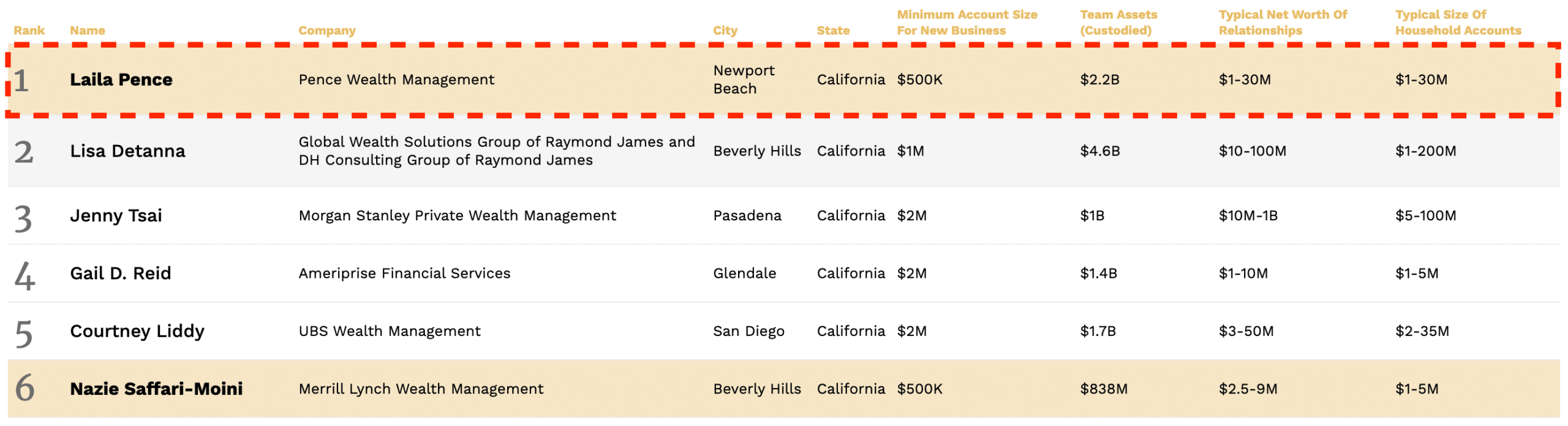

FORBES/SHOOK RECOGNIZES LAILA PENCE AS #5 OF 2022 AMERICA'S TOP WOMAN WEALTH ADVISORS IN THE NATION AND #1 BEST-IN-STATE SOUTHERN CALIFORNIA

We are excited to announce that Forbes has included Laila Pence in the list of 2022 America's Top Women Wealth Advisors for both National1 and Best-In-State Southern California2.

She is honored to receive both recognitions from Forbes. This will be Laila's 6th consecutive time to be included in the rankings of America's Top Women Wealth Advisors since her first recognition in 20171. Our team would like to thank all our clients for their support.

The financial professionals at Pence Wealth Management are affiliated with LPL Financial, a leading* retail investment advisory firm, independent broker-dealer and registered investment advisor (RIA) custodian, providing resources, tools and technology that support advisors in their work to enrich their clients' financial lives.

We invite you to share this exciting news with your family and friends, especially those interested in seeking wealth management services from an experienced advisor. The greatest honor that we can receive is your endorsement.

We look forward to our continued collaborative efforts in planning for your future and, as always, we are available to discuss any opportunities, concerns or changes to your financial plans.

Thank you for your continued business and trust.

*Top RIA custodian (Cerulli Associates, 2019 U.S. RIA Marketplace Report); No. 1 Independent Broker-Dealer in the U.S (Based on total revenues, Financial Planning magazine June 1996-2020); No. 1 provider of third-party brokerage services to banks and credit unions (2019-2020 Kehrer Bielan Research & Consulting Annual TPM Report)

1About Forbes Top Women Wealth Advisors (Best-In-State & National)

The Forbes Top Women Wealth Advisors Best-In-State Wealth Advisor and Top Women Wealth Advisor (National) rankings are based on in-person and telephone due diligence meetings and a ranking algorithm that includes: client retention, industry experience, review of compliance records, firm nominations; and quantitative criteria, including: assets under management and revenue generated for their firms. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK Research receives a fee in exchange for rankings.

2 The 2021 Forbes Best-In-State Wealth Advisors ranking, developed by SHOOK Research, is based on an algorithm of qualitative criteria, gained through telephone, virtual and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years experience, and the algorithm weights factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their approach to working with clients. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Neither Forbes or SHOOK receive a fee in exchange for rankings.

3 Barron's Top 100 Private Wealth Management Teams (2021) and the Top 50 Private Wealth Management teams (2019) is based on assets under management, revenue produced for the firm, regulatory record, quality of practice and philanthropic work.

4 Barron's Top 1200 Financial Advisors (2009-2021) & Top Women Financial Advisors (2008 – 2021) is based on assets under management, revenue produced for the firm, regulatory record, quality of practice and philanthropic work.

5 Barron's Hall of Fame (2019) Advisors appearing in the rankings have answered 100-plus questions about their practices in our annual survey. The questionnaire addresses a wide range of data points, including the assets the advisors oversee, the revenue they collect on those assets, the industry designations they possess, their regulatory records, the length of time they've been in the industry, their charitable and philanthropic work, the investment vehicles they use to allocate assets, the sizes and shapes of their teams, and more. The rankings specifically do not factor in investment performance, as returns are tied inextricably to the risk tolerances of individual clients; to reward outsize returns would be to encourage advisors to chase them. Instead, Barron's Magazine uses assets and revenue as their primary quantitative measures, as clients tend to express their satisfaction by voting with their assets and their fees.

6The Forbes Ranking of America's Top Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years' experience, and the algorithm weights factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receives a fee in exchange for rankings.

Laila Pence is a registered representative with and securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC. Financial planning offered through Pence Wealth Management, a Registered Investment Advisor.

Wealth Management, Inc. ("PWM") is a financial services practice within LPL Financial LLC ("LPL Financial") comprised of multiple financial professionals that provide a series of services including personal investment advisory, third party managed advisory and brokerage services. PWM is an investment adviser registered with the State of California to provide financial planning services. The financial professionals affiliated with PWM are registered with and offer securities and investment advisory services through LPL Financial, member FINRA/SIPC and a registered investment adviser.

As reported by Financial Planning magazine, June 1996-2021, based on total revenue.

PWM, Barron's, Forbes, SHOOK® Research and LPL Financial are separate entities.