plans to air Wednesday.

- Asked about the talks on establishing ties with Israel, Prince Mohammed denied reports that the kingdom has frozen the negotiations because Israel is refusing to make concessions to the Palestinians.

- "There is support from the President Biden administration to get to that point" of an agreement, he told Special Report with Bret Baier.

- "For us, the Palestinian issue is very important. We need to solve that part," and "good negotiations" are continuing.

- The US, Saudi Arabia and Israel are engaged in complex negotiations in which Washington would offer security guarantees to Riyadh, the Saudis would normalize relations with Israel and Israel would take actions aimed at preserving the possibility of a Palestinian state.

- Saudi-Israel normalization remains "difficult," with the process fraught over specifics, including the Palestinian issue, US Secretary of State Antony Blinken said last week.

- The Israeli leader expressed confidence Wednesday during a meeting with President Joe Biden that the Jewish state could reach a deal with Saudi Arabia.

- It would lead to "reconciliation" with the Arab world and "advance" prospects for peace with the Palestinians, Netanyahu said in their meeting on the sidelines of the United Nations General Assembly in New York.

- China has sent some of its largest swarms of jet fighters and warships into the air and waters around Taiwan this month.

- They have been accompanied by an unusual silence.

- While previous Chinese drills of similar scale were paired with waves of propaganda meant to intimidate the self-ruled island, Beijing has said next to nothing about the recent exercises.

- That silence is a sign that the recent activity is less about delivering a political message, Taiwanese authorities and defense analysts say, than about training.

- China's military is trying to sharpen its ability to encircle Taiwan, neutralize the island's natural advantages and block the U.S. from coming to the rescue in the event of an invasion.

- During one day earlier this week, Taiwan's military detected 103 Chinese military aircraft in areas around the island, a recent high, including 40 that entered the island's air-defense identification zone.

- The next day 55 Chinese aircraft flew sorties near Taiwan, the Taiwanese Defense Ministry said.

- Earlier this month, a Chinese aircraft carrier and around two dozen warships, an unusually large grouping, sailed southeast of Taiwan in the Western Pacific.

- Notably, the Chinese sorties have included an increasing number of Y-20 transport and refueling aircraft flying alongside jet fighters to the east of Taiwan.

Thousands of Venezuelan Migrants Will Be Allowed Work Permits in the US – Bloomberg, 9/21/2023

- The Biden administration has moved to provide hundreds of thousands of Venezuelan migrants work permits and protection from deportation under pressure from cities strained by an influx of asylum-seekers.

- The Department of Homeland Security estimated Wednesday that 472,000 Venezuelans who arrived before July 31 will be eligible to work under the fresh Temporary Protected Status designation.

- The move is part of a series of policies aimed at managing the growing number of migrant arrivals at the US-Mexico border and in urban centers.

- Within 30 days, DHS is also aiming to approve work permits for immigrants who entered the country under a pair of humanitarian parole programs established earlier this year.

- However, the new policies fall short of recent calls for DHS to eliminate a months-long waiting period for all asylum seekers to work.

- The agency says only Congress can change that.

- The administration is also expanding a program that allows border officials to swiftly deport some immigrant families who have crossed the border and lack a basis to stay in the US.

India Suspends Visas, Canada Pulls Diplomats Amid Tensions – Bloomberg, 9/21/2023

- Canada said it would reduce the number of diplomats in India due to security concerns, while Prime Minister Narendra Modi's government appeared to suspend visas for Canadians, as a diplomatic row escalated over the murder of a Sikh activist.

- Global Affairs Canada said some diplomats have received threats on social media platforms, part of an unfolding backlash in the South Asian country following Prime Minister Justin Trudeau's claims on Monday that Indian government agents assassinated a prominent Sikh leader on Canadian soil.

- "In the light of the current environment where tensions have heightened, we are taking action to ensure the safety of our diplomats," Global Affairs Canada said in a statement Thursday.

- "Out of an abundance of caution, we have decided to temporarily adjust staff presence in India."

- Separately, BLS International, which runs India visa application centers in Canada, posted an online notice saying that visa services were suspended indefinitely due to "operational reasons" from Sept. 21.

- "You are aware of the security threats being faced by our high commission and consulates in Canada," Indian Ministry of External Affairs spokesperson Arindam Bagchi told reporters in New Delhi.

- "This has disrupted their normal functioning. Accordingly, our high commission and consulates are temporarily unable to process visa applications. We will be reviewing the situation on a regular basis."

ECB's Vujcic Says No More Rate Hikes Needed If Outlook Holds – Bloomberg, 9/21/2023

- European Central Bank Governing Council member Boris Vujcic said additional increases in borrowing costs probably won't be needed if officials' economic outlook comes to pass.

- "If things develop in accordance with our expectations, if we have a continued fall of inflation as we're expecting, then it won't be necessary to raise interest rates further," Vujcic told Croatia's N1 TV on Thursday.

- Vujcic joins other ECB policymakers in signaling that last week's hike in the deposit rate, to 4%, was probably the last of this unprecedented monetary-tightening campaign.

- "I think that in the next three months we'll see a further reduction of the inflation rate. But what it will look like next year is difficult to say. Possible shocks could come from energy, food prices, climate change, and politics"

- "As the inflation rate eases, the level of 4% will become more restrictive. If we see a faster fall of inflation, I think it is easier to lower the rate, than to raise it"

- On banks, "We now have a liquidity surplus in deposits on which banks earn interest. A way to sterilize that is to raise minimum reserve requirements"

Factmonster – TODAY in HISTORY

- The French National Convention voted to abolish the monarchy. – 1792

- The New York Sun published its famous editorial, "Yes, Virginia, there is a Santa Claus." – 1897

- A hurricane struck New York and New England with extensive damage and more than 600 deaths. – 1938

- The People's Republic of China was proclaimed. – 1949

- Malta gained its independence from Great Britain. – 1964

- Belize gained its independence from Great Britain. – 1981

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Historical performance is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Any economic forecasts set forth may not develop as predicted. All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Material presented is excerpts derived from third party content and you may need a subscription to access the full the content. The views and opinions expressed are those of the authors and do not necessarily reflect the views of Pence Wealth Management or LPL Financial. Prior to making any investment decision please consult your financial advisor regarding your specific situation.