Daily Market Report | 07/28/2023

US FINANCIAL MARKET

Stock Market Today: Stocks Move Higher as Big Tech Climbs – Wall Street Journal, 7/28/2023

- U.S. stock indexes rose Friday, lifted by tech shares, as blue-chip earnings and fresh inflation data rolled in.

- The Nasdaq Composite added more than 1.5%. The S&P 500 and Dow industrials also rose.

- The Dow on Thursday snapped a 13-day winning streak, its longest since 1987.

- Big tech stocks, including Alphabet and Meta Platforms, powered ahead.

- Big tech shares were among the day's leading gainers.

- The S&P 500's communications services sector rallied, led by Meta Platforms and Alphabet.

- Intel gained after it posted a return to profit late Thursday on the back of a resurgent PC market. Tesla and other EV stocks rose, while Ford retreated.

- Chevron and Exxon Mobil moved lower after the oil giants' quarterly profits dipped from last year's records.

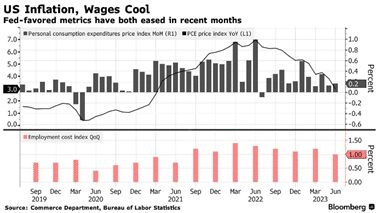

- The Federal Reserve's preferred gauge of consumer inflation, the PCE price index, showed prices rising 3% in June from a year ago. That was a cooldown from the 3.8% increase in May.

- The benchmark 10-year U.S. Treasury yield fell to 3.959%, from 4.011% on Thursday.

- Japan's central bank on Friday let the yield on its 10-year government bond rise to a nearly nine-year high.

- Overseas stock markets were mixed.

- Technology stocks weighed on the Stoxx Europe 600, which slipped.

Exxon Profit Misses Estimates as Natural Gas, Refining Slip – Bloomberg, 7/28/2023

- Exxon Mobil fell short of analysts' expectations with a third straight drop in profit — the longest decline since the 2014-2016 oil-market crash — amid weaker natural gas prices and shrinking returns from fuel sales.

- Adjusted earnings of $1.94 per share were 6 cents below the Bloomberg Consensus.

- Exxon's production from key growth projects in Guyana and the US Permian Basin rose 20% during the first half of 2023 compared with a year earlier.

- Capital spending, meanwhile, is trending toward the high end of its $23 billion-to-$25 billion target for the year, while refining throughput was the highest for any second quarter in 15 years.

- Output from Guyana also reached a record daily equivalent of 380,000 barrels.

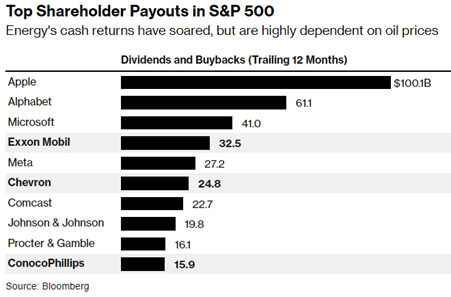

- Exxon pledged to continue buying back shares at a steady pace despite slipping cash flow and a recently announced $4.9 billion purchase of carbon-dioxide pipeline operator Denbury.

- Overall, Exxon paid out $8 billion in the form of buybacks and dividends during the second quarter.

- Shares of Chevron fell in premarket trading Friday, after the oil giant reported full second-quarter results, a week after providing performance highlights, and confirmed a profit beat while reporting revenue that dropped nearly 30% but topped forecasts.

- Total revenue fell 29% to $48.90 billion, above the FactSet consensus of $46.73 billion.

- Net production grew 4% to a new quarterly record of 1.22 million barrels of oil equivalent per day, amid strength in the Permian Basin.

- The company confirmed that excluding nonrecurring items adjusted earnings per share was $3.08, which when revealed on July 23 beat the FactSet consensus of $2.91.

Enphase Energy's stock sinks on revenue miss and weak forecast – Market Watch, 7/28/2023

- Enphase Energy's stock initially plunged more than 15% in extended trading Thursday after the company reported quarterly revenue that fell short of analysts' estimates and offered a weak forecast.

- Revenue was $711.1 million, compared with $530.2 million last year.

- Adjusted earnings were $1.47 a share.

- Enphase provided third-quarter revenue guidance of between $555 million and $600 million, short of the $749 million forecast by analysts on FactSet.

- Analysts surveyed by FactSet had expected on average second-quarter net income of $1.28 a share on revenue of $726 million.

Roku's stock races higher after earnings as revenue blows past estimates – Market Watch, 7/28/2023

- Roku shares surged in Thursday's aftermarket action after the streaming-media company easily topped expectations with its latest results while offering upside with its forecast.

- Revenue rose to $847 million from $764 million, while analysts were modeling $775 million.

- The company logged $743 million in platform revenue, which includes advertising and licensing.

- The FactSet consensus called for $670 million in revenue within that service.

- Revenue in the devices business grew 9% to $103 million, while analysts had been modeling $105 million.

- Roku also posted a loss of $18 million on the basis of adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), whereas the FactSet consensus on the metric was for a $75 million loss.

- The company logged a net loss of $108 million, or 76 cents a share, compared with a loss of $112 million, or 82 cents a share, in the year-earlier period.

- Analysts tracked by FactSet were expecting a loss of $1.26 a share.

- Roku expects $815 million in total net revenue for the third quarter, along with a $50 million loss on the basis of adjusted EBITDA.

- Analysts were forecasting $809 million in revenue and a $57 million loss on the adjusted EBITDA metric.

P&G Earnings Show Its Pricing Power Endures – Wall Street Journal, 7/28/2023

- Shoppers continue to accept high prices for staples from razors to toothpaste, propping up sales at Procter & Gamble even as volumes slipped.

- The consumer-products company said it raised prices by 7% across its brands in the June quarter from a year earlier.

- That followed two straight quarters in which the maker of Pampers and Gillette raised prices by about 10% year over year.

- Sales volumes fell 1% overall in the most recent quarter, dragged down by lower demand in its healthcare and fabric and home-care divisions, including such brands as Crest toothpaste, Tide detergent and Mr. Clean.

- Organic sales, a metric that excludes deals and currency moves, rose 8% for the latest quarter and 7% for the fiscal year ended June 30.

- P&G expects organic sales growth of 4% to 5% for the current year.

- The Cincinnati-based company said overall revenue increased around 5% to $20.6 billion in the latest quarter, slightly surpassing the $20 billion expected by analysts surveyed by FactSet.

Intel Returns to Profit as PC Rebound Lifts Chip Demand – Wall Street Journal, 7/28/2023

- Intel shares soared Thursday as a resurgent personal-computer market helped it bounce back from two quarters of record losses and it forecast new demand from the artificial-intelligence boom.

- Intel's revenue rose in the second quarter compared with the previous one, reaching $12.9 billion and exceeding Wall Street forecasts.

- Revenue was 15% lower than during the same quarter a year earlier.

- The company forecast $12.9 billion to $13.9 billion of revenue in its current quarter, ahead of Wall Street estimates.

- PC shipments declined 13.4% in the second quarter, according to International Data Corp., a more-modest fall than the 29% rout in the first quarter.

- Sales in Intel's PC-chip division fell by 12% in the second quarter, the company said.

- But the $6.8 billion in sales topped the $5.8 billion for that division in the first quarter.

- Sales in the company's data-center and AI division fell 15% in the second quarter to $4 billion.

- Amid the market struggles, Gelsinger has announced layoffs and promised to slash costs by $3 billion this year and boost cuts to as much as $10 billion annually by the end of 2025.

- The $1.5 billion profit defied analysts' expectations of another loss.

- It came after the $2.76 billion shortfall that Intel reported the previous quarter, the worst ever recorded for the storied chip maker.

Ford Raises Profit Forecast Despite Steeper EV Losses – Wall Street Journal, 7/28/2023

- Ford Motor delivered healthy profits for the second quarter and raised its profit outlook for the full year, the latest sign that the car business continues to defy Wall Street's gloomy forecasts heading into the year.

- Revenue rose 12% to $45 billion.

- In its EV division, Ford lost about $1.1 billion, widening from its roughly $700 million loss last quarter.

- In the April-to-June period, strong sales of pickups, especially among businesses and other commercial customers, helped the Dearborn, Mich. auto maker's bottom line.

- Pretax earnings per share: 72 cents per share, easily surpassing the analysts' average forecast of 54 cents per share, according to FactSet.

- At the same time, Ford warned Thursday of steeper-than-expected losses in its electric-vehicle business, which has been buffeted by stiff price competition in some parts of the EV market.

- Ford now expects its EV division to lose $4.5 billion this year, up from an earlier forecast of $3 billion.

- Ford raised its annual pretax-profit guidance to $11 billion to $12 billion, up from its previous projection of $9 billion to $11 billion.

First Solar earnings, revenue bring upside as stock shoots higher – Market Watch, 7/28/2023

- Shares of First Solar were moving higher in Thursday's aftermarket action after the solar-technology company easily cleared expectations with its second-quarter results.

- Net sales increased to $811 million from $621 million, while analysts were looking for $711 million.

- The company notched net income of $171 million, or $1.59 a share, compared with net income of $56 million, or 52 cents a share, in the year-earlier period.

- The FactSet consensus was for $1.00 a share in earnings.

Cadbury-maker Mondelez raises annual forecasts boosted by strong demand – Reuters, 7/28/2023

- Mondelez International on Thursday raised its full-year growth forecasts for the second time this year, helped by robust demand for the Oreo maker's snacks and chocolates despite several rounds of price increases.

- The company logged double-digit organic revenue growth across regions, including Europe, Latin America and North America, which helped improve its margins during the quarter.

- The Toblerone maker now expects full-year organic net revenue and adjusted per-share profit growth of more than 12%, compared to a prior outlook of a 10% increase.

- Separately, Mondelez has sold its remaining stake in Keurig Dr Pepper for $704 million in proceeds, it said in a filing.

Dexcom lifts revenue forecast on demand for glucose-monitoring devices – Reuters, 7/28/2023

- Medical device maker Dexcom on Thursday raised its annual revenue forecast after strong demand for its continuous glucose monitoring (CGM) systems boosted second-quarter results, lifting its shares up in aftermarket trading.

- The company now expects revenue of $3.5 billion to $3.55 billion, compared with its previous range of $3.4 billion to $3.52 billion.

- Analysts estimate annual sales of $3.5 billion, according to Refinitiv data.

- Quarterly sales rose 25% to $871.3 million, beating estimates of $841.6 million.

- Excluding items, the company made a quarterly profit of 34 cents per share, compared with estimates of 23 cents.

T-Mobile Stock Slips Despite Earnings Beat – Barron's, 7/28/2023

- T-Mobile shares are losing ground late Thursday after the mobile carrier announced mixed second quarter results.

- For the June quarter, T-Mobile reported revenue of $19.2 billion, down 2.6% from a year ago, and a little shy of the Wall Street consensus forecast for $19.3 billion.

- T-Mobile said it had 760,000 postpaid phone net subscriber additions in the quarter, ahead of analysts' consensus forecast for 728,000.

- T-Mobile added 509,000 high-speed internet customers, above the consensus at 480,000.

- Adjusted EBITDA, or earnings before interest, taxes, depreciation, and amortization, was $7.3 billion, up 11% from a year ago, in line with estimates.

- T-Mobile said it bought back 25.2 million shares in the quarter for $3.5 billion.

- Profits in the quarter topped estimates though, at $1.86 a share, ahead of Wall Street at $1.69 a share.

- T-Mobile now sees postpaid net customer additions of between 5.6 million and 5.9 million, up from 5.3 million to 5.7 million.

- Core Adjusted EBITDA is now expected to be between $28.9 billion and $29.2 billion, slightly narrowing the range from a previous forecast of $28.8 billion to $29.2 billion.

Facebook Bowed to White House Pressure, Removed Covid Posts – Wall Street Journal, 7/28/2023

- Facebook removed content related to Covid-19 in response to pressure from the Biden administration, including posts claiming the virus was man-made, according to internal company communications viewed by The Wall Street Journal.

- The emails show Facebook executives discussing how they managed users' posts about the origins of a pandemic that the administration was seeking to control.

- "Can someone quickly remind me why we were removing—rather than demoting/labeling—claims that Covid is man made," asked Nick Clegg, the company's president of global affairs, in a July 2021 email to colleagues.

- "We were under pressure from the administration and others to do more," responded a Facebook vice president in charge of content policy, speaking of the Biden administration. "We shouldn't have done it."

- The email, and a number of other such internal company communications, were obtained by the Republican-led House Judiciary Committee, which has been investigating what GOP lawmakers say is the Biden administration's improper efforts to censor Americans' speech on social media about Covid and other topics.

Banks Are Halting Stock Buybacks Again as New Capital Rules Loom – Wall Street Journal, 7/28/2023

- They called it the Basel Endgame, but U.S. banks and their investors have a long way to go before they have outright clarity on new capital rules. That is acting as a stop sign for stock buybacks.

- The Federal Reserve and other banking regulators on Thursday announced a long-awaited proposal on stricter new rules governing the safety nets banks build under themselves.

- That, in turn, will impact the amount of profits banks return to investors through buybacks.

- The proposed rules are the latest iteration of the U.S. interpretation of international Basel requirements.

- The idea behind the rules is for banks to hold more capital against specific business transactions.

- To build the higher buffers, banks will have to hold on to profits instead of investing them or returning them to investors via dividends or buybacks.

- Bankers have been warning that higher capital will crimp their lending, but the first chopping block is undoubtedly stock buybacks.

Yellow in Talks to Sell Its Logistics Business – Wall Street Journal, 7/28/2023

- Trucking company Yellow said it is in talks with multiple parties about selling Yellow Logistics as the financially ailing operator seeks to raise cash.

- Yellow didn't say who the company is talking with but said in a statement Thursday that discussions are "active and ongoing."

- Shares of Yellow initially rose in post-market trading before falling back to 57 cents a share, where they closed the regular session, down 44%.

Biogen to Buy Reata Pharmaceuticals in $7.3 Billion Deal – Wall Street Journal, 7/28/2023

- Biopharmaceutical company Biogen has agreed to buy smaller peer Reata Pharmaceuticals in a $7.3 billion deal that bolsters its portfolio of treatments for neuromuscular and rare diseases.

- Biogen on Friday said it would pay $172.50 a share in cash for Reata, a nearly 59% premium to Thursday's closing price of $108.55 for the Plano, Texas-based company, which earlier this year won Food and Drug Administration approval for Skyclarys as the first U.S. treatment for the genetic disorder Friedreich's ataxia.

- Biogen, based in Cambridge, Mass., said it plans to fund the deal with cash on hand, supplemented by the issuance of term debt, adding that it expects to complete the acquisition by the end of the year.

US ECONOMY & POLITICS

Key US Inflation, Wage Measures Cool in Boost for Soft Landing – Bloomberg, 7/28/2023

- Key measures of US inflation and labor costs cooled significantly in recent months, adding to growing optimism that the economy may be able to avoid a recession.

- The employment cost index, a broad gauge of wages and benefits, increased 1% in the second quarter, marking the slowest advance since 2021, according to Bureau of Labor Statistics figures released Friday.

- A separate report showed the Fed's preferred inflation gauge, the personal consumption expenditures price index, rose 3% from a year earlier in June, the smallest increase in more than two years.

- Core prices — which exclude food and energy and are regarded as a more reliable signal of underlying inflation — advanced by a less-than-expected 4.1%, also the least since 2021.

- The PCE report also indicated consumer spending, adjusted for inflation, rose in June by the most since the start of the year, bolstering the message from data on Thursday that showed the US economy expanded at a solid pace in the second quarter.

- Compared with a year earlier, employment costs were up 4.5%, marking the weakest pace of increase since the first quarter of 2022.

- Wages and salaries for civilian workers rose 4.6%, the slowest advance since the end of 2021.

- Price increases in that category, excluding housing and energy, rose 0.2% in the latest PCE report, similar to May's increase.

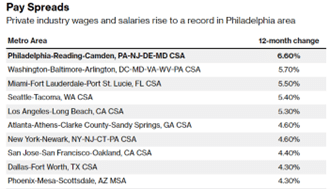

Pay Gap Between Biggest US Cities Is Getting Wider as Wages Slow – Bloomberg, 7/28/2023

- Wage growth is slowing down in the US economy as a whole — but not everywhere.

- The gap between pay hikes across major American cities widened last quarter, according to data published Friday by the Bureau of Labor Statistics.

- The difference between the fastest and slowest increases in employment costs among 15 major metros rose to 4 percentage points, matching the highest figure of the pandemic period.

- In Philadelphia, though, the 6.6% jump in employment costs from a year earlier was the biggest in data going back to 2006.

- At 5.7%, the Washington metro area matched last quarter's record high.

- Meanwhile in Houston, pay increased just 2.6% from last year.

- The second-lowest wage increases came in Minneapolis, at 4.1% — but workers there are at least getting ahead of the cost of living.

- The city reported an inflation rate of just 1.8% in May, the lowest for any major metro in the country.

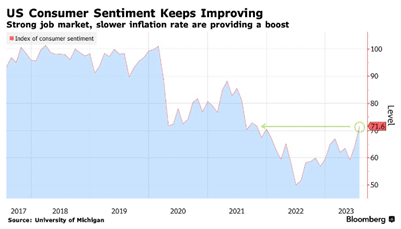

US Consumer Sentiment Rises to Highest Since 2021 as Prices Ease – Bloomberg, 7/28/2023

- US consumer sentiment rose in July to the highest since October 2021 as inflation continued to ease.

- The sentiment index climbed to 71.6 from 64.4 last month, according to the final July reading from the University of Michigan.

- The median estimate in a Bloomberg survey of economists called for 72.6, in line with the group's print earlier in the month.

- Consumers expect prices will climb at an annual rate of 3.4% over the next year, up slightly from the 3.3% expected in June, data Friday showed.

- They still see costs rising 3% over the next five to 10 years.

- The share of consumers blaming high prices for eroding their living standards fell to 36%, the lowest reading in a year and a half, according to the report.

- The current conditions gauge climbed to 76.6 from 69 in June, while a measure of expectations also advanced, the university said.

- Buying conditions for durable goods improved to the highest level in two years.

EUROPE & WORLD

BOJ Sends Yields Soaring With Surprise Change to Rate Limit – Bloomberg, 7/28/2023

- The Bank of Japan jolted financial markets by loosening its grip on bond yields in Governor Kazuo Ueda's first surprise move since taking the helm, a step that will likely spur talk of potential policy normalization to come.

- The BOJ kept its target for 10-year yields at around 0% but said its 0.5% ceiling was now a reference point, not a rigid limit as it sought to make its ultra-loose monetary policy program more flexible.

- The bank said it will offer to buy 10-year debt at 1% each day, suggesting an effective doubling of the movement range for yields.

- While the BOJ left its short-term policy interest rate unchanged at -0.1% and Ueda said the moves didn't represent a step toward the end of its yield curve control program, some investors were unconvinced.

- Japan's benchmark bond yield surged to the highest since 2014, extending gains above the central bank's previous 0.5% cap.

- The yen jumped before the decision on a Nikkei report that the central bank was considering a policy tweak.

British Airways-owner IAG beats forecasts, mindful of uncertainty ahead – CNBC, 7/28/2023

- IAG's quarterly profit beat analyst forecasts by 40% and the British Airways parent company said the outlook for summer travel was encouraging, although it warned it was "mindful" of uncertainty in the wider economy.

- For the three months to the end of June, the group recorded an operating profit before exceptional items of 1.25 billion euros ($1.37 billion), compared to the 895 million euros analysts were on average expecting.

- IAG, which also owns Iberia, Aer Lingus and Vueling, did not on Friday provide an update on its full-year guidance. It had said in May it expected annual profit above the top end of a 1.8 billion euros to 2.3 billion euros range.

- IAG said it was 30% booked for the October-December period, which is typical for this time of year and for now its focus was on delivering resilient operations over the summer given the air traffic control and labour dispute challenges in Europe.

German Inflation Slows More Than Expected as ECB Hikes Near End – Bloomberg, 7/28/2023

- German inflation slowed more than anticipated in July, providing more evidence of a gradual moderation in euro-zone price pressures as the European Central Bank nears the end of its unprecedented cycle of interest-rate hiking.

- The annual reading came in at 6.5%, down from 6.8% in June.

- That's less than the 6.6% median estimate in a Bloomberg survey of economists.

- A national measure of underlying inflation, excluding food and energy costs, also slowed.

- Data earlier Friday showed French price gains moderated to 5%.

- In Spain, they unexpectedly accelerated — but at 2.1% remain close to the ECB's 2% goal.

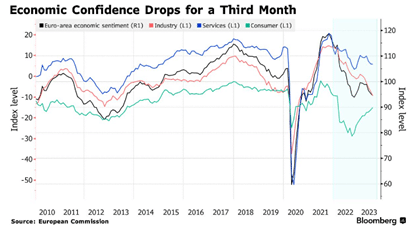

Euro-Area Economic Confidence Slows on Industry, Services – Bloomberg, 7/28/2023

- Euro-area economic confidence slowed more than anticipated this month, adding to concerns that growth in the region is stalling.

- A sentiment gauge published by the European Commission slid to 94.5 from 95.3 in June.

- That's the third monthly decline and worse than the median forecast in a Bloomberg survey of economists.

- Sub-indicators for services and industry both decreased, while consumer expectations improved for a fourth month.

Canada Growth Slows to 1% in Second Quarter; June GDP Shrank – Bloomberg, 7/28/2023

- Canadian economic momentum decelerated in the second quarter after an unexpectedly strong start to the year.

- Preliminary data suggest gross domestic product decreased 0.2% in June, the first contraction this year, led lower by the wholesale and manufacturing sectors, Statistics Canada reported Friday in Ottawa.

- That followed a 0.3% expansion in May, matching the median estimate in a Bloomberg survey of economists.

- Overall, the monthly gains — including April's 0.1% boost — point to annualized growth of 1% in the second quarter.

- Although it will likely be revised, that's slower than the 1.5% pace projected by the Bank of Canada earlier this month, and much weaker than the 3.1% growth in the first three months of 2023.

- In May, service-producing industries were up 0.5%, while goods-producing industries partially offset that gain with a 0.3% decline.

- Manufacturing advanced 1.6% in May, the largest increase since October 2021, and wholesale trade jumped 2.9%.

Brazil Denies U.S. Extradition Request for Alleged Russian Spy – Wall Street Journal, 7/28/2023

- Brazil's government has denied a request from the U.S. to extradite alleged Russian spy Sergey Cherkasov, the Justice Ministry said Thursday in a statement.

- The decision on what to do with Cherkasov, a 37-year-old who was indicted in the U.S. in March, is preliminary and subject to review by Brazilian authorities, a top government official said Thursday.

- The U.S. has charged Cherkasov with acting as a foreign agent, visa fraud, bank fraud and wire fraud.

- The denial is a blow to hopes that Cherkasov could be included in a prisoner exchange between the U.S. and Russia to free Americans the Biden administration considers wrongfully detained in Russia, including Evan Gershkovich, a reporter for The Wall Street Journal who has been jailed in Moscow's Lefortovo prison for nearly four months.

Wagner Chief's Exile Is Anything But as He Schmoozes and Lauds Niger Coup – Bloomberg, 7/28/2023

- As Vladimir Putin was welcoming African heads of state to a summit in St. Petersburg, renegade warlord Yevgeny Prigozhin stole the limelight in the president's home city, schmoozing with visiting officials and lauding a military coup in Niger.

- The Wagner mercenary group leader was supposed to go into exile in neighboring Belarus under a deal to end last month's armed mutiny that shook Putin's rule and killed about a dozen airforce crew as his troops advanced to within 200 kilometers (124 miles) of Moscow.

- Instead, he's been traveling freely in and out of Russia and was invited to talks with Putin in the Kremlin together with his top Wagner commanders only days after the revolt.

- Prigozhin's presence in St. Petersburg, which is also his native city, as Putin hosted the Russia-Africa summit seemed calculated to upstage the showcase event.

- A second photograph on Telegram showed Prigozhin meeting the head of a pan-African TV channel on the sidelines of the summit.

- While Russia joined other powers in calling for the release of ousted Niger President Mohamed Bazoum, the mercenary leader welcomed this week's military coup as "a declaration of independence" in an audio statement on a Telegram channel linked to Wagner.

- "It's getting rid of the colonizers," Prigozhin said.

Factmonster – TODAY in HISTORY

- King Henry VIII of England's chief minister, Thomas Cromwell, was executed and Henry married his fifth wife, Catherine Howard. – 1540

- The great baroque composer Johann Sebastian Bach died. – 1750

- Robespierre, one of the leading figures of the French Revolution, was sent to the guillotine. – 1794

- Peru declared its independence from Spain. – 1821

- The 14th Amendment to the Constitution, which established the citizenship of African Americans and guaranteed due process of law, was ratified. – 1868

- Austria-Hungary declared war on Serbia, precipitating the start of World War I. – 1914

- Herbert Hoover ordered Douglas MacArthur to evict the Bonus Marchers from their camps. – 1932

- Nine Pennsylvania coal miners were rescued after 77 hours of being trapped in a mine shaft. – 2002

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Historical performance is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Any economic forecasts set forth may not develop as predicted. All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Material presented is excerpts derived from third party content and you may need a subscription to access the full the content. The views and opinions expressed are those of the authors and do not necessarily reflect the views of Pence Wealth Management or LPL Financial. Prior to making any investment decision please consult your financial advisor regarding your specific situation.